United Healthcare 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to convert their notes in accordance with existing terms and consent to an amendment to a covenant in the

indenture governing the convertible notes. The compensation consisted of the present value of interest through

October 18, 2007, the earliest redemption date, plus a pro rata share of $1 million. On January 31, 2006,

approximately 91% of the convertible notes were tendered pursuant to the offer, for which we issued 4.8 million

shares of UnitedHealth Group common stock, valued at $282 million, and cash of $93 million.

Our senior debt is rated “A” with a negative outlook by Standard & Poor’s (S&P), “A” with a negative watch by

Fitch, and “A3” with a negative outlook by Moody’s. Our commercial paper is rated “A-1” with a negative

outlook by S&P, “F-1” with a negative watch by Fitch, and “P-2” with a negative outlook by Moody’s. Moody’s

downgraded our rating in October 2006 citing concerns about corporate governance following the release of the

WilmerHale Report (See Note 3 of the Notes to Consolidated Financial Statements). We do not expect this

Moody’s downgrade to significantly affect our borrowing capacity or costs. A significant downgrade in our debt

or commercial paper ratings could adversely affect our borrowing capacity and costs. See “ — Cautionary

Statements Relating to Our Historic Stock Option Practices — Credit Ratings” for additional information.

Under our Board of Directors’ authorization, we maintain a common stock repurchase program. Repurchases

may be made from time to time at prevailing prices, subject to certain restrictions on volume, pricing and timing.

There is no established expiration date for the program. During the year ended December 31, 2006, we

repurchased 40.2 million shares at an average price of approximately $56 per share and an aggregate cost of

approximately $2.2 billion. As of December 31, 2006, we had Board of Directors’ authorization to purchase up to

an additional 136.7 million shares of our common stock. Our common stock repurchase program is discretionary

as we are under no obligation to repurchase shares. We repurchase shares because we believe it is a prudent use

of capital. The Company suspended purchases under its stock repurchase program in the third quarter of 2006

pending completion of our restatement (which is reflected in this Form 10-K) and becoming current in our

periodic SEC filings. The Company intends to resume its stock repurchase program in 2007.

We currently have $1.0 billion remaining under our universal S-3 shelf registration statement (for common stock,

preferred stock, debt securities and other securities), although we will be unable to issue securities on Form S-3

on a primary basis until we have timely filed all reports required to be filed with the SEC for a twelve-month

period. We may offer securities from time to time at prices and terms to be determined at the time of offering.

Under our S-4 acquisition shelf registration statement, we have remaining issuing capacity of 48.6 million shares

of our common stock in connection with acquisition activities. We filed a separate S-4 registration statement for

the 99.2 million shares issued in connection with the December 2005 acquisition of PacifiCare described

previously.

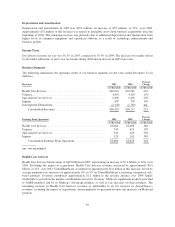

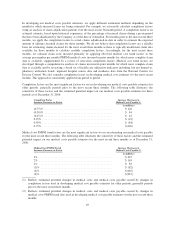

Contractual Obligations, Off-Balance Sheet Arrangements And Commitments

The following table summarizes future obligations due by period as of December 31, 2006, under our various

contractual obligations, off-balance sheet arrangements and commitments (in millions):

2007 2008 to 2009 2010 to 2011 Thereafter Total

Debt and Commercial Paper (1) ................... $1,483 $1,850 $ 750 $3,373 $ 7,456

Interest on Debt and Commercial Paper (2) .......... 366 581 438 1,660 3,045

Operating Leases .............................. 156 273 167 370 966

Purchase Obligations (3) ........................ 182 144 30 5 361

Future Policy Benefits (4) ....................... 121 339 325 1,186 1,971

Other Long-Term Obligations (5) ................. — 74 12 325 399

Total Contractual Obligations ................ $2,308 $3,261 $1,722 $6,919 $14,210

(1) Debt payments could be accelerated upon violation of debt covenants. We believe the likelihood of

acceleration is remote.

(2) Calculated using stated rates from the debt agreements and related interest rate swap agreements and

assuming amounts are outstanding through their contractual term. For variable-rate obligations, we used the

rates in place as of December 31, 2006 to estimate all remaining contractual payments.

45