Under Armour 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

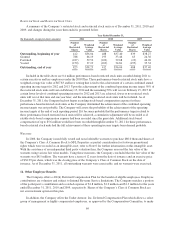

an annual base salary and/or bonus deferral for each year. As of December 31, 2011 and 2010, the Deferred

Compensation Plan obligations were $3.5 million and $3.6 million, respectively, and were included in other long

term liabilities on the consolidated balance sheets.

The Company established the Rabbi Trust to fund obligations to participants in the Deferred Compensation

Plan. As of December 31, 2011 and 2010, the assets held in the Rabbi Trust were TOLI policies with cash-

surrender values of $3.9 million and $3.6 million, respectively. These assets are consolidated as allowed by

accounting guidance, and are included in other long term assets on the consolidated balance sheet. Refer to Note

10 for a discussion of the fair value measurements of the assets held in the Rabbi Trust and the Deferred

Compensation Plan obligations.

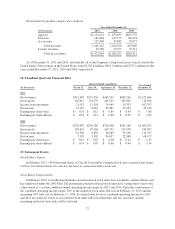

15. Foreign Currency Risk Management and Derivatives

The Company is exposed to gains and losses resulting from fluctuations in foreign currency exchange rates

relating to transactions generated by its international subsidiaries in currencies other than their local currencies.

These gains and losses are primarily driven by intercompany transactions. From time to time, the Company may

elect to enter into foreign currency forward contracts to reduce the risk associated with foreign currency exchange

rate fluctuations on intercompany transactions and projected inventory purchases for its European and Canadian

subsidiaries. In addition, the Company may elect to enter into foreign currency forward contracts to reduce the risk

associated with foreign currency exchange rate fluctuations on Pound Sterling denominated balance sheet items.

As of December 31, 2011, the notional value of the Company’s outstanding foreign currency forward contracts

used to mitigate the foreign currency exchange rate fluctuations on its Canadian subsidiary’s intercompany transactions

was $51.1 million with contract maturities of 1 month or less. As of December 31, 2011, the notional value of the

Company’s outstanding foreign currency forward contracts used to mitigate the foreign currency exchange rate

fluctuations on its European subsidiary’s intercompany transactions was $50.0 million with contract maturities of 1

month. As of December 31, 2011, the notional value of the Company’s outstanding foreign currency forward contract

used to mitigate the foreign currency exchange rate fluctuations on Pounds Sterling denominated balance sheet items

was €10.5 million, or $13.6 million, with a contract maturity of 1 month. The foreign currency forward contracts are

not designated as cash flow hedges, and accordingly, changes in their fair value are recorded in earnings. The fair

values of the Company’s foreign currency forward contracts were liabilities of $0.7 million and $0.6 million as of

December 31, 2011 and 2010, respectively, and were included in accrued expenses on the consolidated balance sheets.

Refer to Note 10 for a discussion of the fair value measurements. Included in other expense, net were the following

amounts related to changes in foreign currency exchange rates and derivative foreign currency forward contracts:

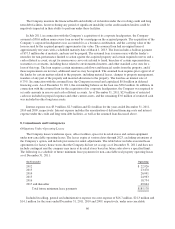

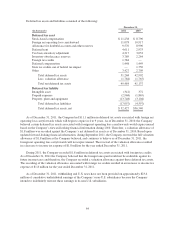

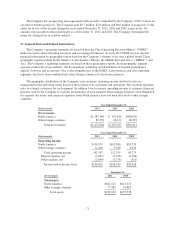

(In thousands)

Year Ended December 31,

2011 2010 2009

Unrealized foreign currency exchange rate gains (losses) $(4,027) $(1,280) $ 5,222

Realized foreign currency exchange rate gains (losses) 298 (2,638) (261)

Unrealized derivative losses (31) (809) (1,060)

Realized derivative gains (losses) 1,696 3,549 (4,412)

The Company enters into foreign currency forward contracts with major financial institutions with

investment grade credit ratings and is exposed to credit losses in the event of non-performance by these financial

institutions. This credit risk is generally limited to the unrealized gains in the foreign currency forward contracts.

However, the Company monitors the credit quality of these financial institutions and considers the risk of

counterparty default to be minimal.

16. Related Party Transactions

The Company has an agreement to license a software system with a vendor whose Co-CEO is a director of

the Company. During the years ended December 31, 2011, 2010 and 2009, the Company paid $1.8 million, $1.5

million and $2.0 million, respectively, in licensing fees and related support services to this vendor. There were no

amounts payable to this related party as of December 31, 2011 and 2010.

70