United Healthcare 2006 Annual Report Download - page 89

Download and view the complete annual report

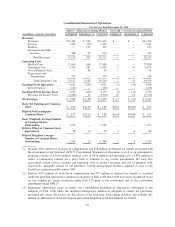

Please find page 89 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the last half of the contract year, when comparatively more members will be incurring claims above the $2,250

initial coverage limit. The uneven timing of Medicare Part D pharmacy benefit claims results in losses in the first

half of year that entitle the Company to risk-share adjustment payments from CMS. Accordingly, during the

interim periods within the contract year we record a net risk-share receivable from CMS in other current assets in

the Consolidated Balance Sheets and a corresponding retrospective premium adjustment in premium revenues in

the Consolidated Statement of Operations. This represents the estimated amount payable by CMS to the

Company under the risk-share contract provisions if the program were terminated based on estimated costs

incurred through that interim period. Those losses reverse in the second half of the year and final risk-share

amounts due to or from CMS, if any, are settled approximately six months after the contract year-end. The

projected net risk-share payable to be paid to CMS as of December 31, 2006 was $350 million.

5. Acquisitions and Divestitures

On December 1, 2006, our Health Care Services business segment acquired the Student Insurance Division

(Student Resources) of The MEGA Life and Health Insurance Company through an asset purchase agreement.

Student Resources primarily serves college and university students. This acquisition strengthened our position in

this market and provided expanded distribution opportunities for our other UnitedHealth Group businesses. In

exchange and under the terms of the asset purchase agreement, we issued a 10-year, $95 million promissory note

bearing a 5.4% fixed interest rate and paid approximately $1 million in cash. The results of operations and

financial condition of Student Resources have been included in our Consolidated Financial Statements since the

acquisition date. The pro forma effects of the Student Resources acquisition on our Consolidated Financial

Statements were not material.

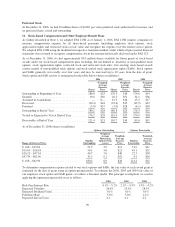

On February 24, 2006, the Company acquired John Deere Health Care, Inc. (JDHC). JDHC serves employers

primarily in Iowa, central and western Illinois, eastern Tennessee and southwestern Virginia. This acquisition

strengthened our resources and capabilities in these areas. The operations of JDHC reside primarily within our

Health Care Services and Uniprise segments. We paid approximately $515 million in cash, including transaction

costs, in exchange for all of the outstanding equity of JDHC. The purchase price and costs associated with the

acquisition exceeded the estimated preliminary fair value of the net tangible assets acquired by approximately

$376 million. Based on management’s consideration of fair value, which included completion of a valuation

analysis, we have allocated the excess purchase price over the fair value of the net tangible assets acquired to

finite-lived intangible assets of $60 million and goodwill of $316 million. The finite-lived intangible assets

consist primarily of member lists and physician and hospital networks, with an estimated weighted-average

useful life of approximately 15 years. The acquired goodwill is deductible for income tax purposes. The results

of operations and financial condition of JDHC have been included in our consolidated financial statements since

the acquisition date. The pro forma effects of the JDHC acquisition on our consolidated financial statements were

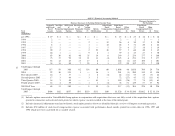

not material. Acquired net tangible assets and liabilities are categorized as follows: cash and cash equivalents of

$46 million; investments of $197 million; accounts receivable and other current assets of $60 million; property,

equipment and capitalized software and other assets of $29 million; medical costs payable of $131 million and

other liabilities of $62 million. JDHC has been renamed UnitedHealthcare Services Company of the River

Valley, Inc.

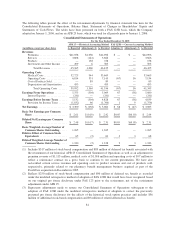

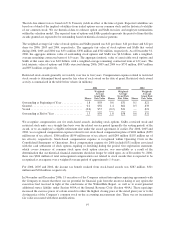

On December 20, 2005, the Company acquired PacifiCare Health Systems, Inc. (PacifiCare). PacifiCare provides

health care and benefit services to individuals and employers, principally in markets in the western United States.

This merger significantly strengthened our resources by enhancing our capabilities on the Pacific Coast and in

other western states and broadening the scope of our product offerings for a host of specialized services. The

operations of PacifiCare reside primarily within our Health Care Services and Specialized Care Services

segments. Under the terms of the agreement, PacifiCare shareholders received 1.1 shares of UnitedHealth Group

common stock and $21.50 in cash for each share of PacifiCare common stock they owned. Total consideration

issued for the transaction was approximately $8.8 billion, composed of approximately 99.2 million shares of

UnitedHealth Group common stock (valued at approximately $5.3 billion based upon the average of

UnitedHealth Group’s share closing price for two days before, the day of and two days after the acquisition

announcement date of July 6, 2005), approximately $2.1 billion in cash, $960 million cash paid to retire

87