U-Haul 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Liquidity and Capital Resources

Our successful Ñnancial restructuring has provided us with a strengthened balance sheet and we believe a

capital structure that will allow us to achieve our operational plans and goals and provide us with suÇcient

liquidity. The majority of the obligations we incurred in connection with our Ñnancial restructuring mature at

the end of Ñscal 2009. The senior subordinated notes mature at the end of Ñscal 2011. As a result, we believe

that our liquidity is strong, which will allow us the ability to focus on our operations and business to improve

our liquidity in the long term. We further believe that as we are successful in improving our operations and

further strengthening our liquidity, we will improve our access to the capital markets. However, there is no

assurance that future cash Öows will be suÇcient to meet our outstanding obligations or our future capital

needs. The terms of our secured indebtedness place Ñnancial and operational covenants on AMERCO and its

subsidiaries, and restrict our ability to incur additional indebtedness and other obligations.

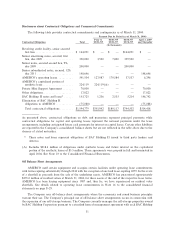

As a result of the deconsolidation of SAC Holding during the fourth quarter of 2004, AMERCO's assets

and liabilities were reduced approximately $472 million and $629 million, respectively, and equity increased

approximately $157 million. This deconsolidation was the result of AMERCO no longer being the primary

beneÑciary of a majority of its variable interests in SAC Holdings.

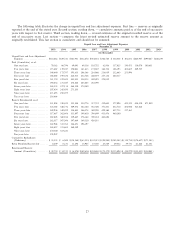

At March 31, 2004, cash and cash equivalents totaled $81.6 million, up from $66.8 million at March 31,

2003. In addition, AMERCO had availability under its revolving credit facility of $35.9 million.

At March 31, 2004 notes and loans payable, as reported, was $1.0 billion, and represented 1.9 times

stockholders' equity. At March 31, 2003, notes and loans payable, as reported, was $1.4 billion and represented

4.3 times stockholders' equity.

On April 30, 2004, AMERCO completed its transaction with UH Storage DE, a W.P. Carey aÇliate,

eÅectively terminating its amended and restated leases (the synthetic leases) with the Bank of Montreal and

Citibank. This transaction will result in AMERCO eliminating its capital lease obligation of approximately

$99.5 million during the Ñrst quarter of Ñscal 2005. (See footnote 23 to Consolidated Financial Statements for

a more complete discussion of this transaction and its eÅect on the Company's Ñnancial statements.)

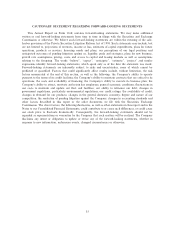

For Ñscal year 2004, cash (used) provided by operating activities was $(40.3) million, compared to

$74.5 million in Ñscal year 2003, and $(19.6) million in Ñscal year 2002.

We provided $55.2 million in net cash from investing activities during Ñscal year 2004, compared to a use

of $36.1 million in Ñscal year 2003 and a use of $148.1 million in Ñscal year 2002. Gross capital expenditures

were $198.4 million, $243.2 million and $381.5 million in 2004, 2003 and 2002, respectively. Capital

dispositions were $63.2 million, $96.9 million and $229.4 million in 2004, 2003 and 2002, respectively. Net

capital expenditures were $135.2 million, $146.3 million and $152.1 million in 2004, 2003 and 2002,

respectively.

Financing activities used $(0.1) million during Ñscal year 2004. This compares with usage of

$(13.0) million during Ñscal year 2003. We provided $159.5 million from Ñnancing activities during Ñscal year

2002.

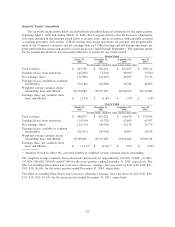

Liquidity and Capital Resources and Requirements of Our Operating Segments

Moving and Self-Storage

To meet the needs of its customers, U-Haul maintains a large Öeet of rental equipment. Historically,

capital expenditures have primarily reÖected new rental equipment acquisitions. The capital required to fund

these expenditures has historically been obtained through internally generated funds from operations, lease

Ñnancing and sales of used equipment. Going forward, we anticipate that a substantial portion of our internally

generated funds will be used to enhance liquidity by paying down existing indebtedness. During each of the

Ñscal years ended March 31, 2005, 2006 and 2007, U-Haul estimates that net capital expenditures will average

approximately $150 million to maintain its Öeet at current levels. Financial covenants contained in our loan

agreements limit the amount of capital expenditures we can make in 2005, 2006 and 2007, net of dispositions,

to $185 million, $245 million and $195 million, respectively. Management estimates that U-Haul will fund its

28