United Healthcare 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

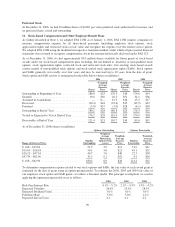

The above amounts reflect fourth quarter 2006 goodwill adjustments related to the finalization and review of the

PacifiCare valuation analysis resulting in a decrease of $247 million in Health Care Services goodwill and an

increase of $252 million in Specialized Care Services goodwill, each representing less than 4% of total goodwill

resulting from the PacifiCare acquisition.

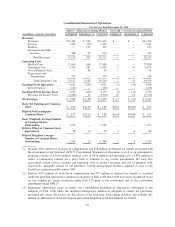

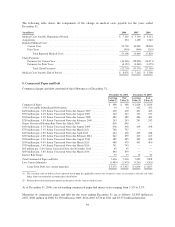

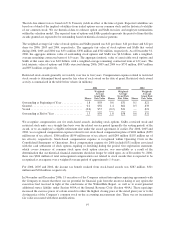

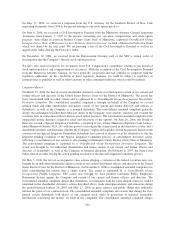

The weighted-average useful life, gross carrying value, accumulated amortization and net carrying value of other

intangible assets as of December 31, 2006 and 2005 were as follows:

December 31, 2006 December 31, 2005

(in millions)

Weighted-

Average

Useful Life

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Customer Contracts and

Membership Lists ...... 15years $1,871 $(246) $1,625 $1,830 $(106) $1,724

Patents, Trademarks and

Technology ........... 13years 303 (89) 214 221 (62) 159

Other .................. 12years 103 (38) 65 161 (24) 137

Total ............... 14years $2,277 $(373) $1,904 $2,212 $(192) $2,020

Amortization expense relating to intangible assets was $181 million in 2006, $94 million in 2005 and $62 million

in 2004. Estimated future amortization expense relating to intangible assets for the years ending December 31 is

as follows: $178 million in 2007, $173 million in 2008, $155 million in 2009, $147 million in 2010, and $142

million in 2011.

8. Medical Costs and Medical Costs Payable

Medical costs and medical costs payable include estimates of our obligations for medical care services that have

been rendered on behalf of insured consumers but for which we have either not yet received or processed claims,

and for liabilities for physician, hospital and other medical cost disputes. We develop estimates for medical costs

incurred but not reported using an actuarial process that is consistently applied, centrally controlled and

automated. The actuarial models consider factors such as time from date of service to claim receipt, claim

backlogs, care provider contract rate changes, medical care consumption and other medical cost trends. We

estimate liabilities for physician, hospital and other medical cost disputes based upon an analysis of potential

outcomes, assuming a combination of litigation and settlement strategies. Each period, we re-examine previously

established medical costs payable estimates based on actual claim submissions and other changes in facts and

circumstances. As the liability estimates recorded in prior periods become more exact, we adjust the amount of

the estimates, and include the changes in estimates in medical costs in the period in which the change is

identified. For example, in every reporting period our operating results include the effects of more completely

developed medical costs payable estimates associated with previously reported periods.

92