Under Armour 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

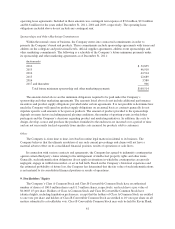

Fair Value of Financial Instruments

The carrying amounts shown for the Company’s cash and cash equivalents, accounts receivable and

accounts payable approximate fair value because of the short term maturity of those instruments. The fair value

of the long term debt approximates its carrying value based on the variable nature of interest rates and current

market rates available to the Company. The fair value of foreign currency forward contracts is based on the net

difference between the U.S. dollars to be received or paid at the contracts’ settlement date and the U.S. dollar

value of the foreign currency to be sold or purchased at the current forward exchange rate.

Recently Issued Accounting Standards

In June 2011, the Financial Accounting Standards Board (“FASB”) issued an Accounting Standards Update

which eliminates the option to report other comprehensive income and its components in the statement of

changes in stockholders’ equity. It requires an entity to present total comprehensive income, which includes the

components of net income and the components of other comprehensive income, either in a single continuous

statement or in two separate but consecutive statements. In December 2011, the FASB issued an amendment to

this pronouncement which defers the specific requirement to present components of reclassifications of other

comprehensive income on the face of the income statement. These pronouncements are effective for financial

statements issued for fiscal years, and interim periods within those years, beginning after December 15, 2011.

The Company believes the adoption of these pronouncements will not have a material impact on its consolidated

financial statements.

In May 2011, the FASB issued an Accounting Standards Update which clarifies requirements for how to

measure fair value and for disclosing information about fair value measurements common to accounting

principles generally accepted in the United States of America and International Financial Reporting Standards.

This guidance is effective for interim and annual periods beginning on or after December 15, 2011. The

Company believes the adoption of this guidance will not have a material impact on its consolidated financial

statements.

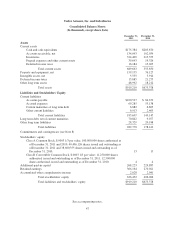

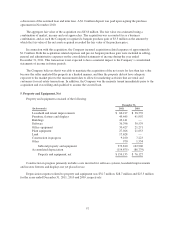

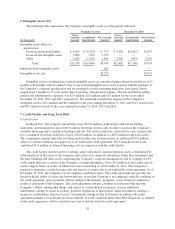

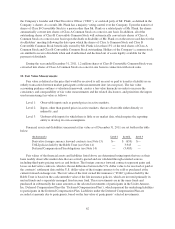

3. Inventories

Inventories consisted of the following:

December 31,

(In thousands) 2011 2010

Finished goods $323,606 $214,524

Raw materials 803 831

Total inventories $324,409 $215,355

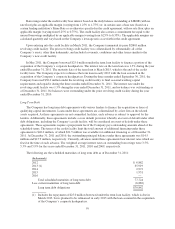

4. Acquisitions

In July 2011, the Company acquired approximately 400.0 thousand square feet of office space comprising

its corporate headquarters for $60.5 million. The acquisition included land, buildings, tenant improvements and

third party lease-related intangible assets. As of the purchase date, 163.6 thousand square feet of the

400.0 thousand square feet acquired was leased to third party tenants. These leases had remaining lease terms

ranging from 9 months to 15 years on the purchase date. The Company intends to occupy additional space as it

becomes available. Since the acquisition, the Company has invested $2.2 million in additional improvements.

The acquisition included the assumption of a $38.6 million loan secured by the property and the remaining

purchase price was paid in cash funded primarily by a $25.0 million term loan borrowed in May 2011. The

carrying value of the assumed loan approximated its fair value on the date of the acquisition. Refer to Note 7 for

56