United Healthcare 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of net periodic benefit cost. FAS 158 also requires additional disclosures in the notes to the consolidated financial

statements. We adopted FAS 158 on December 31, 2006. The adoption of this standard did not have a material

impact on our Consolidated Financial Statements or results of operations.

Recently Issued Accounting Standards

In July 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes — an

interpretation of FASB Statement No. 109” (FIN 48), which clarifies the accounting for uncertain tax positions.

FIN 48 provides that the tax effects from an uncertain tax position are recognized only if it is more likely than

not that the position will be sustained upon examination based on the technical merits of the position. The

provisions of FIN 48 are effective for our 2007 fiscal year. We are currently evaluating the impact of adopting

FIN 48 on our Consolidated Financial Statements. The cumulative effect of adopting this Interpretation will be

recorded as a charge to retained earnings. We do not expect that the adoption of FIN 48 will have a material

impact on our Consolidated Financial Statements.

In September 2006, the FASB issued FAS No. 157, “Fair Value Measurements” (FAS 157), which establishes a

framework for reporting fair value and expands disclosures about fair value measurements. FAS 157 is effective

for our 2008 fiscal year. We are currently evaluating the impact of this standard on our Consolidated Financial

Statements.

In February 2007, the FASB issued FAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities — Including an amendment of FASB Statement No. 115” (FAS 159). FAS 159 permits an entity to

elect fair value as the initial and subsequent measurement attribute for many financial assets and liabilities.

Entities electing the fair value option would be required to recognize changes in fair value in earnings. Entities

electing the fair value option are required to distinguish, on the face of the statement of financial position, the fair

value of assets and liabilities for which the fair value option has been elected and similar assets and liabilities

measured using another measurement attribute. FAS 159 is effective for our fiscal year 2008. The adjustment to

reflect the difference between the fair value and the carrying amount would be accounted for as a cumulative-

effect adjustment to retained earnings as of the date of initial adoption. We are currently evaluating the impact, if

any, of FAS 159 on our Consolidated Financial Statements.

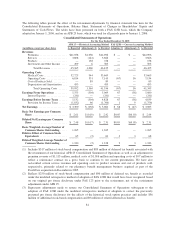

3. Restatement of Consolidated Financial Statements

In March 2006, media reports questioned whether a number of companies, including UnitedHealth Group, had

engaged in backdating stock option grants. Shortly thereafter, the Company was notified that the Securities and

Exchange Commission (the “SEC”) had commenced an inquiry into the Company’s historic practices concerning

stock option grants.

On April 4, 2006, the Company’s Board of Directors (the “Board”) created an independent committee comprised

of three independent directors to review the Company’s option grant practices over the period from 1994 through

2005 (the “Independent Review Period”). The independent committee engaged the law firm of Wilmer Cutler

Pickering Hale and Dorr LLP (“WilmerHale”) as counsel for its independent review, and WilmerHale retained

independent accounting advisors.

WilmerHale’s report of its findings (the “WilmerHale Report”) was furnished to the Board and publicly issued

on October 15, 2006. WilmerHale’s findings include, among other things, that many of the stock option grants it

reviewed were likely backdated, that a 1999 supplemental grant of stock options was not accounted for correctly

in the Company’s financial statements and that the Company’s controls with respect to stock option grants were

inadequate.

After substantially completing its analysis of the accounting adjustments necessary to reflect the findings of the

WilmerHale Report, on November 8, 2006, the Company filed with the SEC a Current Report on Form 8-K

reporting management’s conclusion, which the Audit Committee of the Board had approved, that — due solely to

the Company’s historic stock option practices — the Company’s financial statements for the fiscal years ended

73