Westjet 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 19

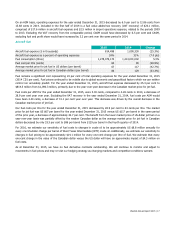

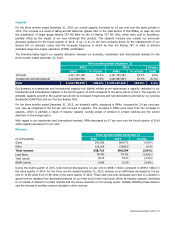

Depreciation and amortization

Depreciation and amortization expense for the year ended December 31, 2015 was $264.9 million, a $38.2 million or 16.8 per

cent increase from $226.7 million in 2014. Amortization expense per ASM was 0.98 cents in 2015, representing a 10.1 per

cent increase from 0.89 cents in the prior year. This year-over-year increase is driven by the overall growth in our fleet, the

changing fleet mix and the impact of the devaluation of the Canadian dollar as our aircraft purchases are denominated in US

dollars. Also, an adjustment recorded in the third quarter of 2015 associated with Q400 engine overhauls increased the

expense in 2015 by approximately $2.7 million. In the third quarter of 2014, we classified 10 Boeing 737 aircraft, sold to

Southwest Airlines, as held-for-sale assets. Therefore while these aircraft generated ASMs prior to their scheduled deliveries,

amortization had ceased in accordance with IFRS 5 – Non-current assets held for sale, thus reducing our comparative

depreciation expense per ASM.

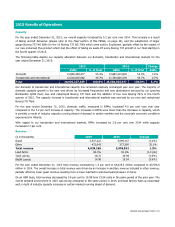

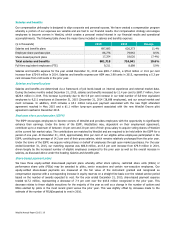

Maintenance

Maintenance expense is comprised of technical maintenance which represents costs incurred for maintenance on our aircraft

fleet and a maintenance provision which represents our estimate of future obligations to meet the lease return conditions

specified in our lease agreements.

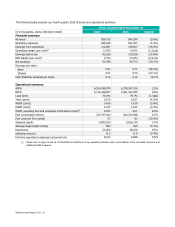

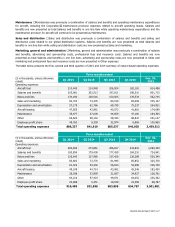

Expense ($ in thousands) CASM (cents)

2015

2014

Change

2015

2014

Change

Technical maintenance

101,738 88,328 15.2% 0.38 0.35 8.6%

Maintenance provision

62,567

38,433

62.8%

0.23

0.15

53.3%

Total maintenance

164,305 126,761 29.6%

0.61

0.50

22.0%

Maintenance expense for the year ended December 31, 2015 was $164.3 million, which represents a $37.5 million or 29.6 per

cent increase from $126.8 million in 2014. Our maintenance cost per ASM was 0.61 cents in 2015, representing an increase of

22.0 per cent from 0.50 cents in the prior year.

Technical maintenance expense for the year ended December 31, 2015 was $101.7 million, which represents a $13.4 million

or 15.2 per cent increase from $88.3 million in 2014. Our technical maintenance cost per ASM was 0.38 cents in 2015,

representing an increase of 8.6 per cent from 0.35 cents in the prior year. These year-over-year increases were mainly

attributable to the impact of foreign exchange as most of our maintenance costs are denominated in US dollars. As our fleet

grows we also have increased the number of maintenance events performed compared to the prior year.

Maintenance provision expense for the year ended December 31, 2015 was $62.6 million, which represents a $24.2 million or

62.8 per cent increase from $38.4 million in 2014. The increase was primarily driven by changes in the projected timing and

scope of maintenance activities mainly as a result of lease extension activity throughout 2015 as well as the devaluation of the

Canadian dollar. Our provision is calculated based on the best information available to us and includes estimates of the cost

and timing of future maintenance activities on leased aircraft, as well as discount rates.

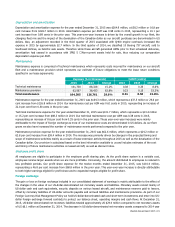

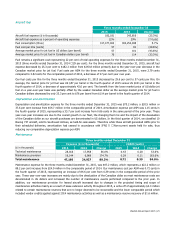

Employee profit share

All employees are eligible to participate in the employee profit sharing plan. As the profit share system is a variable cost,

employees receive larger awards when we are more profitable. Conversely, the amount distributed to employees is reduced in

less profitable periods. Our profit share expense for the twelve months ended December 31, 2015, was $101.0 million,

representing a 46.8 per cent increase from $68.8 million in the prior year. This year-over-year increase is directly attributable

to both higher earnings eligible for profit share and to expanded margins eligible for profit share.

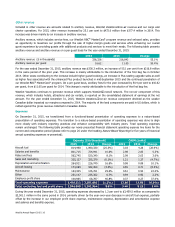

Foreign exchange

The gain or loss on foreign exchange included in our consolidated statement of earnings is mainly attributable to the effect of

the changes in the value of our US-dollar-denominated net monetary assets and liabilities. Monetary assets consist mainly of

US-dollar cash and cash equivalents, security deposits on various leased aircraft, and maintenance reserves paid to lessors,

offset by monetary liabilities of US-dollar accounts payable and accrued liabilities and maintenance provisions. As part of our

Foreign Currency Risk Management Policy we hold US-dollar-denominated cash and short-term investments and enter into US-

dollar foreign exchange forward contracts to protect our balance sheet, operating margins and cash flows. At December 31,

2015, US-dollar-denominated net monetary liabilities totaled approximately US $24.0 million compared to net monetary assets

of US $6.1 million at December 31, 2014. The decrease in US-dollar-denominated net monetary assets compared to 2014 year