Westjet 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 24

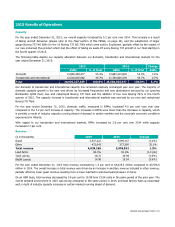

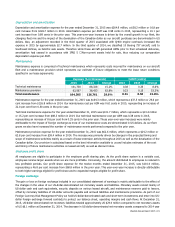

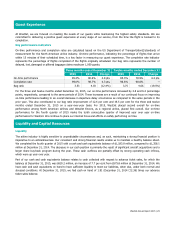

Other revenue

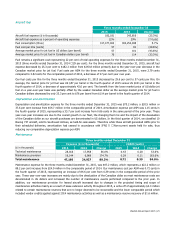

Other revenue increased by6.0 per cent to $116.2 million for the fourth quarter of 2015, from $109.6 million in the same

period of the prior year. This increase was driven mainly by an increase in ancillary revenue. The following table presents

ancillary revenue and ancillary revenue on a per guest basis for the three months ended December 31, 2015:

Three months ended December 31

2015 2014 Change

Ancillary revenue ($ in thousands)

79,832 66,971 19.2%

Ancillary revenue per guest

16.39 13.89 18.0%

For the three months ended December 31, 2015 ancillary revenue was $79.8 million, an increase of 19.2 per cent from $67.0

million in the same quarter of 2014. On a per guest basis, ancillary fees for the quarter increased by 18.0 per cent to $16.39

per guest, from $13.89 per guest during the fourth quarter of 2014. These increases are mainly attributable to the

introduction of the first bag fee in October 2014. Other areas contributing to the increase include higher fees associated with

the enhanced Plus product that we introduced in mid-September 2015 and the continued penetration of our WestJet RBC®

MasterCard± program.

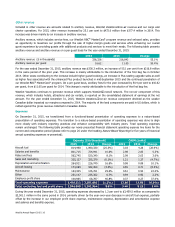

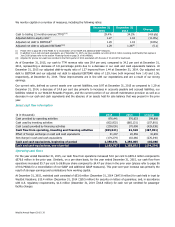

Expenses

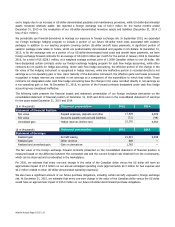

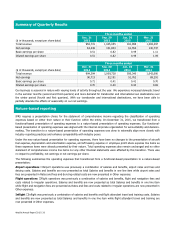

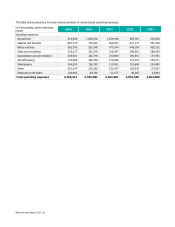

On December 31, 2015, we transitioned from a functional-based presentation of operating expenses to a nature-based

presentation of operating expenses. The transition to a nature-base presentation of operating expenses was done to align

more closely with industry reporting practices and enhance comparability with industry peers. Total operating expenses

remain unchanged. The following table provides our newly presented financial statement operating expense line items for the

current and comparative period (please refer to page 26 under the heading

Nature-Based Reporting

for five years of historical

annual operating expenses re-presented).

Expense ($ in thousands)

CASM (cents)

Three months ended Dec 31 Three months ended Dec 31

2015

2014

Change

2015

2014

Change

Aircraft fuel

182,181

243,816

(25.3%) 2.79

3.82

(27.0%)

Salaries and benefits

198,310

184,210

7.7%

3.04

2.89

5.2%

Rates and fees

139,534

128,289

8.8% 2.14

2.01

6.5%

Sales and marketing

84,009

85,852

(2.1%)

1.29

1.35

(4.4%)

Depreciation and amortization

75,237

54,696

37.6% 1.15

0.86

33.7%

Aircraft leasing

41,881

45,546

(8.0%) 0.64

0.71

(9.9%)

Maintenance

47,160

24,927

89.2% 0.72

0.39

84.6%

Other

68,847

64,052

7.5%

1.06

1.00

6.0%

Employee profit share

8,869

23,399

(62.1%)

0.14

0.37

(62.2%)

Total operating expenses 846,028

854,787

(1.0%) 12.97

13.40

(3.2%)

Total, excluding fuel and profit

share

654,978

587,572

11.5% 10.04

9.21

9.0%

During the three months ended December 31, 2015, operating expenses decreased by 1.0 per cent compared to the same

period in 2014. On an ASM basis, operating expenses decreased by 3.2 per cent to 12.97 cents from 13.40 cents in the same

period in 2014. This decrease was largely driven by decreases in aircraft fuel expense and our employee profit share expense,

partially offset by the increase in maintenance expense and depreciation and amortization expense.