Westjet 2015 Annual Report Download - page 44

Download and view the complete annual report

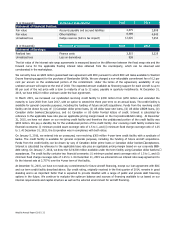

Please find page 44 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WestJet Annual Report 2015 | 42

Failure to maintain our low-cost operating model would have adverse effects on our business strategy,

financial condition and results of operations.

Our low cost business model is a key factor that enables us to provide low fares to our guests, protect and increase our

market share through competitive pricing and fund our future growth initiatives. We continuously monitor and evaluate our

operations for current and future cost saving opportunities that enable us to maintain or enhance our low cost business

model. Although we have been effective in executing our low cost business model to date, there is no assurance that we will

be able to do so in the future, especially related to costs that are outside our control, including fuel, foreign exchange rates,

interest rates, government rates and fees, insurance and competitive and inflationary labour market pressures. Should we not

be able to maintain a cost advantage over our competitors, this would affect our ability to offer competitively low fares to our

guests. We are particularly dependent on the cost-conscious leisure traveler and therefore our ability to profitably offer

competitive and low fares is critical to protecting and increasing our market share and funding our future growth initiatives.

Should we not be able to accomplish these objectives due to higher costs, this would have negative impacts on our earnings

and financial condition.

Our operations are becoming increasingly complex as we continue to add different aircraft to our fleet mix and

expand into new markets. The complexities of a mixed fleet and new markets could result in unexpected costs,

stronger than expected competitive reactions and weaker than expected demand environments, which could

adversely affect our financial condition and results of operations.

We plan to continue adding new markets and additional frequencies to our existing markets through the growth of our

regional Bombardier Q400 fleet, our narrow body Boeing 737 NG fleet and the addition of wide body Boeing 767 aircraft.

The continued expansion of our fleet through smaller regional Bombardier Q400 turboprop aircraft and larger wide body

Boeing 767 jet aircraft create additional operational complexity, new costs and stronger competition not previously

encountered with our single fleet of Boeing 737 NG aircraft. Since we are both a relatively new operator in the regional space

and have only begun to operate wide body aircraft, we may encounter unforeseen or unexpected costs and operational

complexities that may adversely affect our financial condition, results of operations and guest experience.

The addition of new markets also exposes us to further operational complexity and uncertainty, new competition and new

demand environments. Should we not be able to effectively mitigate these additional complexities, competitive forces and new

markets this may adversely affect our financial condition, results of operations and guest experience.

Our network and operations are increasingly dependent on a few key markets and airports including YYZ, YYC

and YVR.

To efficiently serve our network of destinations we are increasingly dependent on the markets and airport operations at

Toronto’s Pearson International Airport, Calgary International Airport and Vancouver International Airport. A significant change

in the demand environment in these markets, a significant change to airport rates and fees or significant operational

disturbances due to weather or other acts outside our control would have an adverse impact to our operations and financial

results.

As we have expanded our use of partnership agreements with other airlines our financial results, network and

system integration and guest experience will become more sensitive to the effectiveness of our interline and

code sharing arrangements.

We continue to expand our network through interline and codeshare partnerships with other airlines around the world. As our

partnerships continue to mature and grow we expect to see a larger volume of traffic being exchanged between us and our

partners resulting in a larger impact to our financial results and an increased reliance on our network and systems integration

with our partners. Consequently, weaker traffic coming from our partners or unexpected costs or technical issues with our

partner network and systems could have an increasingly adverse effect on our operations and financial results.

Our guest experience is also increasingly subject to variation as our guests increase their travel on our partner airlines. This

could have an adverse effect on our business and financial results if our guests perceive a lower quality experience on our

partners.