United Healthcare 2006 Annual Report Download - page 28

Download and view the complete annual report

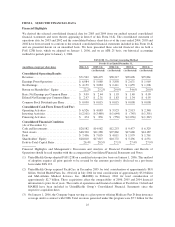

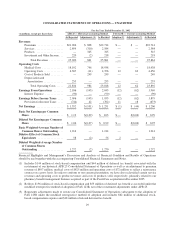

Please find page 28 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.year ended December 31, 2006. This program affects the comparability of 2006 financial information with

prior years. See Note 4 of the Notes to Consolidated Financial Statements for a detailed discussion of this

program.

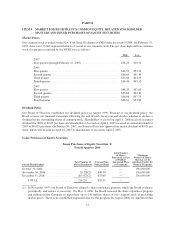

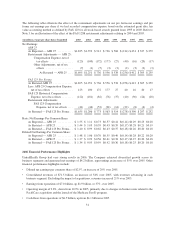

(4) The unaudited Consolidated Statements of Operations and Cash Flows data for 2003 and 2002, and the

unaudited consolidated balance sheet data as of December 31, 2004, 2003 and 2002 have been revised to

reflect adjustments related to the restatement described under “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and Note 3 of the Notes to Consolidated Financial

Statements. Pre-tax adjustments related to 2003 and 2002 include non-cash stock-based compensation

expense totaling $54 million and $62 million, respectively under FAS 123R, our current accounting method.

The cumulative after tax impact of all restatement adjustments related to years prior to 2002 totaled $220

million under FAS 123R, our current accounting method, and has been reflected as an adjustment to

retained earnings at December 31, 2001. The tables following the financial highlights presented under

APB 25, our historical accounting method, reflect the detailed unaudited 2003 and 2002 Statements of

Operations adjustments under APB 25 and FAS 123R.

26