Westjet 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 Annual Report

Evolving our business

Table of contents

-

Page 1

2015 Annual Report Evolving our business -

Page 2

... of Contents President's message to shareholders Management's discussion and analysis of financial results Management's report to the shareholders Independent auditors' report Consolidated financial statements Notes to consolidated financial statements Corporate information 2 6 61 62 63 68 Inside... -

Page 3

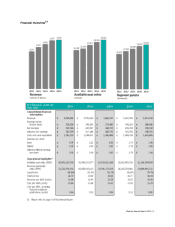

Financial Overview (i) WestJet Annual Report 2015 | 1 -

Page 4

... network of airline partners; The continued expansion of WestJet Encore; The introduction of our enhanced Plus service, with an empty middle seat; The introduction of wide-body aircraft into our fleet; The further evolution of our fare bundles product and ancillary revenue; and Our new inflight... -

Page 5

... is known. Among these awards, Waterstone Human Capital named WestJet one of Canada's 10 most-admired corporate cultures for a record sixth time. The value of our brand was recognized by several organizations in 2015, as both WestJet and WestJet Vacations received the highest brand equity scores... -

Page 6

On behalf of the Board of Directors, the Executive team, and our more than 11,000 WestJetters, thank you for your continued support of our airline. Gregg Saretsky President and Chief Executive Officer March 22, 2016 WestJet Annual Report 2015 | 4 -

Page 7

... with larger aircraft to drive down seat mile costs, growing our airline partnerships to expand our network utility, and further enhancing our WestJet/RBC MasterCard program to include new companion benefits to Southern and European destinations; and WestJet's return on invested capital target of... -

Page 8

Page | 6 -

Page 9

...35 Share capital ...36 Financial instruments and risk management ...37 Risks and uncertainties ...40 Accounting ...48 Controls and procedures ...52 Forward-looking information ...53 Definition of key operating indicators ...55 Non-GAAP and Additional GAAP Measures ...56 WestJet Annual Report 2015... -

Page 10

... in Calgary, Alberta. Through scheduled flights across a growing network, WestJet also operates WestJet Vacations, which provides air, hotel, car and excursion packages, and WestJet Encore, a regional airline which operates a fleet of turboprop aircraft in a network of destinations in Canada and... -

Page 11

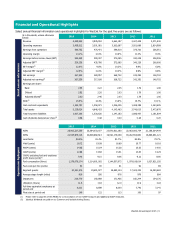

...97 Operational highlights RASM (cents) CASM (cents) CASM, excluding fuel and employee profit share (cents)(i) Fuel consumption (litres) Fuel costs per litre (cents) Segment guests Average stage length (miles) Departures Utilization (hours) Full-time equivalent employees at period end Fleet size at... -

Page 12

...Overview Our 2015 financial results represent our 11th consecutive year of reported profitability with net earnings of $367.5 million and a record annual diluted earnings per share of $2.92. During the year, our operating margin was 14.1 per cent, driven largely by continued lower fuel prices and an... -

Page 13

... agreement between WestJet and Encore pilots. 2015 also marked a year of change for our executive team. We were excited to welcome new members to the executive team: Mark Porter, as the new Executive Vice President (EVP), People and Culture, Harry Taylor, as the new EVP, Finance and Chief Financial... -

Page 14

...supports our ancillary revenues, specifically expanding the distribution channels that can market and sell our Plus fare and pre-reserved seating functionality. Finally, on September 22, 2015, for the third consecutive year the WestJet RBC World Elite MasterCard was rated first in the travel rewards... -

Page 15

...greater connectivity to the airline's broader network. The launch of service between Calgary and Houston is a key destination for both our business and leisure travelers. On January 6, 2016, we announced that flights from Calgary and Toronto to London, United Kingdom will now operate on a year-round... -

Page 16

... million and $250 million. The first quarter and full-year 2016 expected CASM, excluding fuel and employee profit share and capital expenditures are based on an average forecasted foreign exchange rate of approximately 1.41 Canadian dollars to one US dollar. Guidance summary Three months ended March... -

Page 17

...enhanced Plus product which had the effect of taking six seats off every Boeing 737 aircraft in our fleet starting in the fourth quarter of 2015. The following table depicts our capacity allocation between our domestic, transborder and international markets for the year ended December 31, 2015: 2015... -

Page 18

...Aircraft fuel Salaries and benefits Rates and fees Sales and marketing Depreciation and amortization Aircraft leasing Maintenance Other Employee profit share Total operating expenses Total, excluding fuel and profit share 2015 3.03 2.98 2.09 1.21 0.98 0.65 0.61 0.94 0.37 12.86 9.46 During the year... -

Page 19

... of $4.3 million on fuel costs. As at December 31, 2015, we have no fuel derivative contracts outstanding. We will continue to monitor and adjust to movements in fuel prices and may re-visit our hedging strategy as changing markets and competitive conditions warrant. WestJet Annual Report 2015 | 17 -

Page 20

...paym ent plans We have three equity-settled share-based payment plans whereby either stock options, restricted share units (RSUs) or performance share units (PSUs) may be awarded to pilots, senior executives and certain non-executive employees. Our equity-settled share-based payments are measured at... -

Page 21

... of the cost and timing of future maintenance activities on leased aircraft, as well as discount rates. Em ployee profit share All employees are eligible to participate in the employee profit sharing plan. As the profit share system is a variable cost, employees receive larger awards when we... -

Page 22

... 31, 2014 - loss of $2.1 million). We periodically use financial derivatives to manage our exposure to foreign exchange risk. In September 2015, we expanded our foreign exchange hedging program to include a portion of our future US-dollar hotel costs associated with vacation packages in addition... -

Page 23

...of 28 to 30 per cent. 2015 Fourth Quarter Results of Operations Our 2015 fourth quarter financial results represent our 43rd consecutive quarter of reported profitability with net earnings of $63.4 million and diluted earnings per share of $0.51 representing year-over-year declines of 30.1 per cent... -

Page 24

... Net earnings Earnings per share: Basic Diluted Cash dividends declared per share Operational summary ASMs RPMs Load factor Yield (cents) RASM (cents) CASM (cents) CASM, excluding fuel and employee profit share (cents)(i) Fuel consumption (litres) Fuel costs per litre (cents) Segment guests Average... -

Page 25

... reduction in our transborder and international markets in the fourth quarter of 2015 compared to the same period of 2014. The majority of domestic capacity growth in the quarter was driven by increased frequencies and new destinations serviced by our growing Bombardier Q400 fleet and our first two... -

Page 26

... (3.2%) 9.0% Aircraft fuel Salaries and benefits Rates and fees Sales and marketing Depreciation and amortization Aircraft leasing Maintenance Other Employee profit share Total operating expenses Total, excluding fuel and share During the three months ended December 31, 2015, operating expenses... -

Page 27

... per litre. On average, the market price for jet fuel was US $57 per barrel in the fourth quarter of 2015 versus US $101 per barrel in the fourth quarter of 2014, a decrease of approximately 43.6 per cent. The benefit from the lower market price of US-dollar jet fuel on a year-over-year basis was... -

Page 28

... flight and navigation fees are presented as Rates and fees and costs related to irregular operations are now presented in Other expenses. Inflight - Inflight was previously a combination of salaries and benefits and flight attendant travel and training costs. Salaries and benefits are now presented... -

Page 29

... of 2015 and 2014 summary of nature-based operating expenses: Three months ended ($ in thousands, unless otherwise noted) Operating expenses: Aircraft fuel Salaries and benefits Rates and fees Sales and marketing Depreciation and amortization Aircraft leasing Maintenance Other Employee profit share... -

Page 30

... below presents a five year annual summary of nature-based operating expenses: ($ in thousands, unless otherwise noted) Operating expenses: Aircraft fuel Salaries and benefits Rates and fees Sales and marketing Depreciation and amortization Aircraft leasing Maintenance Other Employee profit share... -

Page 31

... to our bag ratio improvement of 12.4 per cent and 19.5 per cent for the three and twelve months ended December 31, 2015 on a year-over-year basis. For 2015, WestJet placed second overall for on-time performance among North American airlines and WestJet Encore, as a regional airline, placed first... -

Page 32

... aircraft maintenance provision as well as a decrease in our cash and cash equivalents and the absence of an assets held for sale balance that was present in the prior year. Select cash flow inform ation ($ in thousands) Cash provided by operating activities Cash used by investing activities Cash... -

Page 33

...measure that represents the cash that a company is able to generate after meeting its requirements to maintain or expand its asset base. It is a calculation of operating cash flow, less the amount of cash used in investing activities related to property and equipment. Our free cash flow for the year... -

Page 34

...range of public and private debt financing options in the future. We continue to evaluate the optimum balance and sources of financing available to us based on our internal requirements and capital structure as well as the external environment for aircraft financing. WestJet Annual Report 2015 | 32 -

Page 35

... called Foreign exchange found on page 19 of this MD&A). We plan to meet our contractual obligations and commitments through our current cash and cash equivalents balance combined with cash flows from operations and future sources of financing. We continuously monitor the capital markets and assess... -

Page 36

...and 2021. WestJet's Boeing 737 MAX 7 and MAX 8 aircraft orders can each be substituted for the other model of aircraft, or for Boeing 737 MAX 9 aircraft. We have options to purchase an additional 9 Bombardier Q400 aircraft for delivery between the years 2017 to 2018. WestJet Annual Report 2015 | 34 -

Page 37

...of financial position, we include an amount equal to 7.5 times our annual aircraft leasing expense in assessing our overall leverage through our adjusted debt-to-equity and adjusted net debt to EBITDAR ratios discussed previously under the heading "Liquidity". Fuel and de-icing facility corporations... -

Page 38

...issued and outstanding Stock options RSUs - Key employee plan RSUs - Executive share unit plan PSUs - Executive share unit plan Total voting shares potentially issuable Total outstanding and potentially issuable voting shares Quarterly dividend policy Our dividend is reviewed against the Corporation... -

Page 39

... at and for the year ended December 31, 2015, we are not party to any fuel hedging contracts. Foreign exchange risk Foreign exchange risk is the risk that the fair value or future cash flows of a financial instrument would fluctuate as a result of changes in foreign exchange rates. We are exposed to... -

Page 40

... interest rates over the term of all such debt. The swap agreements were designated as cash flow hedges for accounting purposes. For a discussion of the nature and extent of our use of interest rate swap agreements, including the business purposes they serve, the financial statement classification... -

Page 41

...of our variable-rate long-term debt approximates its carrying value, as it is at a floating market rate of interest. Please refer to 2015 Results of Operations - Foreign exchange and Liquidity and Capital Resources -Financing on page 19 and page 31, respectively, of this MD&A for a discussion of the... -

Page 42

... travelers. There is no guarantee that our fuel cost initiatives and revenue management practices will be effective in offsetting volatile or increasing fuel prices. If we are unable to mitigate volatile or increasing fuel prices, this would have an adverse effect on our WestJet Annual Report 2015... -

Page 43

... affect our business. Our business is labour intensive and requires large numbers of pilots, flight attendants, mechanics, guest service and other personnel. Our growth and general turnover requires us to locate, hire, train and retain a significant number of new employees each year. There can... -

Page 44

... effects on our business strategy, financial condition and results of operations. Our low cost business model is a key factor that enables us to provide low fares to our guests, protect and increase our market share through competitive pricing and fund our future growth initiatives. We continuously... -

Page 45

... inform ation, w e could dam age our reputation and incur substantial costs. In the ordinary course of our business we receive, process and store vast amounts of information from our guests, often through online operations that depend upon the secure communication of information over public networks... -

Page 46

... to service interest, principal and other contractual operating obligations. Our future operating performance and cash flows as well as changes in the debt and equity markets will determine whether we are able to continue to successfully service our fixed obligations as WestJet Annual Report 2015... -

Page 47

... future operating performance and cash flows or adverse changes in the debt and equity markets, including any adverse regulatory or government imposed changes, would negatively impact our ability to service our existing fixed obligations as well as obtain new sources of financing on reasonable terms... -

Page 48

... place a greater amount of pressure on our pricing and if we are not able to operate at a competitive and profitable price level, we would experience adverse effects to our operations, financial results, financial condition and future growth plans. Governm ent intervention, regulations, rulings... -

Page 49

... increase in insurance, airport security and other costs. Any resulting reduction in guest revenues and/or increases in costs, including insurance, security or other costs could have a material adverse effect on our business, results from operations and financial condition. Additional terrorist... -

Page 50

... on management's judgement that resource allocation decisions and performance assessments are done at a consolidated company and fleet level with a view that the Corporation manages an integrated network of markets with a consolidated fleet of different sized aircraft. WestJet Annual Report 2015... -

Page 51

... cash flows and the lifespan of life-limited parts. These estimates are based on data and information obtained from various sources including the lessor, current maintenance schedules and fleet plans, contracted costs with maintenance service providers, other vendors and company-specific history... -

Page 52

... use an option pricing model to determine the fair value of certain share-based payments. Inputs to the model are subject to various estimates about volatility, interest rates, dividend yields and expected life of the units issued. Fair value inputs are subject to market factors as well as internal... -

Page 53

... instrument accounting standard addressing: classification and measurement (Phase 1), impairment (Phase II) and hedge accounting (Phase III). A new standard on lease accounting addressing the principles to apply to report useful information about the amount, timing and uncertainty of cash flows... -

Page 54

... to provide reasonable assurance that all relevant information is gathered and reported to management, including the chief executive officer (CEO) and the chief financial officer (CFO), on a timely basis so that appropriate decisions can be made regarding public disclosure. An evaluation of our DC... -

Page 55

..., United Kingdom will be serviced from six Canadian cities, through London Gatwick beginning in the spring of 2016, referred to under the heading Network expansion and fleet on page 12; that our business and leisure guests will have the opportunity to take advantage of our low fares, high value and... -

Page 56

...costs for the first quarter of 2016 is based on current forecasted jet fuel prices of US and an average foreign exchange rate; Our expectation of net capital expenditures for the fullyear 2016 is based on our 2016 capital budget and contractual commitments; • • • WestJet Annual Report 2015... -

Page 57

good standing, and that our aircraft delivery schedule • will proceed as expected; That the future outcome of our current legal proceedings and claims will not have a material effect upon our financial position, results of operations or cash flows is based on a review of current legal proceedings... -

Page 58

...earnings before tax, excluding special items, finance costs and implied interest on our off-balance-sheet aircraft leases. Invested capital includes average long-term debt, average finance lease obligations, average shareholders' equity and off-balance-sheet aircraft operating leases. Free cash flow... -

Page 59

... debt-to-equity ($ in thousands) Long-term debt(i) Off-balance-sheet aircraft operating leases(ii) Adjusted debt Total shareholders' equity Add: Hedge reserves Adjusted equity Adjusted debt-to-equity December 31 2015 1,174,833 1,305,668 2,480,501 1,959,993 (1,903) 1,958,090 1.27 December 31 2014... -

Page 60

... 31, 2015 and December 31, 2014, the Corporation met its internal guideline of an adjusted net debt to EBITDAR measure of no more than 2.50. Operating cash flow per share ($ in thousands, except share per share data) Cash flow from operating activities Weighted average number of shares outstanding... -

Page 61

... earnings before income taxes (trailing twelve months) Add: Finance costs Implicit interest in operating leases(ii) Return Invested capital: Average long-term debt(iii) Average shareholders' equity Off-balance-sheet aircraft leases(iv) Invested capital Return on invested capital December 31 2015... -

Page 62

-

Page 63

... governance of the Corporation, including ensuring management fulfills its responsibilities for financial reporting and internal control, and reviewing and approving the consolidated financial statements. The Board carries out these responsibilities principally through its Audit Committee. The Audit... -

Page 64

... Airlines Ltd. at December 31, 2015 and December 31, 2014, and its consolidated financial performance and its consolidated cash flows for the years then ended in accordance with International Financial Reporting Standards. Chartered Professional Accountants February 1, 2016 Calgary, Canada WestJet... -

Page 65

... Statement of Earnings For the years ended December 31 (Stated in thousands of Canadian dollars, except per share amounts) Note 2015 2014 Revenue: Guest Other Operating expenses: Aircraft fuel Salaries and benefits Rates and fees Sales and marketing Depreciation and amortization Aircraft... -

Page 66

... ticket sales Deferred rewards program Non-refundable guest credits Current portion of maintenance provisions Current portion of long-term debt Non-current liabilities: Maintenance provisions Long-term debt Other liabilities Deferred income tax Total liabilities Shareholders' equity: Share capital... -

Page 67

... of Cash Flows For the years ended December 31 (Stated in thousands of Canadian dollars) Note 2015 2014 Operating activities: Net earnings Items not involving cash: Depreciation and amortization Change in maintenance provisions Change in other liabilities Amortization of transaction costs... -

Page 68

Consolidated Statement of Changes in Equity For the years ended December 31 (Stated in thousands of Canadian dollars) 2015 2014 Note Share capital: Balance, beginning of period Issuance of shares pursuant to compensation plans Shares repurchased 11 11 11 603,287 1,833 (22,324) 582,796 603,861 ... -

Page 69

... taxes of $(8,455) (2014 - $(3,048)). Net of income taxes of $5,877 (2014 - $2,475). Net of income taxes of $2,166 (2014 - $3,065). Net of income taxes of $(934) (2014 - $(841)). The accompanying notes are an integral part of the consolidated financial statements. WestJet Annual Report 2015 | 67 -

Page 70

... the services and products are provided to the guest. Ancillary revenues include items such as fees associated with guest itinerary changes or cancellations, baggage fees, buy-on-board sales, pre-reserved seating fees and breakage from the WestJet Rewards Program. WestJet Annual Report 2015 â", 68 -

Page 71

...) 1. Statement of significant accounting policies (continued) (d) Revenue recognition (continued) (iii) WestJet Rewards Program The Corporation has a rewards program that allows guests to accumulate credits based on their WestJet travel spend to be used towards future flights and vacation packages... -

Page 72

... per share amounts) 1. Statement of significant accounting policies (continued) (e) Financial instruments (continued) The Corporation may, from time to time, use various financial derivatives to reduce market risk exposure from changes in foreign exchange rates, interest rates and jet fuel prices... -

Page 73

...cost of maintenance activities. The unwinding of the discounted present value is recorded as a finance cost on the consolidated statement of earnings. The discount rate used by the Corporation is the current pre-tax risk-free rate approximated by the corresponding term of a US or Canadian government... -

Page 74

...-hour maintenance contracts The Corporation is party to certain power-by-the-hour aircraft maintenance agreements, whereby the Corporation makes payments to maintenance providers based on flight hours flown. Payments are capitalized when they relate to qualifying capital expenditures such as major... -

Page 75

..., ratio, share and per share amounts) 1. Statement of significant accounting policies (continued) (p) Share-based payment plans Equity-settled share-based payments to employees are measured at the fair value of the equity instrument granted. An option valuation model is used to fair value stock... -

Page 76

... life-limited parts. These estimates are based on data and information obtained from various sources including the lessor, current maintenance schedules and fleet plans, contracted costs with maintenance service providers, other vendors and company-specific history. WestJet Annual Report 2015 | 74 -

Page 77

... available information at each reporting date. (x) Fair value of equity-settled share-based payments The Corporation uses an option pricing model to determine the fair value of certain share-based payments. Inputs to the model are subject to various estimates relating to volatility, interest rates... -

Page 78

... for the years ended December 31, 2015 and 2014 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 2. New accounting standards and interpretations The IASB and International Financial Reporting Interpretations Committee (IFRIC) have issued the following... -

Page 79

...'s off-balance-sheet obligations related to its aircraft operating leases, all of which are presented in detail below. The Corporation monitors its capital structure on a number of bases, including cash to trailing 12 months revenue, adjusted debt-to-equity and adjusted net debt to earnings before... -

Page 80

... Statements As at and for the years ended December 31, 2015 and 2014 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 4. Cash and cash equivalents December 31 2015 340,504 843,293 1,183,797 December 31 2014 400,808 957,263 1,358,071 Bank balances... -

Page 81

...Consolidated Financial Statements As at and for the years ended December 31, 2015 and 2014 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 6. Property and equipment (continued) December 31, 2015 Aircraft Ground property and equipment Spare engines and... -

Page 82

... portion Long-term portion (i) (ii) Reflects changes to the timing and scope of maintenance activities and the discount rate used to present value the liability. At December 31, 2015, the Corporation's aircraft lease maintenance provisions are discounted using a weighted average risk-free rate of... -

Page 83

...amortized over a 12-year term, repayable in quarterly principal instalments totaling $27,539, at an effective weighted average fixed rate of 5.92%, maturing between 2016 and 2020. These facilities are guaranteed by the Export-Import Bank of the United States (Ex-Im Bank) and secured by 37 Boeing 737... -

Page 84

...the applicable base rate plus an applicable pricing margin based on the Corporation's debt rating. On January 7, 2016, the Corporation received the $300,000 funds flow from the term facility using Canadian dollar bankers' acceptances. The credit facility contains two financial covenants: (i) minimum... -

Page 85

... to Consolidated Financial Statements As at and for the years ended December 31, 2015 and 2014 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 11. Share capital (a) Authorized Unlimited number of common voting shares The common voting shares may be... -

Page 86

... charged to share capital. The excess of the market price over the average book value, including transaction costs, was $101,489 (December 31, 2014 - $32,680) and was charged to retained earnings. (c) Stock option plan The Corporation has a stock option plan, whereby at December 31, 2015, 9,109,276... -

Page 87

... to Consolidated Financial Statements As at and for the years ended December 31, 2015 and 2014 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 11. Share capital (continued) (c) Stock option plan (continued) Changes in the number of options, with their... -

Page 88

... expense The following table summarizes share-based payment expense for the Corporation's equity-based plans: Stock option plan Key employee plan Executive share unit plan Total share-based payment expense 2015 10,955 2,700 3,599 17,254 2014 11,449 3,039 4,138 18,626 WestJet Annual Report 2015 | 86 -

Page 89

... year ended December 31, 2015, the Corporation paid dividends totaling $69,711 (2014 - $61,313). 13. Earnings per share The following reflects the share data used in the computation of basic and diluted earnings per share: Weighted average number of shares outstanding - basic Employee stock options... -

Page 90

... Statements As at and for the years ended December 31, 2015 and 2014 (Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts) 14. Financial instruments and risk management (a) Fair value of financial assets and financial liabilities The Corporation's financial... -

Page 91

... 31, 2014 - 6.48 year term), equal to the weighted average remaining term of the Corporation's long-term debt at December 31, 2015. The fair value measurements are classified in level 1 as the measurement inputs are unadjusted, observable inputs in active markets. WestJet Annual Report 2015 | 89 -

Page 92

... future cash flows of a financial instrument will fluctuate due to changes in market prices. The Corporation's significant market risks relate to fuel price risk, foreign exchange risk and interest rate risk. (i) Fuel price risk The airline industry is inherently dependent upon jet fuel to operate... -

Page 93

... and airport operations, which, at December 31, 2015, totaled $26,675 (2014 - $25,204). A reasonable change in market interest rates at December 31, 2015, would not have significantly impacted the Corporation's net earnings due to the small size of these deposits. Long-term debt The Corporation is... -

Page 94

... Corporation reviews the size and credit rating of both current and any new counterparties in addition to limiting the total exposure to any one counterparty. (ii) (iii) (iv) (v) There were no new bad debts recorded for the year ended December 31, 2015 (2014 - $nil). WestJet Annual Report 2015... -

Page 95

...-derivative and derivative financial liabilities at December 31, 2015. The analysis is based on foreign exchange and interest rates in effect at the consolidated statement of financial position date, and includes both principal and interest cash flows for long-term debt. Accounts payable and accrued... -

Page 96

... foreign exchange rate. Within 1 year 1 - 3 years 3 - 5 years Over 5 years (c) Letters of guarantee At December 31, 2015, the Corporation has a revolving letter of credit facility totaling $30,000 (December 31, 2014 - $30,000). The facility requires funds to be assigned and held in cash security for... -

Page 97

... for key management personnel for the years ended December 31, 2015 and 2014. Salaries, benefits and other compensation(i) Share-based payment expense(ii) (i) (ii) 2015 10,754 3,284 14,038 2014 5,845 6,835 12,680 Other compensation includes the employee share purchase plan, profit share, cash... -

Page 98

... to airport operations, fuel rebates, marketing programs and ancillary revenue products and services. Industry receivables include receivables relating to travel agents, interline agreements with other airlines and partnerships. All significant counterparties are reviewed and approved for credit on... -

Page 99

... flight attendant travel and training expenses are now presented in Other. Maintenance - Maintenance was previously a combination of salaries and benefits and operating maintenance expenditures for aircraft, including the Corporation's maintenance provision expenses related to aircraft operating... -

Page 100

This page intentionally left blank -

Page 101

...WestJet stock are publicly traded on the Toronto Stock Exchange under the symbol WJA. Investor relations contact information Phone: 1-877-493-7853 Email: [email protected] WestJet headquarters 22 Aerial Place NE Calgary, Alberta T2E 3J1 Phone: 403-444-2600 Toll-free: 888-293-7853 Annual...