United Healthcare 2006 Annual Report Download - page 74

Download and view the complete annual report

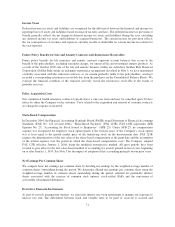

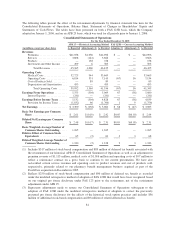

Please find page 74 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.recognized over the life of the agreements as an adjustment to interest expense in the Consolidated Statements of

Operations. Our existing interest rate swap agreements convert a majority of our interest from a fixed to a

variable rate and are accounted for under the short cut method as fair value hedges. Additional information on

our existing interest rate swap agreements is included in Note 9.

Fair Value of Financial Instruments

In the normal course of business, we invest in various financial assets, incur various financial liabilities and enter

into agreements involving derivative securities.

Fair values are disclosed for all financial instruments for which it is practicable to estimate fair value, whether or

not such values are recognized in the Consolidated Balance Sheets. Where available, management obtains quoted

market prices for these disclosures; otherwise, fair values are estimated using valuation techniques.

The carrying amounts reported in the Consolidated Balance Sheets for cash and cash equivalents, premium and

other receivables, unearned premiums, accounts payable and accrued expenses, income taxes payable, and certain

other current liabilities approximate fair value because of their short-term nature.

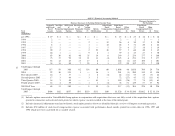

The following methods and assumptions were used to estimate the fair value of each class of financial

instrument:

• Current and long-term investments, available-for-sale, at fair value: The carrying amount is stated at fair

value, based on quoted market prices, where available. For securities not actively traded, fair values were

estimated using values obtained from independent pricing services or quoted market prices of comparable

instruments.

• Senior Unsecured Notes: Estimated based on third-party quoted market prices for the same or similar issues.

• Commercial paper: The carrying amount for commercial paper approximates fair value as the underlying

instruments have variable interest rates at market value.

• Interest rate swaps: The fair value of the interest rate swaps are based on the quoted market prices by the

financial institution that is the counterparty to the swap.

Recently Adopted Accounting Standards

Effective January 1, 2006, we adopted FAS 123R, which revises FAS No. 123, “Accounting for Stock-Based

Compensation” (FAS 123). See Note 3 for details on its impact to our Consolidated Financial Statements.

In September 2006, the SEC issued Staff Accounting Bulletin No. 108, “Considering the Effects of Prior Year

Misstatements when Quantifying Misstatements in Current Year Financial Statements” (SAB 108). SAB 108

provides interpretive guidance on how the effects of the carryover or reversal of prior year misstatements should

be considered in quantifying a current year misstatement. Under SAB 108, registrants should quantify errors

using both a balance sheet and income statement approach (“dual approach”) and evaluate whether either

approach results in a misstatement that is material when all relevant quantitative and qualitative factors are

considered. We adopted SAB 108 on December 31, 2006.

In September 2006, the FASB issued FAS No. 158, “Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans—an amendment of FASB Statements No. 87, 88, 106 and 132(R)” (FAS 158). This

statement requires balance sheet recognition of the overfunded or underfunded status of pension and

postretirement benefit plans and recognition, as a component of other comprehensive income, net of tax, the

gains or losses and prior service costs or credits that arise during the period but are not recognized as components

72