United Healthcare 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

identifiable. This was generally the date on which stock option awards became viewable by all optionees on

the Company’s intranet portal for employee benefits. In the event the communication date was not readily

available, with respect to Section 16 officers, this alternative methodology would select as the measurement

date the date on which a Section 16 officer filed a Form 4 (or other statement of changes in beneficial

ownership) with respect to a specific grant and, for employees who are not Section 16 officers, the date on

which the Company has determined that the CEO Certificate was likely executed by the former CEO of the

Company.

•Legal Execution Date. This methodology would select as the measurement date the date on which the

Company has determined that the legal documentation approving a grant was likely executed, based on

evaluation of all available information. For Section 16 Officers, this date is typically the date on which the

Company has determined that the Written Action of the Compensation Committee was likely executed by a

majority of the members of the Compensation Committee and, for all other employees, this date is typically

the date on which the Company has determined that the CEO Certificate was likely executed by the former

CEO of the Company.

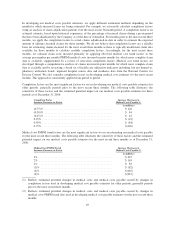

Decrease to Earnings Before Income Taxes

FAS 123R - Current Accounting Method APB 25 - Historical Accounting Method

(in millions)

Year

Communication

Measurement Dates

Legal Execution

Measurement Dates

Communication

Measurement Dates

Legal Execution

Measurement Dates

pre-1994 ..................... n/a n/a $— $ —

1994 ........................ n/a n/a — —

1995 ........................ $— $ 1 — 1

1996 ........................ — 1 — 1

1997 ........................ — — — 1

1998 ........................ — 1 — 1

1999 ........................ — 1 — 1

2000 ........................ — 41 — 54

2001 ........................ 3 27 7 36

2002 ........................ 3 19 4 23

2003 ........................ 5 21 9 35

2004 ........................ 8 19 12 25

2005 ........................ 10 26 21 45

2006 ........................ 14 31 n/a n/a

Total Impact .................. $43 $188 $53 $223

Revenues

Revenues are principally derived from health care insurance premiums. We recognize premium revenues in the

period eligible individuals are entitled to receive health care services. Customers are typically billed monthly at a

contracted rate per eligible person multiplied by the total number of people eligible to receive services, as

recorded in our records. Employer groups generally provide us with changes to their eligible population one

month in arrears. Each billing includes an adjustment for prior month changes in eligibility status that were not

reflected in our previous billing. We estimate and adjust the current period’s revenues and accounts receivable

accordingly. Our estimates are based on historical trends, premiums billed, the level of contract renewal activity

and other relevant information. We revise estimates of revenue adjustments each period and record changes in

the period they become known.

Goodwill, Intangible Assets and Other Long-Lived Assets

As of December 31, 2006, we had long-lived assets, including goodwill, other intangible assets, property,

equipment and capitalized software, of $20.6 billion. We review our goodwill for impairment annually at the

reporting unit level, and we review our remaining long-lived assets for impairment when events and changes in

51