Westjet 2015 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 9

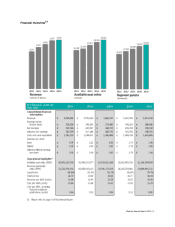

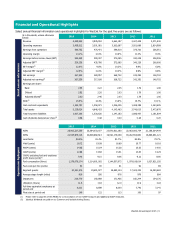

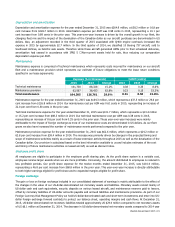

Financial and Operational Highlights

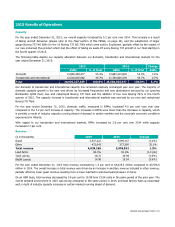

Select annual financial information and operational highlights for WestJet for the past five years are as follows:

($ in thousands, unless otherwise

noted)

2015 2014 2013 2012 2011

Select annual information

Revenue 4,029,265 3,976,552 3,662,197

3,427,409 3,071,540

Operating expenses 3,459,512 3,501,081 3,262,687

3,051,689 2,814,989

Earnings from operations 569,752 475,471 399,510

375,720 256,551

Operating margin 14.1% 12.0% 10.9% 11.0% 8.4%

Earnings before income taxes (EBT) 520,258 390,307 372,085

340,229

208,006

Adjusted EBT(i) 520,258 435,766 372,085

340,229 208,006

EBT margin(i) 12.9% 9.8% 10.2% 9.9% 6.8%

Adjusted EBT margin(i) 12.9% 11.0% 10.2% 9.9% 6.8%

Net earnings 367,530 283,957 268,722

242,392 148,702

Adjusted net earnings(i) 367,530 317,188 268,722

242,392 148,702

Earnings per share:

Basic 2.94 2.22 2.05 1.79 1.06

Diluted 2.92 2.20 2.03 1.78 1.06

Adjusted diluted(i) 2.92 2.46 2.03 1.78 1.06

ROIC(i) 15.3% 14.3% 13.9% 13.7% 10.1%

Cash and cash equivalents 1,183,797 1,358,071 1,256,005

1,408,199 1,243,605

Total assets 5,129,024 4,646,433 4,143,463

3,746,615 3,473,678

Total long-term liabilities 1,617,106 1,530,630 1,147,163

1,086,457 1,161,604

Cash dividends declared per share(ii) 0.56 0.48 0.40 0.28 0.20

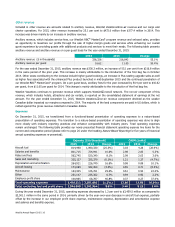

2015 2014 2013 2012 2011

Operational highlights

ASMs 26,902,227,359 25,584,033,077 23,970,921,260

22,063,583,754 21,186,304,409

RPMs 21,525,979,116 20,828,992,613 19,591,173,039

18,262,554,881 16,890,941,121

Load factor 80.0% 81.4% 81.7% 82.8% 79.7%

Yield (cents) 18.72 19.09 18.69 18.77 18.18

RASM (cents) 14.98 15.54 15.28 15.53 14.50

CASM (cents) 12.86 13.68 13.61 13.83 13.29

CASM, excluding fuel and employee

profit share (cents)

(i) 9.46 9.15 9.06 9.12 8.85

Fuel consumption (litres) 1,278,079,174 1,214,001,002 1,144,937,872

1,079,108,614 1,027,821,192

Fuel costs per litre (cents) 64 90 91 92 89

Segment guests 20,281,376 19,651,977 18,485,144

17,423,352 16,040,682

Average stage length (miles) 910 936 976 978 984

Departures 209,770 192,858 171,436 160,244 154,176

Utilization (hours) 11.6 11.8 12.0 11.9 11.8

Full-time equivalent employees at

period end

9,211 8,698 8,000 7,742 7,141

Fleet size at period end 140 122 113 100 97

(i) Please refer to page 56 of this MD&A for a reconciliation of non-GAAP measures and additional GAAP measures.

(ii) Identical dividends are paid on our Common and Variable Voting Shares.