Westjet 2015 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 16

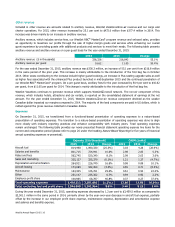

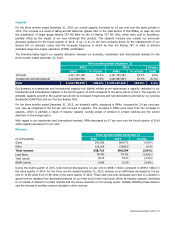

Other revenue

Included in other revenue are amounts related to ancillary revenue, WestJet Vacations’ non-air revenue and our cargo and

charter operations. For 2015, other revenue increased by 25.1 per cent to $472.0 million from $377.4 million in 2014. This

increase was driven mainly by an increase in ancillary revenue.

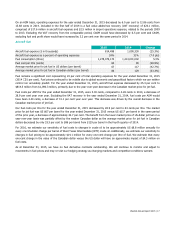

Ancillary revenue, which includes service fees, our WestJet RBC® MasterCard± program revenue and onboard sales, provides

an opportunity to maximize our profits through the sale of higher-margin goods and services while enhancing our overall

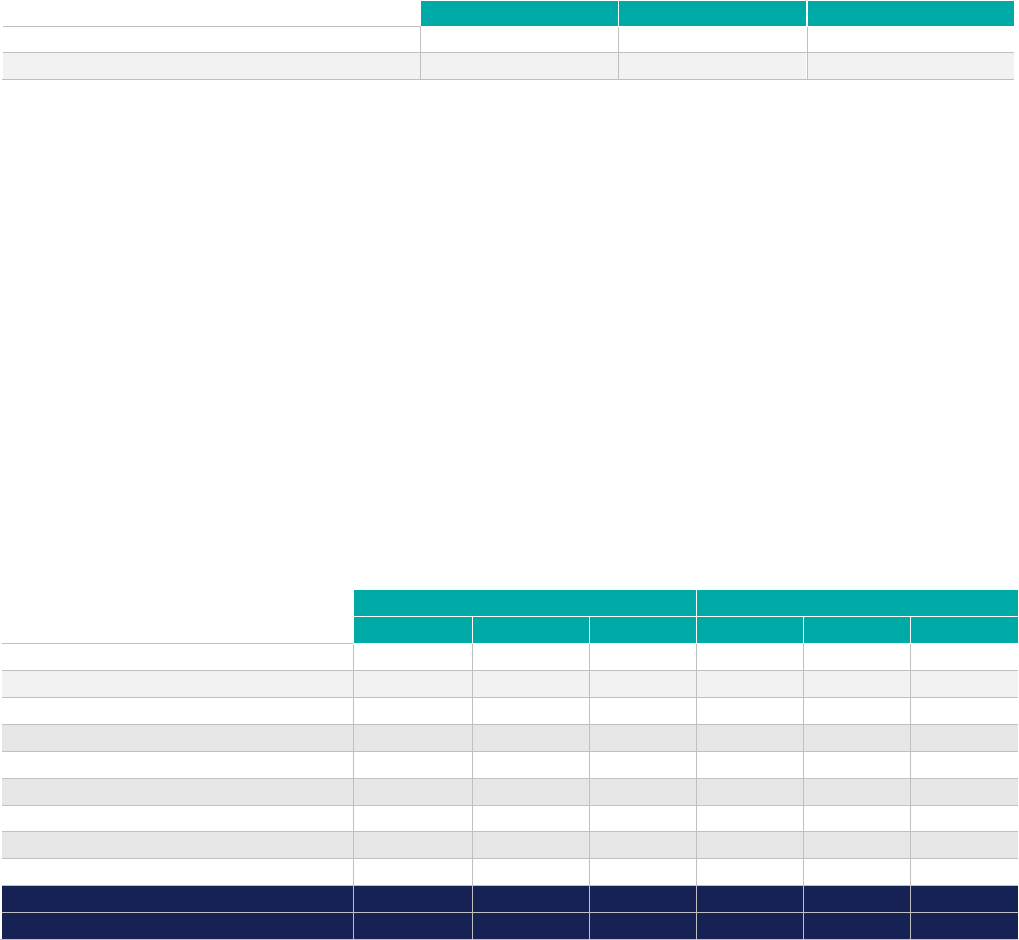

guest experience by providing guests with additional products and services to meet their needs. The following table presents

ancillary revenue and ancillary revenue on a per guest basis for the year ended December 31, 2015:

2015 2014 Change

Ancillary revenue ($ in thousands)

336,326 216,842 55.1%

Ancillary revenue per guest

16.62

11.05

50.4%

For the year ended December 31, 2015, ancillary revenue was $336.3 million, an increase of 55.1 per cent from $216.8 million

in the same period of the prior year. This increase is mainly attributable to the introduction of the first bag fee in October

2014. Other areas contributing to the increase include higher guest bookings, an increase in Plus seating upgrade sales as well

as higher fees associated with the enhanced Plus product launched in mid-September 2015 and the continued penetration of

our WestJet RBC® MasterCard± program. On a per guest basis, ancillary fees for the year increased by 50.4 per cent to $16.62

per guest, from $11.05 per guest for 2014. This change is mainly attributable to the introduction of the first bag fee.

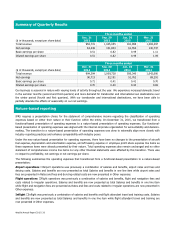

WestJet Vacations continues to generate revenue which supports WestJet’s overall network. The non-air component of this

revenue, which includes hotels, attractions and car rentals, is reported on the consolidated statement of earnings at the net

amount. For the year ended December 31, 2015, WestJet Vacations’ non-air revenue component declined as the weaker

Canadian dollar impacted our margins compared to 2014. The majority of the land components are paid in US dollars, which is

netted against the gross revenue collected in Canadian dollars.

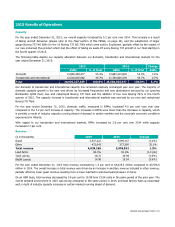

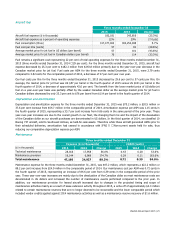

Expenses

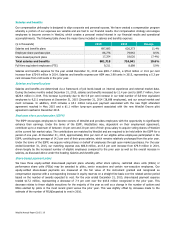

On December 31, 2015, we transitioned from a functional-based presentation of operating expenses to a nature-based

presentation of operating expenses. The transition to a nature-based presentation of operating expenses was done to align

more closely with industry reporting practices and enhance comparability with industry peers. Total operating expenses

remain unchanged. The following table provides our newly presented financial statement operating expense line items for the

current and comparative period (please refer to page 26 under the heading

Nature-Based Reporting

for five years of historical

annual operating expenses re-presented).

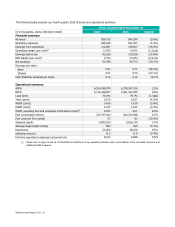

Expense ($ in thousands) CASM (cents)

2015

2014

Change

2015

2014

Change

Aircraft fuel

814,498

1,090,330

(25.3%) 3.03

4.26

(28.9%)

Salaries and benefits

801,715

724,941

10.6% 2.98

2.83

5.3%

Rates and fees

562,745

520,340

8.1% 2.09

2.03

3.0%

Sales and marketing

325,127 325,370 (0.1%) 1.21 1.27 (4.7%)

Depreciation and amortization

264,921

226,740

16.8% 0.98

0.89

10.1%

Aircraft leasing

174,089

182,450

(4.6%) 0.65

0.71

(8.5%)

Maintenance

164,305

126,761

29.6% 0.61

0.50

22.0%

Other

251,147

235,362

6.7% 0.94

0.92

2.2%

Employee profit share

100,965

68,787

46.8%

0.37

0.27

37.0%

Total operating expenses 3,459,512

3,501,081

(1.2%) 12.86

13.68

(6.0%)

Total, excluding fuel and profit share

2,544,049

2,341,964

8.6%

9.46

9.15

3.4%

During the year ended December 31, 2015, operating expenses decreased by 1.2 per cent to $3,459.5 million as compared to

$3,501.1 million in the same period in 2014, primarily driven by the year-over-year decrease in aircraft fuel expense, partially

offset by the increase in our employee profit share expense, maintenance expense, depreciation and amortization expense

and salaries and benefits expense.