U-Haul 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

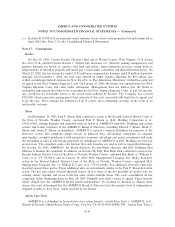

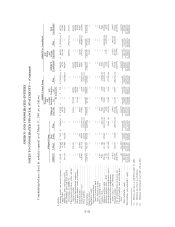

On May 20, 2003, RepWest consented to an Order for Supervision issued by the Arizona Department of

Insurance (""DOI''). The DOI determined that RepWest's level of risk based capital (""RBC'') allowed for

regulatory control. Pursuant to this order and Arizona law, during the period of supervision, RepWest may not

engage in certain activities without the prior approval of the DOI.

If RepWest fails to satisfy the requirements to abate the DOI's concerns, the DOI may take further

action, including, but not limited to, commencing a conservatorship.

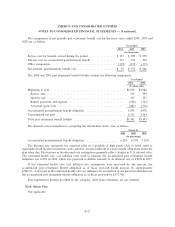

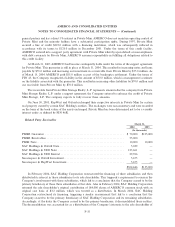

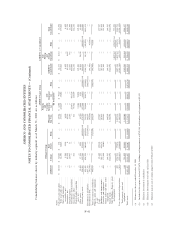

Audited statutory net income (loss) for Oxford for the years ended December 31, 2003, 2002 and 2001

was $3.3 million, $(11.6 million) and $(1.3 million), respectively; audited statutory capital and surplus was

$64.0 million and $39.1 million at December 31, 2003 and 2002, respectively. Audited statutory net income for

CFLIC for the years ended December 31, 2003, 2002 and 2001 was $4.1 million, $3.2 million and

$3.6 million, respectively; audited statutory capital and surplus was $22.5 million and $17.2 million at

December 31, 2003 and 2002, respectively. Audited statutory net income (loss) for NAI for the years ended

December 31, 2003, 2002 and 2001 was $3.1 million, $3.1 million and $(0.7) million, respectively; audited

statutory capital and surplus was $12.5 million and $9.5 million at December 31, 2003 and 2002, respectively.

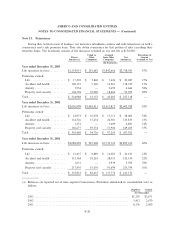

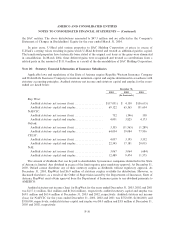

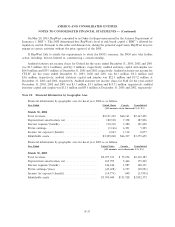

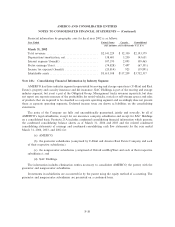

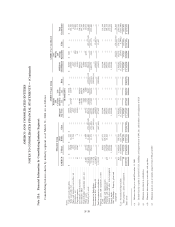

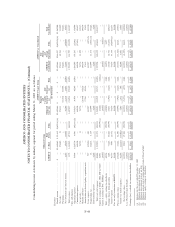

Note 21: Financial Information by Geographic Area

Financial information by geographic area for Ñscal year 2004 is as follows:

Year Ended United States Canada Consolidated

(All amounts are in thousands U.S. $'s)

March 31, 2004

Total revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $2,101,332 $66,163 $2,167,495

Depreciation/amortization, net ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 180,538 7,358 187,896

Interest expense/(beneÑt) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 118,310 3,380 121,690

Pretax earnings ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (1,166) 6,391 5,225

Income tax expense/(beneÑt) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,963 1,114 8,077

IdentiÑable assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $3,309,268 $66,337 $3,375,605

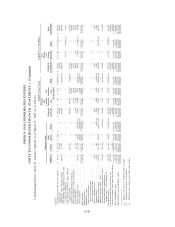

Financial information by geographic area for Ñscal year 2003 is as follows:

Year Ended United States Canada Consolidated

(All amounts are in thousands U.S. $'s)

March 31, 2003

Total revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $2,077,333 $ 55,054 $2,132,387

Depreciation/amortization, net ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 169,799 5,466 175,265

Interest expense/(beneÑt) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 146,144 1,987 148,131

Pretax earnings/(loss)ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (45,628) 6,707 (38,921)

Income tax expense/(beneÑt) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (14,775) 840 (13,935)

IdentiÑable assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $3,700,444 $131,928 $3,832,372

F-37