Westjet 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 57

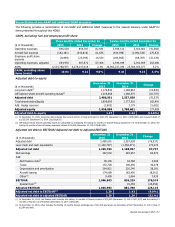

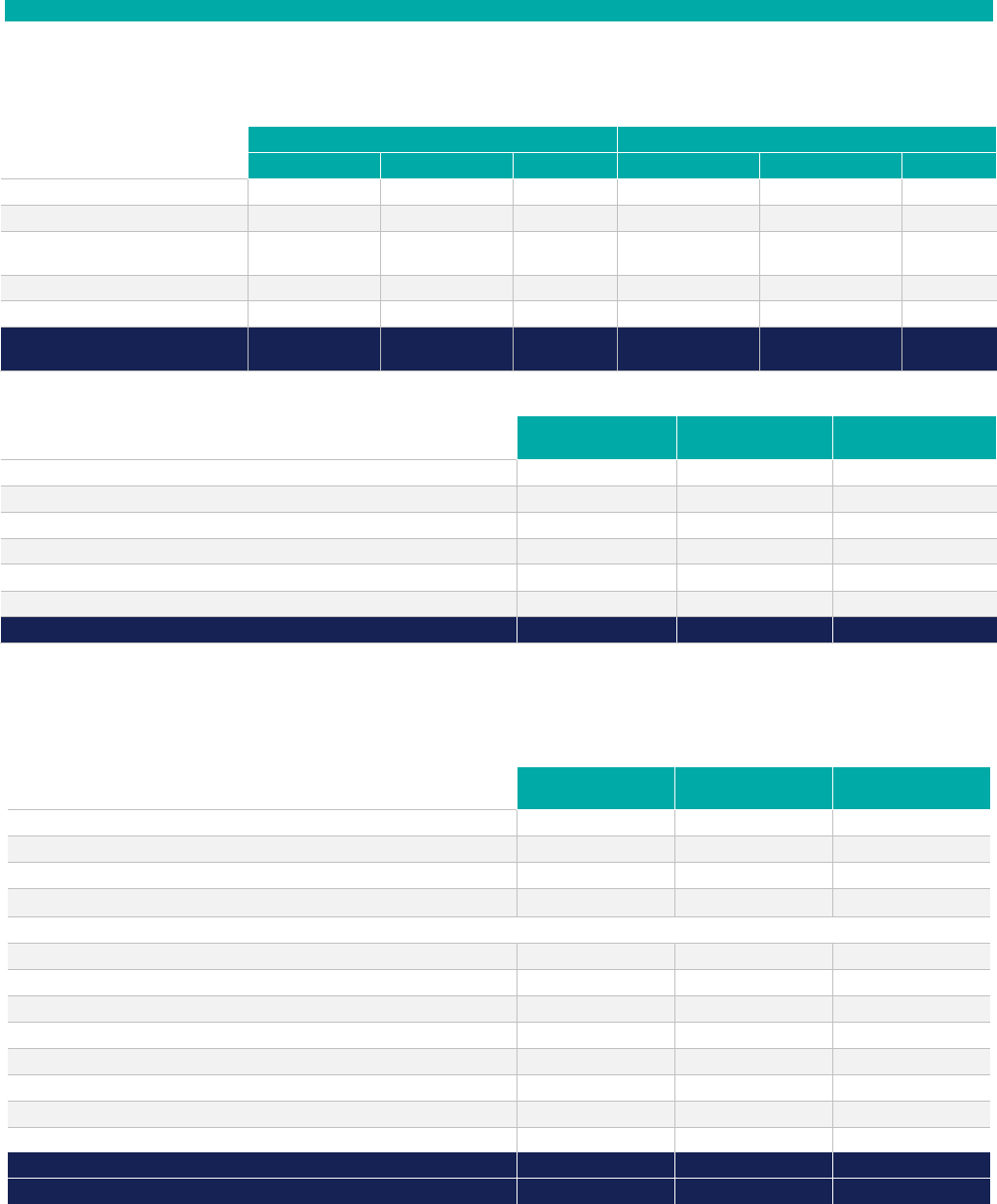

Reconciliation of non-GAAP and additional GAAP measures

The following provides a reconciliation of non-GAAP and additional GAAP measures to the nearest measure under GAAP for

items presented throughout this MD&A.

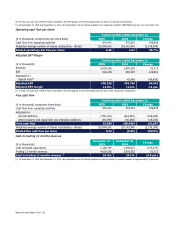

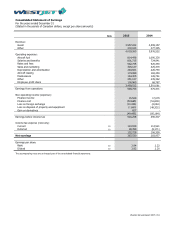

CASM, excluding fuel and employee profit share

Three months ended December 31

Twelve months ended December 31

($ in thousands)

2015 2014 Change 2015 2014 Change

Operating expenses

846,028

854,787

(8,759)

3,459,512

3,501,081

(41,568)

Aircraft fuel expense (182,181) (243,816) 61,635 (814,498) (1,090,330) 275,832

Employee profit share

expense

(8,869) (23,399) 14,530 (100,965) (68,787) (32,178)

Operating expenses, adjusted 654,978 587,572 67,406 2,544,049 2,341,964 202,086

ASMs 6,524,788,975 6,378,247,018 2.3% 26,902,227,359 25,584,033,077 5.2%

CASM, excluding above

items (cents)

10.04 9.21 9.0% 9.46 9.15 3.4%

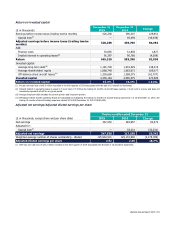

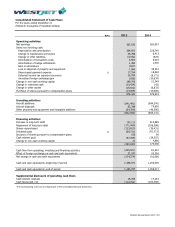

Adjusted debt-to-equity

($ in thousands)

December 31

2015

December 31

2014

Change

Long-term debt

(i)

1,174,833 1,188,663 (13,830)

Off-balance-sheet aircraft operating leases

(ii)

1,305,668 1,368,375 (62,707)

Adjusted debt 2,480,501 2,557,038 (76,537)

Total shareholders’ equity 1,959,993 1,777,502 182,491

Add: Hedge reserves (1,903) 3,179 (5,082)

Adjusted equity

1,958,090

1,780,681

177,409

Adjusted debt-to-equity 1.27 1.44 (11.8%)

(i) At December 31, 2015, long-term debt includes the current portion of long-term debt of $141,572 (December 31, 2014 – $159,843) and long-term debt of

$1,033,261 (December 31, 2014 – $1,028,820).

(ii) Off-balance-sheet aircraft operating leases are calculated by multiplying the trailing 12 months of aircraft leasing expense by 7.5. At December 31, 2015, the

trailing 12 months of aircraft leasing expenses totaled $174,089 (December 31, 2014 – $182,450).

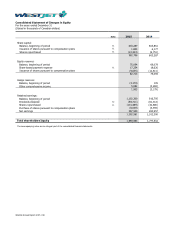

Adjusted net debt to EBITDAR/Adjusted net debt to adjusted EBITDAR

($ in thousands)

December 31

2015

December 31

2014

Change

Adjusted debt 2,480,501 2,557,038 (76,537)

Less: Cash and cash equivalents

(1,183,797)

(1,358,071)

174,274

Adjusted net debt

1,296,704

1,198,967

97,737

Net earnings 367,530 283,957 83,573

Add:

Net finance costs(i)

38,136

34,768

3,368

Taxes 152,728 106,350 46,378

Depreciation and amortization

264,921

226,740

38,181

Aircraft leasing 174,089 182,450 (8,361)

Other

(ii)

9,499 2,064 7,435

EBITDAR

1,006,903

836,329

170,574

Special Item

(iii)

- 45,459 (45,459)

Adjusted EBITDAR

1,006,903

881,788

125,115

Adjusted net debt to EBITDAR(iv)

1.29

1.43

(9.8%)

Adjusted net debt to adjusted EBITDAR

1.29 1.36 (5.1%)

(i) At December 31, 2015, net finance costs includes the trailing 12 months of finance income of $15,529 (December 31, 2014 – $17,070) and the trailing 12

months of finance cost of $53,665 (December 31, 2014 – $51,838).

(ii) At December 31, 2015, other includes the trailing 12 months foreign exchange loss of $10,326 and a gain on derivatives of 827 (December 31, 2014 – loss of

$2,064 and $nil).