U-Haul 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In April 2003, the FASB issued SFAS No. 149 Amendment of Statement 133 on Derivative Instruments

and Hedging Activities. This Statement (SFAS 149) amends and clariÑes the accounting for derivative

instruments, including certain derivative instruments embedded in other contracts and for hedging activities

under SFAS 133. In particular, SFAS 149 (1) clariÑes under what circumstances a contract with an initial net

investment meets the characteristic of a derivative as discussed in SFAS 133, (2) clariÑes when a derivative

contains a Ñnancing component, (3) amends the deÑnition of an underlying derivative to conform it to the

language used in FIN 45, and (4) amends certain other existing pronouncements. SFAS 149 is generally

eÅective for contracts entered into or modiÑed after June 30, 2003. The Company has adopted SFAS 149 and

it had no material impact on the Company's Ñnancial position, results of operations or cash Öows.

In May 2003, the FASB issued SFAS No. 150 (SFAS 150), Accounting for Certain Financial

Instruments with Characteristics of both Liabilities and Equity. This Statement establishes standards for

classifying and measuring as liabilities certain Ñnancial instruments that embody obligations of the issuer and

have characteristics of both liabilities and equity. SFAS 150 is eÅective at the beginning of the Ñrst interim

period beginning after June 15, 2003; including all Ñnancial instruments created or modiÑed after May 31,

2003. The Company has adopted SFAS 150 and it had no material impact on the Company's Ñnancial

position, results of operations or cash Öows.

In December 2003, FASB issued SFAS No. 132 (Revised 2003), Employers' Disclosure about Pensions

and Other Post-retirement BeneÑts and amendment of FASB Statements No. 87, 88 and 106. This Statement

revises employers' disclosures about pension plans and other post-retirement beneÑt plans. The disclosures

required by this Statement are eÅective for Ñscal years ending after December 15, 2003. The Company has

incorporated these expanded disclosures into our footnotes of the Ñnancial statements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

We are exposed to Ñnancial market risks, including changes in interest rates and currency exchange rates.

To mitigate these risks, we may utilize derivative Ñnancial instruments, among other strategies. We do not use

derivative Ñnancial instruments for speculative purposes.

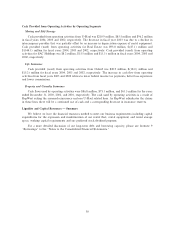

Interest Rate Risk

The exposure to market risk for changes in interest rates relates primarily to our variable rate debt

obligations. We have used interest rate swap agreements to provide for matching the gain or loss recognition

on the hedging instrument with the recognition of the changes in the cash Öows associated with the hedges

asset or liability attributable to the hedged risk or the earnings eÅect of the hedged forecasted transaction. At

March 31, 2004 and at March 31, 2003, the Company had no interest rate swap contracts. On May 13, 2004

the Company entered into separate interest rate cap contracts for $200 million of its variable rate debt

obligations for a two year term and for $50 million of its variable rate debt obligations for a three year term. At

March 31, 2004, the Company had approximately $515 million of variable rate debt obligations. A Öuctuation

in the interest rates of 100 basis points would change interest expense for the Company by approximately

$5.2 million annually.

Foreign Currency Exchange Rate Risk

The exposure to market risk for changes in foreign currency exchange rates relates primarily to our

Canadian business. Approximately 2% of our revenue is generated in Canada. The result of a 10% change in

the value of the U.S. dollar relative to the Canadian dollar would not be material. We typically do not hedge

any foreign currency risk since the exposure is not considered material.

38