Under Armour 2011 Annual Report Download - page 38

Download and view the complete annual report

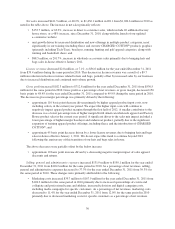

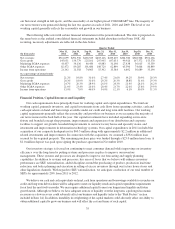

Please find page 38 of the 2011 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.oil. In general, as a percentage of net revenues, we expect cost of goods sold associated with our apparel and

accessories to be lower than that of our footwear. No cost of goods sold is associated with license revenues.

We include outbound freight costs associated with shipping goods to customers as cost of goods sold;

however, we include the majority of outbound handling costs as a component of selling, general and

administrative expenses. As a result, our gross profit may not be comparable to that of other companies that

include outbound handling costs in their cost of goods sold. Outbound handling costs include costs associated

with preparing goods to ship to customers and certain costs to operate our distribution facilities. These costs were

$26.1 million, $14.7 million and $12.2 million for the years ended December 31, 2011, 2010 and 2009,

respectively.

Our selling, general and administrative expenses consist of costs related to marketing, selling, product

innovation and supply chain and corporate services. Personnel costs are included in these categories based on the

employees’ function. Personnel costs include salaries, benefits, incentives and stock-based compensation related

to the employee. Our marketing costs are an important driver of our growth. Marketing costs consist primarily of

commercials, print ads, league, team, player and event sponsorships, amortization of footwear promotional rights

and depreciation expense specific to our in-store fixture program. In addition, marketing costs include costs

associated with our Special Make-Up Shop (“SMU Shop”) located at one of our distribution facilities where we

manufacture a limited number of products primarily for our league, team, player and event sponsorships. Selling

costs consist primarily of costs relating to sales through our wholesale channel, commissions paid to third parties

and the majority of our direct to consumer sales channel costs, including the cost of factory house and specialty

store leases. Product innovation and supply chain costs include our apparel, footwear and accessories product

innovation, sourcing and development costs, distribution facility operating costs, and costs relating to our Hong

Kong and Guangzhou, China offices which help support product development, manufacturing, quality assurance

and sourcing efforts. Corporate services primarily consist of corporate facility operating costs and company-wide

administrative expenses.

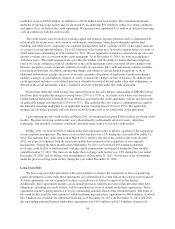

Other expense, net consists of unrealized and realized gains and losses on our derivative financial

instruments and unrealized and realized gains and losses on adjustments that arise from fluctuations in foreign

currency exchange rates relating to transactions generated by our international subsidiaries.

28