United Healthcare 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

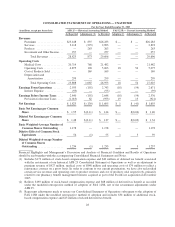

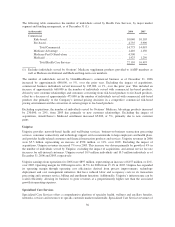

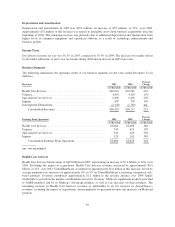

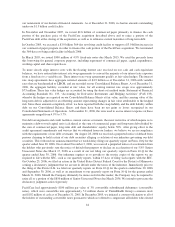

The following table summarizes the number of individuals served by Health Care Services, by major market

segment and funding arrangement, as of December 31 (1):

(in thousands) 2006 2005

Commercial

Risk-based ..................................................... 10,040 10,105

Fee-based ...................................................... 4,735 3,990

Total Commercial ........................................... 14,775 14,095

Medicare Advantage ............................................. 1,410 1,150

Medicare Part D Stand-alone ...................................... 4,500 —

Medicaid ...................................................... 1,425 1,250

Total Health Care Services .................................... 22,110 16,495

(1) Excludes individuals served by Ovations’ Medicare supplement products provided to AARP members as

well as Medicare institutional and Medicaid long-term care members.

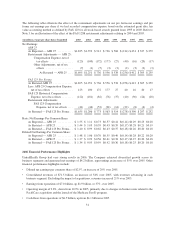

The number of individuals served by UnitedHealthcare’s commercial business as of December 31, 2006

increased by approximately 680,000, or 5%, over the prior year. Excluding the impact of acquisitions,

commercial business individuals served increased by 185,000, or 1%, over the prior year. This included an

increase of approximately 660,000 in the number of individuals served with commercial fee-based products,

driven by new customer relationships and customers converting from risk-based products to fee-based products,

offset by a decrease of approximately 475,000 in the number of individuals served with commercial risk-based

products due primarily to the Company’s internal pricing decisions in a competitive commercial risk-based

pricing environment and the conversion of certain groups to fee-based products.

Excluding acquisitions, the number of individuals served by Ovations’ Medicare Advantage products increased

by 230,000, or 20%, from 2005 due primarily to new customer relationships. Excluding the impact of

acquisitions, AmeriChoice’s Medicaid enrollment increased 65,000, or 5%, primarily due to new customer

gains.

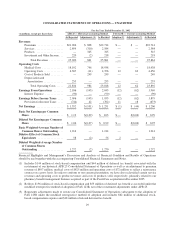

Uniprise

Uniprise provides network-based health and well-being services, business-to-business transaction processing

services, consumer connectivity and technology support services nationwide to large employers and health plans,

and provides health-related consumer and financial transaction products and services. Uniprise revenues in 2006

were $5.5 billion, representing an increase of $558 million, or 11%, over 2005. Excluding the impact of

acquisitions, Uniprise revenues increased 7% over 2005. This increase was driven primarily by growth of 4% in

the number of individuals served by Uniprise, excluding the impact of acquisitions, and annual service fee rate

increases for self-insured customers. Uniprise served 10.9 million individuals and 10.5 million individuals as of

December 31, 2006 and 2005, respectively.

Uniprise earnings from operations for 2006 were $897 million, representing an increase of $157 million, or 21%,

over 2005. Operating margin for 2006 improved to 16.5% for 2006 from 15.1% in 2005. Uniprise has expanded

its operating margin through operating cost efficiencies derived from process improvements, technology

deployment and cost management initiatives that have reduced labor and occupancy costs in its transaction

processing and customer service, billing and enrollment functions. Additionally, Uniprise’s infrastructure can be

scaled efficiently, allowing its business to grow revenues at a proportionately higher rate than the associated

growth in operating expenses.

Specialized Care Services

Specialized Care Services offers a comprehensive platform of specialty health, wellness and ancillary benefits,

networks, services and resources to specific customer markets nationwide. Specialized Care Services revenues of

36