Westjet 2015 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 20

end is largely due to an increase in US-dollar-denominated payables and maintenance provisions, while US-dollar-denominated

assets remained relatively stable. We reported a foreign exchange loss of $10.3 million for the twelve months ended

December 31, 2015 on the revaluation of our US-dollar-denominated monetary assets and liabilities (December 31, 2014 –

loss of $2.1 million).

We periodically use financial derivatives to manage our exposure to foreign exchange risk. In September 2015, we expanded

our foreign exchange hedging program to include a portion of our future US-dollar hotel costs associated with vacation

packages in addition to our existing program covering certain US-dollar aircraft lease payments. A significant portion of

vacation package costs relate to hotels, which are predominantly denominated and payable in US dollars. At December 31,

2015, to fix the exchange rate on a portion of our US-dollar-denominated hotel costs and aircraft lease payments, we have

foreign exchange forward contracts for an average of US $19.0 million per month for the period of January 2016 to December

2016, for a total of US $228.1 million, at a weighted average contract price of 1.3069 Canadian dollars to one US dollar. We

have designated certain contracts under our foreign exchange hedging program for cash flow hedge accounting, while other

contracts do not qualify for hedge accounting. Under cash flow hedge accounting, the effective portion of the change in the

fair value of the hedging instrument is recognized in hedge reserves, while any ineffective portion is recorded directly to net

earnings as a non-operating gain or loss. Upon maturity of the derivative instrument, the effective gains and losses previously

recognized in hedge reserves are recorded in net earnings as a component of the expenditure to which they relate. Those

contracts not designated under cash flow hedge accounting have the change in fair value recorded directly in net earnings as

a non-operating gain or loss. At December 31, 2015, no portion of the forward contracts designated under cash flow hedge

accounting was considered ineffective.

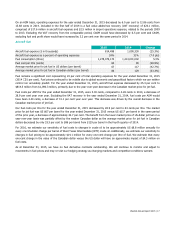

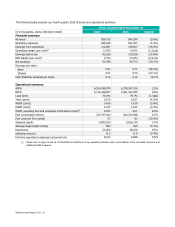

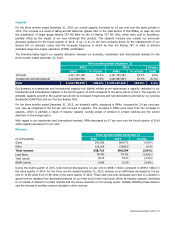

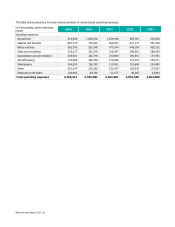

The following table presents the financial impact and statement presentation of our foreign exchange derivatives on the

consolidated statement of financial position at December 31, 2015 and 2014 and on the consolidated statement of earnings

for the years ended December 31, 2015 and 2014.

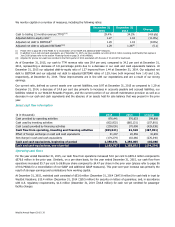

($ in thousands)

Statement presentation

2015

2014

Statement of Financial Position:

Fair value

Prepaid expenses, deposits and other

17,409

6,409

Fair value Accounts payable and accrued liabilities

(51)

(49)

Unrealized gain

Hedge reserves (before tax)

15,770

6,360

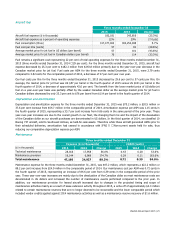

($ in thousands)

Statement presentation

2015

2014

Statement of Earnings:

Realized gain Aircraft leasing 21,515 9,498

Realized gain

Other revenue

608

―

Realized and unrealized gain

Gain on derivatives

1,765

―

The fair value of the foreign exchange forward contracts presented on the consolidated statement of financial position is

measured based on the difference between the contracted rate and the current forward rate obtained from the counterparty,

which can be observed and corroborated in the marketplace.

For 2016, we estimate that every one-cent change in the value of the Canadian dollar versus the US dollar will have an

approximate impact of $7.5 million on our annual unhedged operating costs (approximately $4.3 million for fuel expense and

$3.2 million related to other US-dollar-denominated operating expenses).

We also have a significant amount of our future purchase obligations, including certain aircraft, exposed to foreign exchange

risk. At December 31, 2015, we estimate that every one-cent change in the value of the Canadian dollar versus the US dollar

would have an approximate impact of $35.0 million on our future US-dollar-denominated purchase obligations.