Under Armour 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

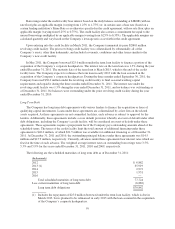

Restricted Stock and Restricted Stock Units

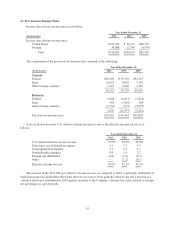

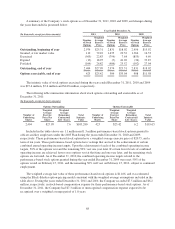

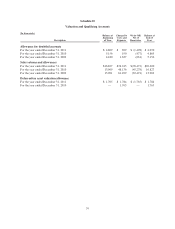

A summary of the Company’s restricted stock and restricted stock units as of December 31, 2011, 2010 and

2009, and changes during the years then ended is presented below:

Year Ended December 31,

(In thousands, except per share amounts) 2011 2010 2009

Number

of

Restricted

Shares

Weighted

Average

Value

Number

of

Restricted

Shares

Weighted

Average

Value

Number

of

Restricted

Shares

Weighted

Average

Value

Outstanding, beginning of year 412 $36.04 488 $37.40 639 $38.27

Granted 788 66.19 195 33.46 63 24.36

Forfeited (227) 59.52 (102) 39.68 (19) 44.96

Vested (150) 37.19 (169) 34.81 (195) 35.32

Outstanding, end of year 823 $58.23 412 $36.04 488 $37.40

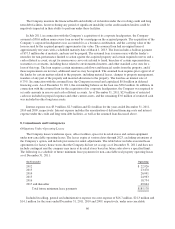

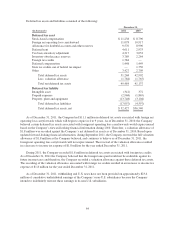

Included in the table above are 0.4 million performance-based restricted stock units awarded during 2011 to

certain executives and key employees under the 2005 Plan. These performance-based restricted stock units have a

weighted average fair value of $67.83 and have vesting that is tied to the achievement of a certain combined annual

operating income target for 2012 and 2013. Upon the achievement of the combined operating income target, 50% of

the restricted stock units will vest on February 15, 2014 and the remaining 50% will vest on February 15, 2015. If

certain lower levels of combined operating income for 2012 and 2013 are achieved, fewer or no restricted stock

units will vest at that time and one year later, and the remaining restricted stock units will be forfeited. As of

December 31, 2011, the Company had not begun recording stock-based compensation expense for these

performance-based restricted stock units as the Company determined the achievement of the combined operating

income targets was not probable. The Company will assess the probability of the achievement of the operating

income targets at the end of each reporting period. If it becomes probable that the performance targets related to

these performance-based restricted stock units will be achieved, a cumulative adjustment will be recorded as if

ratable stock-based compensation expense had been recorded since the grant date. Additional stock based

compensation of up to $5.6 million would have been recorded through December 31, 2011 for these performance-

based restricted stock units had the full achievement of these operating income targets been deemed probable.

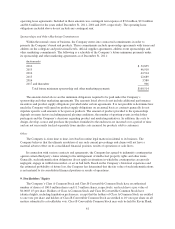

Warrants

In 2006, the Company issued fully vested and non-forfeitable warrants to purchase 480.0 thousand shares of

the Company’s Class A Common Stock to NFL Properties as partial consideration for footwear promotional

rights which were recorded as an intangible asset, refer to Note 6 for further information on this intangible asset.

With the assistance of an independent third party valuation firm, the Company assessed the fair value of the

warrants using various fair value models. Using these measures, the Company concluded that the fair value of the

warrants was $8.5 million. The warrants have a term of 12 years from the date of issuance and an exercise price

of $36.99 per share, which was the closing price of the Company’s Class A Common Stock on the date of

issuance. As of December 31, 2011, all outstanding warrants were exercisable, and no warrants were exercised.

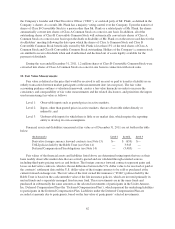

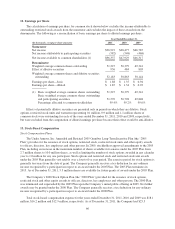

14. Other Employee Benefits

The Company offers a 401(k) Deferred Compensation Plan for the benefit of eligible employees. Employee

contributions are voluntary and subject to Internal Revenue Service limitations. The Company matches a portion

of the participant’s contribution and recorded expense of $1.8 million, $1.2 million and $1.3 million for the years

ended December 31, 2011, 2010 and 2009, respectively. Shares of the Company’s Class A Common Stock are

not an investment option in this plan.

In addition, the Company offers the Under Armour, Inc. Deferred Compensation Plan which allows a select

group of management or highly compensated employees, as approved by the Compensation Committee, to make

69