United Healthcare 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

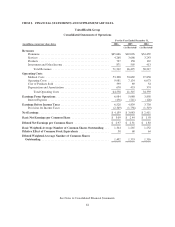

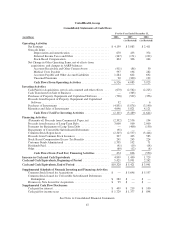

UnitedHealth Group

Consolidated Statements of Changes in Shareholders’ Equity (As Restated)

(in millions)

Common Stock Additional

Paid-in

Capital

Retained

Earnings

Net

Unrealized

Gains on

Investments

Total

Shareholders’

Equity

Comprehensive

IncomeShares Amount

Balance at December 31, 2003, as previously

reported under APB 25 .................... 1,166 $12 $ 52 $ 4,915 $149 $ 5,128

APB25CumulativeRestatementAdjustments..... — — 784 (738) — 46

Adjustments to Historical Common Stock

Repurchases .............................. — — (836) 836 — —

Balance at December 31, 2003, as restated under

APB 25 ................................. 1,166 12 — 5,013 149 5,174

FAS 123R Adoption ......................... — — 713 (659) — 54

FAS 123R Adjustments ....................... — — 292 (284) — 8

Adjustments to Historical Common Stock

Repurchases .............................. — — (731) 731 — —

Balance at December 31, 2003, as restated under

FAS 123R ............................... 1,166 12 274 4,801 149 5,236

Issuances of Common Stock, and related tax

benefits ................................ 223 2 6,206 — — 6,208

Common Stock Repurchases ................. (103) (1) (3,445) — — (3,446)

Stock-Based Compensation, and related tax

benefits ................................ — — 398 — — 398

Comprehensive Income Net Earnings ........ — — — 2,411 — 2,411 $2,411

Other Comprehensive Income Adjustments:

Change in Net Unrealized Gains on

Investments,netoftaxeffects .......... — — — — (17) (17) (17)

Comprehensive Income ................. $2,394

Common Stock Dividend ............... — — — (18) — (18)

Balance at December 31, 2004, as restated ...... 1,286 13 3,433 7,194 132 10,772

Issuances of Common Stock, and related tax

benefits ................................ 126 1 6,145 — — 6,146

Common Stock Repurchases ................. (54) — (2,557) — — (2,557)

Stock-Based Compensation, and related tax

benefits ................................ — — 489 — — 489

Comprehensive Income Net Earnings .......... — — — 3,083 — 3,083 $3,083

Other Comprehensive Income Adjustments:

Change in Net Unrealized Gains on

Investments,netoftaxeffects .......... — — — — (99) (99) (99)

Comprehensive Income ................. $2,984

Common Stock Dividend ............... — — — (19) — (19)

Balance at December 31, 2005, as restated ...... 1,358 14 7,510 10,258 33 17,815

Issuances of Common Stock, and related tax

benefits ................................ 22 — 342 — — 342

Common Stock Repurchases ................. (40) (1) (2,344) — — (2,345)

Conversion of Convertible Debt .............. 5 — 282 — — 282

Stock-Based Compensation, and related tax

benefits ................................ — — 616 — — 616

Comprehensive Income Net Earnings .......... — — — 4,159 — 4,159 $4,159

Other Comprehensive Income Adjustments:

Change in Net Unrealized Gains on

Investments,netoftaxeffects .......... — — — — (18) (18) (18)

Comprehensive Income ................. $4,141

Common Stock Dividend ................... — — — (41) — (41)

Balance at December 31, 2006 ................ 1,345 $13 $ 6,406 $14,376 $ 15 $20,810

See Notes to Consolidated Financial Statements.

66