United Healthcare 2006 Annual Report Download - page 35

Download and view the complete annual report

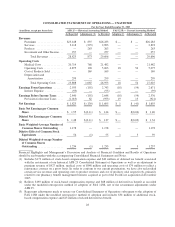

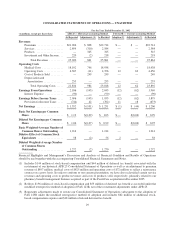

Please find page 35 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Service Revenues Service revenues in 2006 totaled $4.3 billion, an increase of $602 million, or 16%, over 2005.

Excluding the impact of acquisitions, service revenues increased by approximately 12% over 2005. The increase

in service revenues was driven primarily by aggregate growth of 8% in the number of individuals served by

Uniprise and UnitedHealthcare under fee-based arrangements during 2006, as well as annual rate increases. In

addition, Ingenix service revenues increased by approximately 23% due to new business growth in the health

information and contract research businesses and from businesses acquired since the beginning of 2005.

Product Revenues Product revenues in 2006 totaled $737 million, an increase of $579 million over 2005. This

was primarily due to pharmacy revenues at our PBM business, which was acquired in December 2005 with the

purchase of PacifiCare.

Investment and Other Income Investment and other income during 2006 totaled $871 million, representing an

increase of $366 million over 2005. Interest income increased by $372 million in 2006, principally due to the

impact of increased levels of cash and fixed-income investments during the year, due in part to the acquisition of

PacifiCare, as well as higher yields on fixed-income investments. Net capital gains on sales of investments were

$4 million in 2006, compared with net capital gains of $10 million in 2005.

Medical Costs

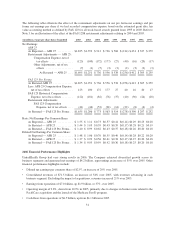

The combination of pricing, benefit designs, consumer health care utilization and comprehensive care facilitation

efforts is reflected in the medical care ratio (medical costs as a percentage of premium revenues). The

consolidated medical care ratio increased from 80.0% in 2005 to 81.2% in 2006. This medical care ratio increase

resulted primarily from the impact of the acquisition of PacifiCare and launch of the Medicare Part D program,

both of which carry a higher medical care ratio than the historic UnitedHealth Group businesses.

For each period, our operating results include the effects of revisions in medical cost estimates related to all prior

periods. Changes in medical cost estimates related to prior fiscal years, resulting from more complete claim

information and other facts and circumstances, that are identified in the current year are included in total medical

costs reported for the current fiscal year. Medical costs for 2006 include approximately $430 million of favorable

medical cost development related to prior fiscal years. Medical costs for 2005 include approximately

$400 million of favorable medical cost development related to prior fiscal years. The increase in favorable

medical cost development in 2006 was driven by an increase in medical payables due to organic growth and

businesses acquired since the beginning of 2005.

Medical costs for 2006 increased $19.6 billion, or 58%, to $53.3 billion, due to the impact of businesses acquired

since the beginning of 2005, medical costs associated with the new Medicare Part D program and a medical cost

trend of 7% to 8% on commercial risk-based business. Medical costs associated with the new Medicare Part D

program for 2006 were $4.9 billion. Medical trend was due to both medical inflation and increases in health care

consumption.

Operating Costs

The operating cost ratio (operating costs as a percentage of total revenues) for 2006 of 14.0%, improved from

15.4% in 2005. This decrease was primarily driven by revenue mix changes, with premium revenues growing at

a faster rate than service revenues primarily due to the new Medicare Part D program and the PacifiCare

acquisition. Operating costs as a percentage of premium revenues are generally considerably lower than

operating costs as a percentage of fee-based revenues. The decrease in the operating cost ratio reflected

productivity gains from technology deployment and other cost management initiatives, including cost savings

associated with the PacifiCare acquisition integration, and an insurance recovery of $43 million. These items

were partially offset by a $22 million charitable contribution to the United Health Foundation and approximately

$44 million of additional cash expenses related to the stock option review, exclusive of the FAS 123R

compensation expense.

33