Westjet 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2015 | 58

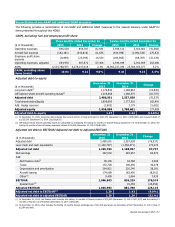

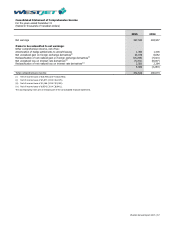

(iii) Pre-tax non-cash loss of $45.5 million recorded in the third quarter of 2014 associated with the sale of 10 aircraft to Southwest.

(iv) At December 31, 2015 and December 31, 2014, the Corporation met its internal guideline of an adjusted net debt to EBITDAR measure of no more than 2.50.

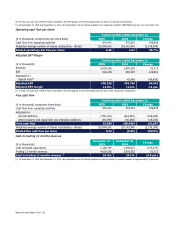

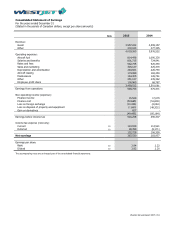

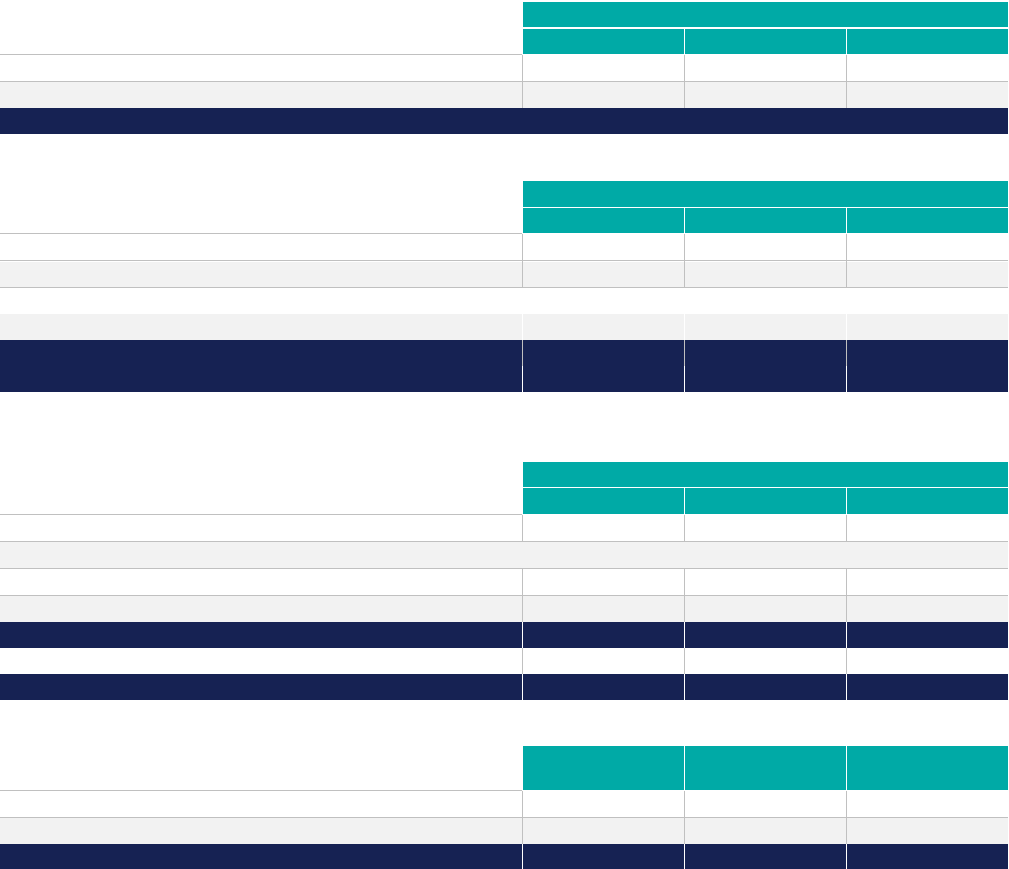

Operating cash flow per share

Twelve months ended December 31

($ in thousands, except share per share data) 2015 2014 Change

Cash flow from operating activities

876,441

576,633

299,808

Weighted average number of shares outstanding - diluted 125,964,541 129,142,940 (3,178,399)

Diluted operating cash flow per share

6.96

4.47

55.7%

Adjusted EBT Margin

Twelve months ended December 31

($ in thousands)

2015

2014

Change

Revenue

4,029,265 3,976,552 52,713

EBT

520,258

390,307

129,951

Adjusted for:

Special item(i)

― 45,459 (45,459)

Adjusted EBT 520,258 435,766 84,492

Adjusted EBT margin

12.9%

11.0%

1.9 pts.

(i) Pre-tax non-cash loss of $45.5 million recorded in the third quarter of 2014 associated with the sale of the 10 aircraft to Southwest.

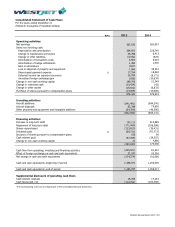

Free cash flow

Twelve months ended December 31

($ in thousands, except per share data)

2015

2014 Change

Cash flow from operating activities

876,441

576,633

299,808

Adjusted for:

Aircraft additions

(758,143)

(618,545)

(139,598)

Other property and equipment and intangible additions (64,789) (46,586) (18,203)

Free cash flow

53,509

(88,498)

142,007

Weighted average number of shares outstanding - diluted 125,964,541 129,142,940 (3,178,399)

Diluted free cash flow per share

0.42

(0.69)

160.9%

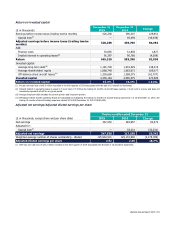

Cash to trailing 12 months revenue

($ in thousands)

December 31

2015

December 31

2014

Change

Cash and cash equivalents 1,183,797 1,358,071 (174,274)

Trailing 12 months revenue 4,029,265 3,976,552 52,713

Cash to trailing 12 months revenue (i)

29.4%

34.2%

(4.8 pts.)

(i) At December 31, 2015 and December 31, 2014, the Corporation met its internal guideline of cash to trailing 12 months revenue of approximately 30 per cent.