Westjet 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2015 and 2014

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

WestJet Annual Report 2015 | 85

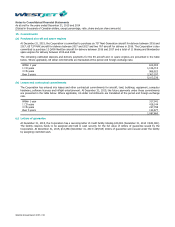

11. Share capital (continued)

(c) Stock option plan (continued)

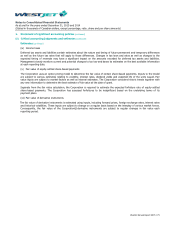

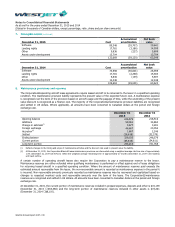

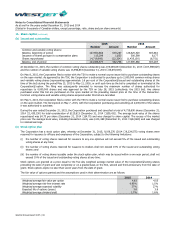

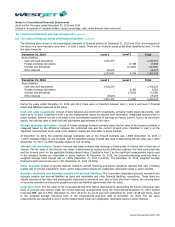

Changes in the number of options, with their weighted average exercise prices, are summarized below:

2015

2014

Number of

options

Weighted

exercise price

Number of

options

Weighted

exercise price

Stock options outstanding, beginning of period

3,738,714

22.33

2,834,639

19.20

Granted

2,477,323

26.63

2,353,474

23.94

Exercised

(371,169)

19.04

(1,447,250)

18.82

Forfeited

(111,736)

23.65

(2,149)

22.90

Expired

(26,585)

20.89

-

-

Stock options outstanding, end of period

5,706,547

24.40

3,738,714

22.33

Exercisable, end of period

2,785,374

22.44

912,772

19.38

Under the terms of the Corporation's stock option plan, with the approval of the Corporation, option holders can either (i) elect

to receive shares by delivering cash to the Corporation in the amount of the exercise price of the options, or (ii) choose a

cashless settlement alternative, whereby they can elect to receive a number of shares equivalent to the market value of the

options over the exercise price. For the year ended December 31, 2015, option holders exercised 363,734 options (2014 –

1,442,006 options) on a cashless basis and received 107,864 shares (2014 – 495,354 shares). For the year ended December 31,

2015, 7,435 options were exercised on a cash basis (2014 – 5,244 options) and option holders received 7,435 shares (2014 –

5,244 shares).

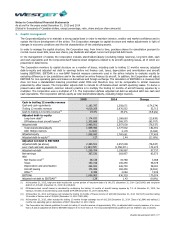

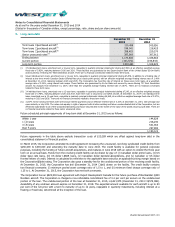

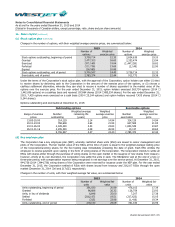

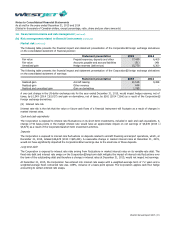

Options outstanding and exercisable at December 31, 2015:

Outstanding options

Exercisable options

Range of exercise

prices

Number

outstanding

Weighted average

remaining life

(years)

Weighted

average exercise

price

Number

exercisable

Weighted

average exercise

price

13.85-20.00

314,129

2.14

14.94

314,129

14.94

20.01-23.00

768,638

2.64

21.94

627,569

21.93

23.01-26.00

2,328,440

3.33

23.83

1,833,539

23.87

26.01-31.16

2,295,340

4.08

26.94

10,137

28.63

5,706,547

3.47

24.40

2,785,374

22.44

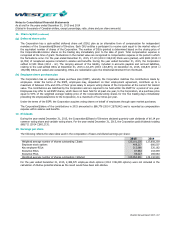

(d) Key employee plan

The Corporation has a key employee plan (KEP), whereby restricted share units (RSU) are issued to senior management and

pilots of the Corporation. The fair market value of the RSUs at the time of grant is equal to the weighted average trading price

of the Corporation’s voting shares for the five trading days immediately preceding the date of grant. Each RSU entitles the

employee to receive payment upon vesting in the form of voting shares of the Corporation. The Corporation intends to settle all

RSUs with shares either through the purchase of voting shares on the open market or the issuance of new shares from treasury;

however, wholly at its own discretion, the Corporation may settle the units in cash. The RSU’s time vest at the end of a two or

three-year period, with compensation expense being recognized in net earnings over the service period. At December 31, 2015,

944,738 (2014 – 944,738) voting shares of the Corporation were reserved for issuance under the KEP plan. For the year ended

December 31, 2015, the Corporation settled nil RSUs with shares issued from treasury and 216,107 RSUs through the open

market (December 31, 2014 – nil and 217,623, respectively).

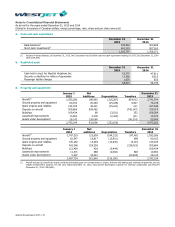

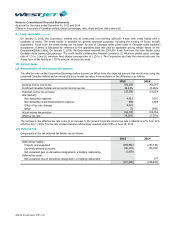

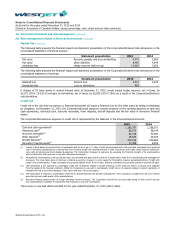

Changes in the number of units, with their weighted average fair value, are summarized below:

2015

2014

Number of

units

Weighted fair

value

Number of

units

Weighted fair

value

Units outstanding, beginning of period

391,030

20.99

476,103

17.39

Granted

96,686

26.32

126,759

23.93

Units, in lieu of dividends

6,846

25.00

7,207

27.38

Settled

(216,107)

19.51

(217,623)

15.05

Forfeited

(315)

23.98

(1,416)

19.34

Units outstanding, end of period

278,140

24.09

391,030

20.99