United Healthcare 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

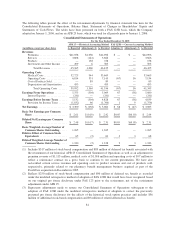

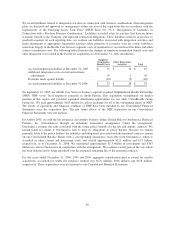

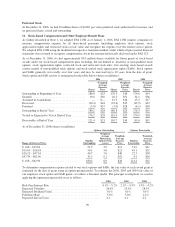

6. Cash, Cash Equivalents and Investments

As of December 31, the amortized cost, gross unrealized gains and losses, and fair value of cash, cash

equivalents and investments were as follows (in millions):

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

2006

Cash and Cash Equivalents ............................... $10,320 $ — $ — $10,320

Debt Securities — Available for Sale ....................... 9,710 57 (52) 9,715

Equity Securities — Available for Sale ...................... 291 22 (1) 312

Debt Securities — Held to Maturity ........................ 235 — — 235

Total Cash and Investments ........................... $20,556 $ 79 $(53) $20,582

2005

Cash and Cash Equivalents ............................... $ 5,421 $ — $ — $ 5,421

Debt Securities — Available for Sale ....................... 9,011 60 (52) 9,019

Equity Securities — Available for Sale ...................... 217 45 (1) 261

Debt Securities — Held to Maturity ........................ 281 — — 281

Total Cash and Investments ........................... $14,930 $105 $(53) $14,982

As of December 31, 2006 and 2005, respectively, debt securities consisted of $3,310 million and $2,256 million

in U.S. Government and Agency obligations, $4,203 million and $4,554 million in state and municipal

obligations, and $2,437 million and $2,490 million in corporate obligations. At December 31, 2006, we held

$833 million in debt securities with maturities of less than one year, $3,694 million in debt securities with

maturities of one to five years, $2,733 million in debt securities with maturities of five to 10 years and $2,690

million in debt securities with maturities of more than ten years.

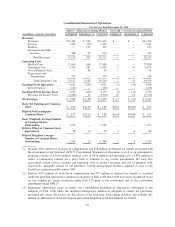

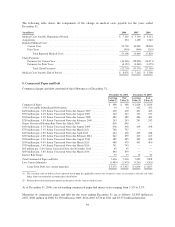

In accordance with FASB Staff Position FAS 115-1/124-1, “The Meaning of Other-Than-Temporary Impairment

and Its Application to Certain Investments,” the following table shows the gross unrealized losses and fair value

of investments with unrealized losses that, in our judgment, are other-than-temporarily impaired. These

investments are aggregated by investment type and length of time that individual securities have been in a

continuous unrealized loss position (in millions)1:

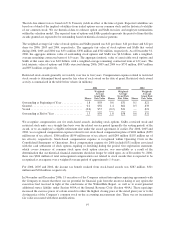

As of December 31, 2006

Less Than 12 Months

12 Months or

Greater Total

Fair

Value

Gross

Unrealized

Losses

Fair

Value

Gross

Unrealized

Losses

Fair

Value

Gross

Unrealized

Losses

U.S. Government and Agency obligations ....... $1,433 $ (7) $ 643 $(11) $2,076 $(18)

State and municipal obligations ................ 956 (4) 1,171 (12) 2,127 (16)

Corporate obligations ........................ 635 (4) 855 (14) 1,490 (18)

Total Debt Securities — Available for Sale . . $3,024 $(15) $2,669 $(37) $5,693 $(52)

Total Equity Securities ................... $ 19 (1) $ — — $ 19 $ (1)

(1) Debt securities classified as held-to-maturity investments have been excluded from this analysis. These

investments are predominantly held in U.S. Government or Agency obligations and the contractual terms do

not permit the issuer to settle the securities at a price less than the amortized cost of the investment.

Additionally, the fair values of these investments approximate their amortized cost.

The unrealized losses on investments in U.S. Government and Agency obligations, state and municipal

obligations and corporate obligations at December 31, 2006 were mainly caused by interest rate increases and not

90