Under Armour 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

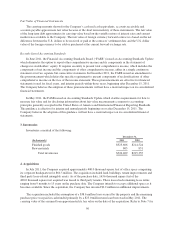

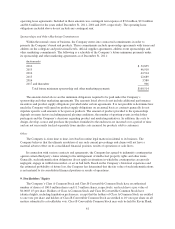

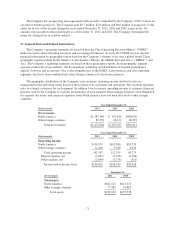

11. Provision for Income Taxes

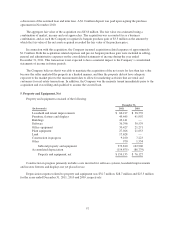

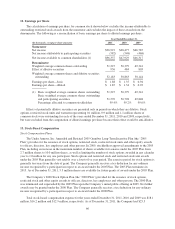

Income (loss) before income taxes is as follows:

Year Ended December 31,

(In thousands) 2011 2010 2009

Income (loss) before income taxes:

United States $122,774 $ 96,179 $86,752

Foreign 34,088 12,740 (4,334)

Total $156,862 $108,919 $82,418

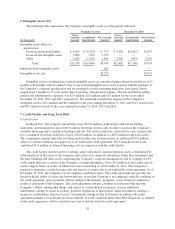

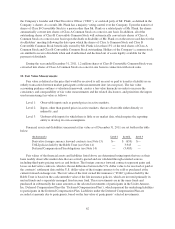

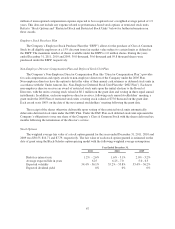

The components of the provision for income taxes consisted of the following:

Year Ended December 31,

(In thousands) 2011 2010 2009

Current

Federal $38,209 $ 39,139 $32,215

State 10,823 8,020 7,285

Other foreign countries 7,291 3,620 1,345

56,323 50,779 40,845

Deferred

Federal 5,604 (6,617) (2,421)

State 548 (3,487) 244

Other foreign countries (2,532) (233) (3,035)

3,620 (10,337) (5,212)

Provision for income taxes $59,943 $ 40,442 $35,633

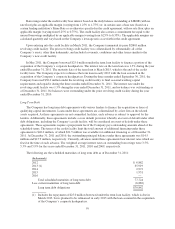

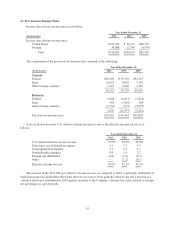

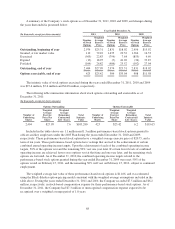

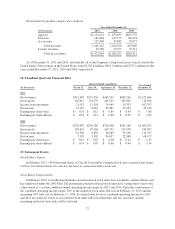

A reconciliation from the U.S. statutory federal income tax rate to the effective income tax rate is as

follows:

Year Ended December 31,

2011 2010 2009

U.S. federal statutory income tax rate 35.0% 35.0% 35.0%

State taxes, net of federal tax impact 4.1 1.2 5.7

Unrecognized tax benefits 3.1 2.3 1.1

Nondeductible expenses 0.8 1.4 2.2

Foreign rate differential (4.8) (1.6) (0.7)

Other — (1.2) (0.1)

Effective income tax rate 38.2% 37.1% 43.2%

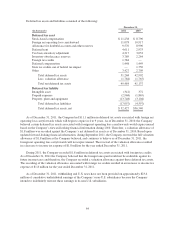

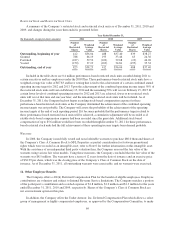

The increase in the 2011 full year effective income tax rate, as compared to 2010, is primarily attributable to

federal and state tax credits that reduced the effective tax rate in 2010, partially offset by the 2011 reversal of a

valuation allowance established in 2010 against a portion of the Company’s deferred tax assets related to foreign

net operating loss carryforwards.

63