United Healthcare 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

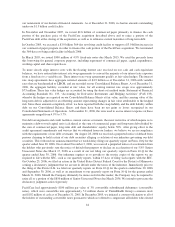

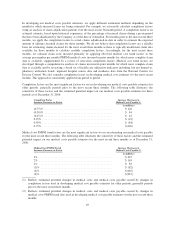

The analyses above include those outcomes that are considered reasonably likely based on the Company’s

historical experience in estimating its liabilities for incurred but not reported benefit claims.

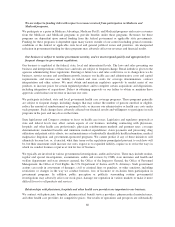

In order to evaluate the impact of changes in medical cost estimates for any particular discrete period, one should

consider both the amount of development recorded in the current period pertaining to prior periods and the

amount of development recorded in subsequent periods pertaining to the current period. The accompanying table

provides a summary of the net impact of favorable development on medical costs and earnings from operations

(in millions).

Favorable

Development

Increase (Decrease)

to Medical Costs(a)

Medical Costs Earnings from Operations

As Restated (b) As Adjusted (c) As Restated (b) As Adjusted

2002 ............ $ 70 $ (80) $18,938 $18,858 $1,969 $2,049

2003 ............ $150 $ (60) $21,482 $21,422 $2,671 $2,731

2004 ............ $210 $(190) $27,858 $27,668 $3,858 $4,048

2005 ............ $400 $ (30) $33,669 $33,639 $5,080 $5,110

2006 ............ $430 (d) $53,308 (d) $6,984 (d)

(a) The amount of favorable development recorded in the current year pertaining to the prior year less the

amount of favorable development recorded in the subsequent year pertaining to the current year.

(b) Restated to include the impact of FAS 123R, which we adopted effective January 1, 2006, as well as

impacts associated with the restatement described in Note 3 “Restatement of Consolidated Financial

Statements.”

(c) Represents reported amounts adjusted to reflect the net impact of medical cost development.

(d) Not yet determinable as the amount of prior period development recorded in 2007 will change as our

December 31, 2006 medical costs payable estimate develops throughout 2007.

Our estimate of medical costs payable represents management’s best estimate of the Company’s liability for

unpaid medical costs as of December 31, 2006, developed using consistently applied actuarial methods.

Management believes the amount of medical costs payable is reasonable and adequate to cover the Company’s

liability for unpaid claims as of December 31, 2006; however, actual claim payments may differ from established

estimates. The increase in favorable medical cost development in 2006 was driven primarily by growth in the

size of the medical cost base and related medical payables due to organic growth and businesses acquired since

the beginning of 2005. As our medical costs payable estimate increases in amount due to increases in the fully

insured consumer base and inflationary increases in medical costs, the absolute dollar amount of subsequent

changes to that estimate will increase even if the accuracy of our medical costs payable estimate remains

consistent as a percentage of the original estimate. Assuming a hypothetical 1% difference between our

December 31, 2006 estimates of medical costs payable and actual medical costs payable, excluding the AARP

business, 2006 earnings from operations would increase or decrease by $71 million and diluted net earnings per

common share would increase or decrease by $0.03 per share.

Historic Stock Option Measurement Dates

The selection by the Company of the methodologies described in Note 3 of the Notes to Consolidated Financial

Statements to determine the measurement dates of historic stock option grants involved judgment and careful

evaluation of all relevant facts and circumstances for each historical grant. The Company believes it has used the

most appropriate methodologies. However, the Company also conducted a sensitivity analysis to assess how the

restatement adjustments would have changed under two alternative methodologies for determining measurement

dates. The following table sets forth the incremental effect on earnings before income taxes that would result

from using the alternate measurement date determination methodologies described below:

•Communication Date. This methodology would select as the measurement date the date on which stock

option grants were communicated to employees, assuming that the communication date is readily

50