Under Armour 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

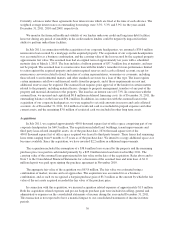

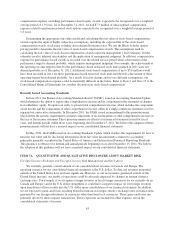

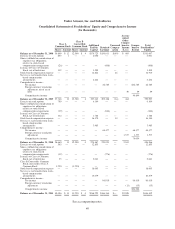

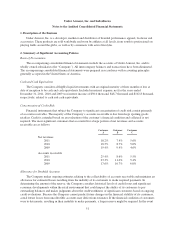

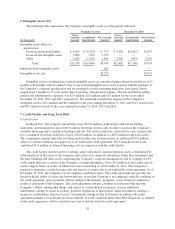

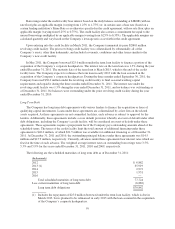

Under Armour, Inc. and Subsidiaries

Consolidated Statements of Stockholders’ Equity and Comprehensive Income

(In thousands)

Class A

Common Stock

Class B

Convertible

Common Stock Additional

Paid-In

Capital

Retained

Earnings

Unearned

Compen-

sation

Accum-

ulated

Other

Compre-

hensive

Income

(Loss)

Compre-

hensive

Income

Total

Stockholders’

EquityShares Amount Shares Amount

Balance as of December 31, 2008 36,809 $ 12 12,500 $ 4 $174,725 $156,011 $ (60) $ 405 $331,097

Exercise of stock options 853 1 — — 4,000 — — — 4,001

Shares withheld in consideration of

employee tax obligations

relative to stock-based

compensation arrangements (26) — — — — (608) — — (608)

Issuance of Class A Common

Stock, net of forfeitures 112 — — — 1,509 — — — 1,509

Stock-based compensation expense — — — — 12,864 — 46 — 12,910

Net excess tax benefits from stock-

based compensation

arrangements — — — — 4,244 — — — 4,244

Comprehensive income :

Net income — — — — — 46,785 — — $46,785 46,785

Foreign currency translation

adjustment, net of tax of

$101 — — — — — — — 59 59 59

Comprehensive income 46,844

Balance as of December 31, 2009 37,748 13 12,500 4 197,342 202,188 (14) 464 399,997

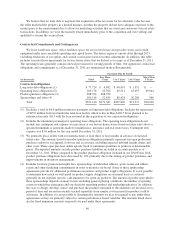

Exercise of stock options 799 — — — 6,104 — — — 6,104

Shares withheld in consideration of

employee tax obligations

relative to stock-based

compensation arrangements (19) — — — — (644) — — (644)

Issuance of Class A Common

Stock, net of forfeitures 132 — — — 1,788 — — — 1,788

Stock-based compensation expense — — — — 16,170 — 14 — 16,184

Net excess tax benefits from stock-

based compensation

arrangements — — — — 3,483 — — — 3,483

Comprehensive income :

Net income — — — — — 68,477 — — 68,477 68,477

Foreign currency translation

adjustment — — — — — — — 1,577 1,577 1,577

Comprehensive income 70,054

Balance as of December 31, 2010 38,660 13 12,500 4 224,887 270,021 — 2,041 496,966

Exercise of stock options 563 — — — 12,853 — — — 12,853

Shares withheld in consideration of

employee tax obligations

relative to stock-based

compensation arrangements (12) — — — — (776) — — (776)

Issuance of Class A Common

Stock, net of forfeitures 35 — — — 2,041 — — — 2,041

Class B Convertible Common

Stock converted to Class A

Common Stock 1,250 — (1,250) — — — — — —

Stock-based compensation expense — — — — 18,063 — — — 18,063

Net excess tax benefits from stock-

based compensation

arrangements — — — — 10,379 — — — 10,379

Comprehensive income :

Net income — — — — — 96,919 — — 96,919 96,919

Foreign currency translation

adjustment — — — — — — — (13) (13) (13)

Comprehensive income $96,906

Balance as of December 31, 2011 40,496 $ 13 11,250 $ 4 $268,223 $366,164 $— $2,028 $636,432

See accompanying notes.

49