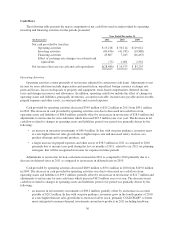

Under Armour 2011 Annual Report Download - page 47

Download and view the complete annual report

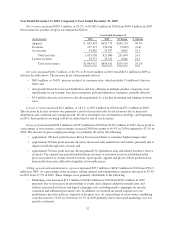

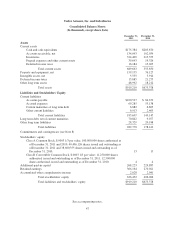

Please find page 47 of the 2011 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.bags and CHARGED COTTON®, and continued increases in our made-for strategy across our factory

house store base. In 2009, operational initiatives were put in place to improve our inventory

management which assisted in the decrease of inventory for that period; and

• an increase in accounts receivable during 2010 primarily due to a 36.9% increase in net sales during the

fourth quarter of 2010; partially offset by

• higher income taxes payable in 2010 as compared to 2009.

Adjustments to net income for non-cash items increased in 2010 as compared to 2009 primarily due to

unrealized foreign currency exchange rate losses in 2010 as compared to unrealized foreign currency exchange

rate gains in 2009.

Investing Activities

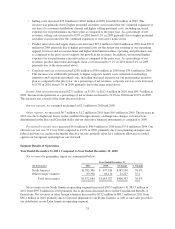

Cash used in investing activities increased $47.6 million to $89.4 million in 2011 from $41.8 million in

2010. This increase in cash used in investing activities was primarily due to the acquisition of our corporate

headquarters and increased investments in our direct to consumer sales channel, in-store fixture program and

corporate and distribution facilities. In addition, in connection with the assumed loan for the acquisition of our

corporate headquarters, we were required to set aside $5.0 million in restricted cash. Refer to Note 7 of the

consolidated financial statements for a discussion of restricted cash.

Cash used in investing activities increased $21.9 million to $41.8 million in 2010 from $19.9 million in

2009. This increase in cash used in investing activities was primarily due to increased investments in new factory

house stores and corporate and distribution facilities, partially offset by lower investments in our in-store fixture

program and branded concept shops. In addition, cash used in investing activities increased due to a deposit made

in late December 2010 for a minority investment completed in early 2011 in Dome Corporation, our Japanese

licensee.

Total capital expenditures were $115.4 million, $33.1 million and $24.6 million in 2011, 2010 and 2009,

respectively, which includes the acquisition of our corporate headquarters and other related expenditures in 2011.

Total capital expenditures in 2011, 2010 and 2009 included non-cash transactions of $36.0 million, $2.9 million

and $4.8 million, respectively. Because we receive certain capital expenditures prior to transmitting payment for

these capital investments, total capital expenditures exceed capital investments included in our consolidated

statements of cash flows. Capital expenditures for 2012 are expected to be in the range of $60 million to $65

million.

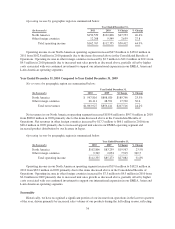

Financing Activities

Cash provided by financing activities increased $38.6 million to $45.8 million in 2011 from $7.2 million in

2010. This increase was primarily due to the term loan borrowed under the credit facility to partially fund the

purchase of our corporate headquarters, as well as excess tax benefits and proceeds from stock-based

compensation arrangements.

Cash provided by financing activities increased $23.7 million to $7.2 million in 2010 from cash used in

financing activities of $16.5 million in 2009. This increase was primarily due to the final payment made on our

prior revolving credit facility that was terminated during 2009.

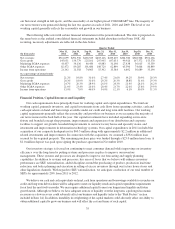

Credit Facility

In March 2011, we entered into a new $325.0 million credit facility with certain lending institutions and

terminated our prior $200.0 million revolving credit facility in order to increase our available financing and to

expand our lending syndicate. The credit facility has a term of four years and provides for a committed revolving

37