United Healthcare 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

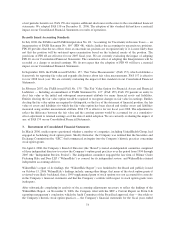

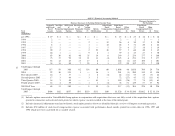

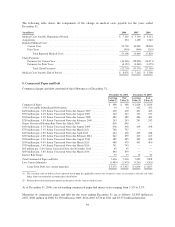

Consolidated Balance Sheets

As of December 31, 2005

APB 25 — Historical Accounting Method FAS 123R — Current Accounting Method

(in millions, except per share data) As Reported Adjustments (1) As Restated Adoption (2) Adjustments (3) As Restated

Assets

Current Assets

Cash and Cash Equivalents $ 5,421 $ — $ 5,421 $ — $ — $ 5,421

Short-Term Investments ........ 590 — 590 — — 590

Accounts Receivable, net ....... 1,290 (83) 1,207 — — 1,207

Assets Under Management ..... 1,825 — 1,825 — — 1,825

Deferred Income Taxes ........ 645 5 650 — — 650

Other Current Assets .......... 869 (15) 854 — — 854

Total Current Assets ....... 10,640 (93) 10,547 — — 10,547

Long-Term Investments ............ 8,971 — 8,971 — — 8,971

Property, Equipment, and Capitalized

Software, net .................. 1,647 — 1,647 — — 1,647

Goodwill ........................ 16,206 32 16,238 — — 16,238

Other Intangible Assets, net ......... 2,020 — 2,020 — — 2,020

Other Assets ..................... 1,890 (25) 1,865 — — 1,865

Total Assets ............. $41,374 $ (86) $41,288 $ — $ — $41,288

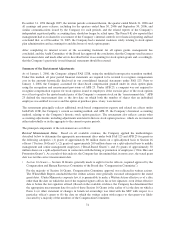

Liabilities and Shareholders’ Equity

Current Liabilities

Medical Costs Payable $ 7,301 $ (39) $ 7,262 $ — $ — $ 7,262

Accounts Payable and Accrued

Liabilities ................. 3,301 (16) 3,285 (95) 95 3,285

Other Policy Liabilities ........ 1,824 21 1,845 — — 1,845

Commercial Paper and Current

Maturities of Long-Term

Debt ..................... 3,261 — 3,261 — — 3,261

Unearned Premiums ........... 957 43 1,000 — — 1,000

Total Current Liabilities .... 16,644 9 16,653 (95) 95 16,653

Long-Term Debt, less current

maturities ..................... 3,850 (16) 3,834 — — 3,834

Future Policy Benefits for Life and

Annuity Contracts .............. 1,761 — 1,761 — — 1,761

Deferred Income Taxes and Other

Liabilities ..................... 1,386 (134) 1,252 24 (51) 1,225

Commitments and Contingencies ....

Shareholders’ Equity

Common Stock ............... 14 — 14 — — 14

Additional Paid-In Capital ...... 6,921 338 7,259 664 (413) 7,510

Retained Earnings ............ 10,765 (283) 10,482 (593) 369 10,258

Accumulated Other

Comprehensive Income:

Net Unrealized Gains on

Investments, net of tax

effects ................ 33 — 33 — — 33

Total Shareholders’

Equity ................ 17,733 55 17,788 71 (44) 17,815

Total Liabilities and

Shareholders’ Equity . . . $41,374 $ (86) $41,288 $ — $ — $41,288

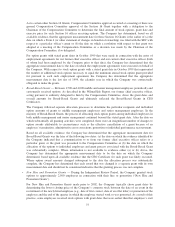

(1) Includes adjustments to increase current income taxes payable by $95 million, decrease non-current deferred

tax liabilities by $236 million, increase additional paid-in capital by $372 million and to decrease retained

earnings by $231 million associated with the restatement of our historical APB 25 Consolidated Balance

Sheets.

(2) Reflects adjustments to decrease non-current deferred tax liabilities by $212 million, increase additional

paid-in capital by $1,036 million and decrease retained earnings by $824 million associated with the

adoption of FAS 123R under the modified retrospective method as of December 31, 2005 that would have

been recognized based on our original pro forma disclosure under FAS 123 prior to the restatement, net of

the restatement adjustments under APB 25.

(3) Represents adjustments made to restate our Consolidated Balance Sheets subsequent to the adoption of FAS

123R under the modified retrospective method to correct the previously presented pro forma disclosures for

the effects of the historical stock option practices and includes adjustments to increase current income taxes

payable by $95 million, decrease non-current deferred tax liabilities by $51 million, decrease additional

paid-in capital by $413 million and increase retained earnings by $369 million. Includes adjustments to our

historical common stock repurchase accounting considering the increase in compensation recognized in

relation to the timing of stock repurchase activity and the related impact to period end reclassifications

within shareholders’ equity to restore additional paid-in capital.

83