United Healthcare 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.our restatement of our historical financial statements. As of December 31, 2006, we had no amounts outstanding

under our $1.3 billion credit facility.

In November and December 2005, we issued $2.6 billion of commercial paper primarily to finance the cash

portion of the purchase price of the PacifiCare acquisition described above and to retire a portion of the

PacifiCare debt at the closing of the acquisition, as well as to refinance current maturities of long-term debt.

In October 2005, we executed a $3.0 billion 364-day revolving credit facility to support a $3.0 billion increase in

our commercial paper program in order to finance the cash portion of the PacifiCare acquisition. We terminated

the 364-day revolving credit facility in March 2006.

In March 2005, we issued $500 million of 4.9% fixed-rate notes due March 2015. We used the proceeds from

this borrowing for general corporate purposes, including repayment of commercial paper, capital expenditures,

working capital and share repurchases.

To more closely align interest costs with the floating interest rate received on our cash and cash equivalent

balances, we have entered into interest rate swap agreements to convert the majority of our interest rate exposure

from a fixed rate to a variable rate. These interest rate swap agreements qualify as fair value hedges. The interest

rate swap agreements have aggregate notional amounts of $4.9 billion as of December 31, 2006 with variable

rates that are benchmarked to LIBOR, and are recorded on our Consolidated Balance Sheets. As of December 31,

2006, the aggregate liability, recorded at fair value, for all existing interest rate swaps was approximately

$73 million. These fair value hedges are accounted for using the short-cut method under Statement of Financial

Accounting Standards No. 133, “Accounting for Derivative Instruments and Hedging Activities” (FAS 133),

whereby the hedges are reported on our Consolidated Balance Sheets at fair value, and the carrying value of the

long-term debt is adjusted for an offsetting amount representing changes in fair value attributable to the hedged

risk. Since these amounts completely offset, we have reported both the swap liability and the debt liability within

debt on our Consolidated Balance Sheets and there have been no net gains or losses recognized in our

Consolidated Statements of Operations. At December 31, 2006, the rates used to accrue interest expense on these

agreements ranged from 4.9% to 5.7%.

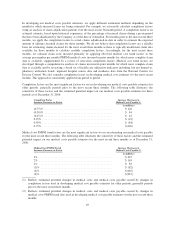

Our debt arrangements and credit facilities contain various covenants, the most restrictive of which require us to

maintain a debt-to-total-capital ratio (calculated as the sum of commercial paper and long-term debt divided by

the sum of commercial paper, long-term debt and shareholders’ equity) below 50%. After giving effect to the

credit agreement amendments and waivers that we obtained from our lenders, we believe we are in compliance

with the requirements of our debt covenants. On August 28, 2006 we received a purported notice of default from

persons claiming to hold certain of our debt securities alleging a violation of our indenture governing our debt

securities. This followed our announcement that we would delay filing our quarterly report on Form 10-Q for the

quarter ended June 30, 2006. On or about November 2, 2006, we received a purported notice of acceleration from

the holders who previously sent the notice of default that purports to declare an acceleration of our 5.8% Senior

Unsecured Notes due March 15, 2036 as a result of our not filing our quarterly report on Form 10-Q for the

quarter ended June 30, 2006. Our indenture requires us to provide to the trustee copies of the reports we are

required to file with the SEC, such as our quarterly reports, within 15 days of filing such reports with the SEC.

On October 25, 2006, we filed an action in the United States District Federal Court for the District of Minnesota

seeking a declaratory judgment that we are not in default under the terms of the indenture. Immediately prior to

the filing of this Form 10-K, we filed our quarterly reports on Form 10-Q for the quarters ended June 30, 2006

and September 30, 2006, as well as an amendment to our quarterly report on Form 10-Q for the quarter ended

March 31, 2006. Should the Company ultimately be unsuccessful in this matter, the Company may be required to

retire all or a portion of the $850 million of Senior Unsecured Notes due March 2036. We intend to prosecute the

declaratory judgment action vigorously.

PacifiCare had approximately $100 million par value of 3% convertible subordinated debentures (convertible

notes), which were convertible into approximately 5.2 million shares of UnitedHealth Group’s common stock

and $102 million of cash as of December 31, 2005. In December 2005, we initiated a consent solicitation to all of

the holders of outstanding convertible notes pursuant to which we offered to compensate all holders who elected

44