United Healthcare 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

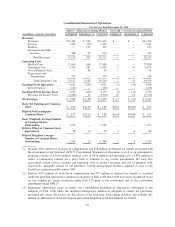

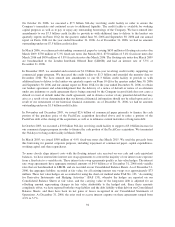

Consolidated Statements of Cash Flows

For the Year Ended December 31, 2005

APB 25 — Historical Accounting Method FAS 123R — Current Accounting Method

(in millions) As Reported Adjustments (1) As Restated Adoption (2) Adjustments (3) As Restated

Operating Activities

Net Earnings ............................. $3,300 $(238) $ 3,062 $ 68 $(47) $ 3,083

Noncash Items:

Depreciation and Amortization ........... 453 — 453 — — 453

Deferred Income Taxes and Other ......... 167 (85) 82 (251) (2) (171)

Stock-Based Compensation .............. — 317 317 (67) 56 306

Net Change in Other Operating Items, net of

effects from acquisitions, and changes in

AARP balances

Accounts Receivable and Other Assets ..... (83) (3) (86) — — (86)

Medical Costs Payable .................. 193 3 196 — — 196

Accounts Payable and Other Accrued

Liabilities .......................... 580 22 602 (3) 3 602

Unearned Premiums ................... (284) (16) (300) — — (300)

Cash Flows From Operating Activities ....... 4,326 — 4,326 (253) 10 4,083

Investing Activities

Cash Paid for Acquisitions, net of cash assumed

and other effects ......................... (2,562) — (2,562) — — (2,562)

Cash Transferred on Sale of Business .......... (363) — (363) — — (363)

Purchases of Property, Equipment and Capitalized

Software ............................... (509) — (509) — — (509)

Purchases of Investments .................... (5,876) — (5,876) — — (5,876)

Maturities and Sales of Investments ........... 5,821 — 5,821 — — 5,821

Cash Flows Used for Investing Activities ..... (3,489) — (3,489) — — (3,489)

Financing Activities

Repayment of Commercial Paper, net .......... 2,556 — 2,556 — — 2,556

Proceeds from Issuance of Long-Term Debt ..... 500 — 500 — — 500

Payments for Retirement of Long-Term Debt .... (400) — (400) — — (400)

Common Stock Repurchases ................. (2,557) — (2,557) — — (2,557)

Proceeds from Common Stock Issuances under

Stock-Based Compensation Plans ........... 423 — 423 — — 423

Stock-Based Compensation Excess Tax

Benefit ................................ — — — 253 (10) 243

Customer Funds Administered ............... 102 — 102 — — 102

Dividends Paid ............................ (19) — (19) — — (19)

Other ................................... (12) — (12) — — (12)

Cash Flows From (Used For) Financing

Activities .............................. 593 — 593 253 (10) 836

Increase in Cash and Cash Equivalents ...... 1,430 — 1,430 — — 1,430

Cash and Cash Equivalents, Beginning of

Period ................................ 3,991 — 3,991 — — 3,991

Cash and Cash Equivalents, End of Period . . . $ 5,421 $ — $ 5,421 $ — $ — $ 5,421

(1) Includes adjustments to operating cash flows for stock-based compensation and related tax effects

associated with the restatement of our historical APB 25 Consolidated Statement of Cash Flows, as well as

operating cash flow adjustments due to immaterial adjustments, individually and in the aggregate, unrelated

to historical stock option practices.

(2) Reflects adjustments to operating cash flows for stock-based compensation and deferred tax assets and to

financing cash flows for excess tax benefits as recorded under the modified retrospective method of

adoption of FAS 123R that would have been recognized based on our original pro forma disclosure under

FAS 123 prior to the restatement, net of the restatement adjustments under APB 25.

(3) Represents adjustments made to restate our Consolidated Statement of Cash Flows subsequent to the

adoption of FAS 123R under the modified retrospective method to correct the previously presented pro

forma disclosures for the effects of the historical stock option practices and includes adjustments to

operating cash flows for additional stock-based compensation expense and deferred tax assets and to

financing cash flows for excess tax benefits.

84