Westjet 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 32

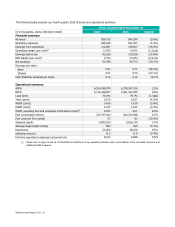

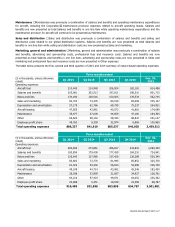

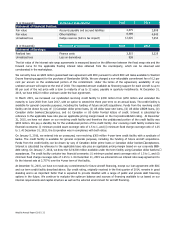

($ in thousands)

Statement presentation

2015

2014

Statement of Financial Position:

Fair value Accounts payable and accrued liabilities

4,475

2,809

Fair value Other liabilities

8,489

4,845

Unrealized loss Hedge reserves (before tax impact)

12,026

7,654

($ in thousands)

Statement presentation

2015

2014

Statement of Earnings:

Realized loss

Finance costs

3,515

3,225

Unrealized loss Loss on derivatives 938 −

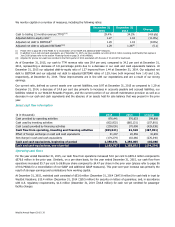

The fair value of the interest rate swap agreements is measured based on the difference between the fixed swap rate and the

forward curve for the applicable floating interest rates obtained from the counterparty, which can be observed and

corroborated in the marketplace.

We currently have an $820 million guaranteed loan agreement with EDC pursuant to which EDC will make available to WestJet

Encore financing support for the purchase of Bombardier Q400s. We are charged a non-refundable commitment fee of 0.2 per

cent per annum on the undisbursed portion of the commitment. Under the terms of the agreement, availability of any

undrawn amount will expire at the end of 2018. The expected amount available as financing support for each aircraft is up to

80 per cent of the net price with a term to maturity of up to 12 years, payable in quarterly installments. At December 31,

2015, we have $422.0 million undrawn under the loan agreement.

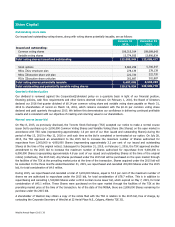

In March 2015, we increased our syndicated revolving credit facility to $300 million from $250 million and extended the

maturity to June 2018 from June 2017, with an option to extend the three year term on an annual basis. The credit facility is

available for general corporate purposes, including the funding of future aircraft acquisitions. Funds from the revolving credit

facility can be drawn by way of: (i) Canadian dollar prime loans, (ii) US dollar base rate loans, (iii) US dollar LIBOR loans, (iv)

Canadian dollar bankers’ acceptances, and (v) Canadian or US dollar fronted letters of credit. Interest is calculated by

reference to the applicable base rate plus an applicable pricing margin based on the Corporation’s debt rating. At December

31, 2015, we have not drawn on our revolving credit facility and therefore the undisbursed portion of the credit facility was

$300 million. We pay a standby fee for the undisbursed portion of the credit facility. Our revolving credit facility contains two

financial covenants: (i) minimum pooled asset coverage ratio of 1.5 to 1, and (ii) minimum fixed charge coverage ratio of 1.25

to 1. At December 31, 2015, the Corporation was in compliance with both ratios.

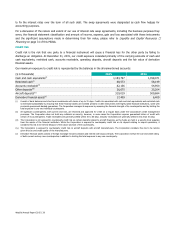

On January 5, 2016, we entered into an unsecured, non-revolving $300 million 4-year term credit facility with a syndicate of

banks. The credit facility is available for general corporate purposes, including the funding of future aircraft acquisitions.

Funds from the credit facility can be drawn by way of Canadian dollar prime loans or Canadian dollar bankers’ acceptances.

Interest is calculated by reference to the applicable base rate plus an applicable pricing margin based on our corporate BBB-

debt rating. On January 7, 2016, we drew the full $300 million available under the term facility using Canadian dollar bankers’

acceptances. The credit facility contains two financial covenants: (i) minimum pooled asset coverage ratio of 1.5 to 1, and (ii)

minimum fixed charge coverage ratio of 1.25 to 1. On December 11, 2015 we entered into an interest rate swap agreement to

fix the interest rate at 2.757% over the 4-year term of the facility.

At December 31, 2015, we have not made any commitments for future aircraft financing, except our loan agreement with EDC

and our term credit facility described above. Our credit rating, originally received in the first quarter of 2014, remains in good

standing and is an important factor that is expected to provide WestJet with a range of public and private debt financing

options in the future. We continue to evaluate the optimum balance and sources of financing available to us based on our

internal requirements and capital structure as well as the external environment for aircraft financing.