Westjet 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 40

Risks and Uncertainties

The risks described below are not intended to be an exhaustive list of all risks facing our Company. Other risks of which we

are not currently aware or which we currently deem immaterial may surface and have a material adverse impact on our

business.

Risks relating to the business

Our financial results are affected by foreign exchange and interest rate fluctuations.

We are exposed to foreign exchange risks arising from fluctuations in exchange rates on our U.S.-dollar-denominated net

monetary assets and liabilities and operating expenditures, mainly aircraft fuel, aircraft leasing expense, certain maintenance

costs, a portion of airport operation costs, certain IT and computer reservation system fees, and the land components

associated with our WestJet Vacation packages. Since our revenues are received primarily in Canadian dollars, we do not have

offsetting gains therefore we are fully exposed to fluctuations in the US-dollar exchange rate with respect to these payment

obligations.

As of the date of this MD&A, we are also exposed to fluctuations in the US-dollar exchange rate relating to 18 Boeing 737 NG

aircraft purchase commitments and 65 Boeing MAX aircraft purchase commitments. The purchase of our Boeing aircraft are

financed by funds drawn in Canadian dollars while the aircraft are paid for in U.S. funds at the date of each aircraft deposit.

As a result, we are exposed to foreign currency fluctuations prior to each deposit date.

A significant deterioration of the Canadian dollar against the US dollar would have an adverse effect on our US-dollar

operating and capital costs and our earnings would be negatively impacted. In addition, our foreign exchange hedging is

currently limited to certain US-dollar operating expenditures and there is no assurance that this hedging will be effective in

mitigating the impact of adverse changes in the US-dollar exchange rate on our earnings.

We are also exposed to general market fluctuations in interest rates for our future aircraft purchase commitments that will be

financed at prevailing market rates. We continuously review financing alternatives available to us for our future aircraft

deliveries. A significant increase in market interest rates would have an adverse impact on our future borrowing costs and

earnings and there is no assurance our interest rate hedging program will be effective in mitigating these increases.

We are dependent on the price and availability of jet fuel. Continued periods of high fuel costs, volatility of fuel

prices and/or significant disruptions in the supply of fuel could adversely affect our results of operations.

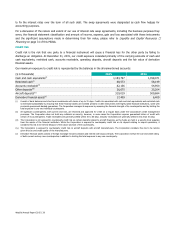

Jet fuel pricing represents a significant risk, as our fuel costs constitute our largest single expense category, representing 24.0

and 31.1 per cent of operating costs in 2015 and 2014, respectively. Fuel prices are affected by a host of factors outside our

control, such as significant weather events, geopolitical tensions, refinery capacity and global demand and supply. A small

change in the price of fuel can significantly affect our fuel costs and ultimately our earnings.

The ability to protect and grow our earnings in a volatile and rising fuel price environment is affected by our ability to manage

fuel costs through key cost initiatives such as investments in fuel efficient aircraft as well as cost effective fuel management IT

systems and fuel purchasing and dispensing services. These cost initiatives can only partially mitigate volatile and rising fuel

prices, require long lead times to implement, and may or may not create a competitive cost advantage compared to the

effectiveness of our competitors’ fuel savings investments and technologies at a given point in time. We discontinued our fuel

hedging program in 2012 but may re-visit the program as changing markets and competitive conditions warrant. There is no

assurance that any new fuel hedging program will be effective in offsetting volatile or rising fuel prices or create a competitive

advantage compared to our competitors.

The ability to protect and grow our earnings in a volatile and rising fuel price environment is also affected by our ability to

manage fuel costs through revenue management and pricing initiatives. The effectiveness of these initiatives are limited by

factors outside our control including the ability of the market to absorb price increases, the competitive pricing actions of our

competitors, and the general macroeconomic conditions affecting discretionary consumer spending as it relates to both leisure

and business travelers.

There is no guarantee that our fuel cost initiatives and revenue management practices will be effective in offsetting volatile or

increasing fuel prices. If we are unable to mitigate volatile or increasing fuel prices, this would have an adverse effect on our