Under Armour 2011 Annual Report Download - page 52

Download and view the complete annual report

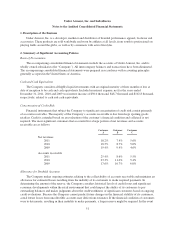

Please find page 52 of the 2011 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.within the retail environment that could impact the ability of our customers to pay outstanding balances and

make judgments about the creditworthiness of significant customers based on ongoing credit evaluations.

Because we cannot predict future changes in the financial stability of our customers, future losses from

uncollectible accounts may differ from our estimates. If the financial condition of our customers were to

deteriorate, resulting in their inability to make payments, a larger reserve might be required. In the event we

determine that a smaller or larger reserve was appropriate, we would record a benefit or charge to selling, general

and administrative expenses in the period in which we made such a determination.

Inventory Valuation and Reserves

We value our inventory at standard cost which approximates our landed cost, using the first-in, first-out

method of cost determination. Market value is estimated based upon assumptions made about future demand and

retail market conditions. If we determine that the estimated market value of our inventory is less than the

carrying value of such inventory, we record a charge to cost of goods sold to reflect the lower of cost or market.

If actual market conditions are less favorable than those projected by us, further adjustments may be required that

would increase our cost of goods sold in the period in which we make such a determination.

Impairment of Long-Lived Assets

We continually evaluate whether events and circumstances have occurred that indicate the remaining

estimated useful life of long-lived assets may warrant revision or that the remaining balance may not be

recoverable. These factors may include a significant deterioration of operating results, changes in business plans,

or changes in anticipated cash flows. When factors indicate that an asset should be evaluated for possible

impairment, we review long-lived assets to assess recoverability from future operations using undiscounted cash

flows. Impairments are recognized in earnings to the extent that the carrying value exceeds fair value. No

material impairments were recorded in the years ended December 31, 2011, 2010 and 2009.

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred income tax assets and

liabilities are established for temporary differences between the financial reporting basis and the tax basis of our

assets and liabilities at tax rates expected to be in effect when such assets or liabilities are realized or settled.

Deferred income tax assets are reduced by valuation allowances when necessary.

Assessing whether deferred tax assets are realizable requires significant judgment. We consider all available

positive and negative evidence, including historical operating performance and expectations of future operating

performance. The ultimate realization of deferred tax assets is often dependent upon future taxable income and

therefore can be uncertain. To the extent we believe it is more likely than not that all or some portion of the asset

will not be realized, valuation allowances are established against our deferred tax assets, which increase income

tax expense in the period when such a determination is made.

Income taxes include the largest amount of tax benefit for an uncertain tax position that is more likely than

not to be sustained upon audit based on the technical merits of the tax position. Settlements with tax authorities,

the expiration of statutes of limitations for particular tax positions, or obtaining new information on particular tax

positions may cause a change to the effective tax rate. We recognize accrued interest and penalties related to

unrecognized tax benefits in the provision for income taxes on the consolidated statements of income.

Stock-Based Compensation

We account for stock-based compensation in accordance with accounting guidance that requires all stock-

based compensation awards granted to employees and directors to be measured at fair value and recognized as an

expense in the financial statements. As of December 31, 2011, we had $24.6 million of unrecognized

42