Under Armour 2011 Annual Report Download - page 49

Download and view the complete annual report

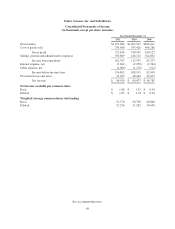

Please find page 49 of the 2011 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Currently, advances under these agreements bear interest rates which are fixed at the time of each advance. The

weighted average interest rates on outstanding borrowings were 3.5%, 5.3% and 5.9% for the years ended

December 31, 2011, 2010 and 2009, respectively.

We monitor the financial health and stability of our lenders under our credit and long term debt facilities,

however during any period of instability in the credit markets lenders could be negatively impacted in their

ability to perform under these facilities.

In July 2011, in connection with the acquisition of our corporate headquarters, we assumed a $38.6 million

nonrecourse loan secured by a mortgage on the acquired property. The acquisition of our corporate headquarters

was accounted for as a business combination, and the carrying value of the loan secured by the acquired property

approximates fair value. The assumed loan had an original term of approximately ten years with a scheduled

maturity date of March 1, 2013. The loan includes a balloon payment of $37.3 million due at maturity, and may

not be prepaid. The assumed loan is a nonrecourse loan with the lender’s remedies for non-performance limited

to action against the acquired property and certain required reserves and a cash collateral account, except for

nonrecourse carveouts related to fraud, breaches of certain representations, warranties or covenants, including

those related to environmental matters, and other standard carveouts for a loan of this type. The loan requires

certain minimum cash flows and financial results from the property, and if those requirements are not met,

additional reserves may be required. The assumed loan requires prior approval of the lender for certain matters

related to the property, including material leases, changes to property management, transfers of any part of the

property and material alterations to the property. The loan has an interest rate of 6.73%. In connection with the

assumed loan, we incurred and capitalized $0.8 million in deferred financing costs. As of December 31, 2011, the

outstanding balance on the loan was $38.2 million. In addition, in connection with the assumed loan for the

acquisition of our corporate headquarters, we were required to set aside amounts in reserve and cash collateral

accounts. As of December 31, 2011, $2.0 million of restricted cash was included in prepaid expenses and other

current assets, and the remaining $3.0 million of restricted cash was included in other long term assets.

Acquisitions

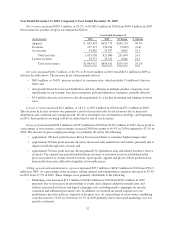

In July 2011, we acquired approximately 400.0 thousand square feet of office space comprising part of our

corporate headquarters for $60.5 million. The acquisition included land, buildings, tenant improvements and

third party lease-related intangible assets. As of the purchase date, 163.6 thousand square feet of the

400.0 thousand square feet of office space acquired was leased to third party tenants. These leases had remaining

lease terms ranging from 9 months to 15 years as of the purchase date. We intend to occupy additional space as it

becomes available. Since the acquisition, we have invested $2.2 million in additional improvements.

The acquisition included the assumption of a $38.6 million loan secured by the property and the remaining

purchase price was paid in cash funded primarily by a $25.0 million term loan borrowed in May 2011. The

carrying value of the assumed loan approximated its fair value on the date of the acquisition. Refer above and to

Note 7 to the Consolidated Financial Statements for a discussion of the assumed loan and term loan. A $1.0

million deposit was paid upon signing the purchase agreement in November 2010.

The aggregate fair value of the acquisition was $63.8 million. The fair value was estimated using a

combination of market, income and cost approaches. The acquisition was accounted for as a business

combination, and as such we recognized a bargain purchase gain of $3.3 million as the amount by which the fair

value of the net assets acquired exceeded the fair value of the purchase price.

In connection with this acquisition, we incurred acquisition related expenses of approximately $1.9 million.

Both the acquisition related expenses and pre-tax bargain purchase gain were included in selling, general and

administrative expenses on the consolidated statements of income during the year ended December 31, 2011.

This transaction is not expected to have a material impact to our consolidated statements of income in future

periods.

39