U-Haul 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$3.8 million from 2001 due to the termination of major medical programs. Annuity and life beneÑts decreased

$3.6 million from 2002 and $1.3 million from 2001 due to decreases in life insurance exposure.

Amortization of deferred policy acquisition costs (DAC) and the value of business acquired

(VOBA) was $25.0 million, $20.5 million, and $18.6 million for 2003, 2002, and 2001, respectively. These

costs are amortized for life and health policies as the premium is earned over the term of the policy; and for

deferred annuities, amortized in relation to interest spreads. Amortization associated with annuity policies

increased $6.4 million from 2002 and $7.5 million from 2001 primarily due to increased surrender activity.

Other segments decreased $1.9 million from 2002 to 2003, and $1.1 million from 2001 to 2003 due to

decreased new business volume.

Operating expenses were $27.1 million, $40.5 million, and $37.5 million for the years ended Decem-

ber 31, 2003, 2002, and 2001, respectively. Commissions have decreased $4.1 million from 2002 and

$3.1 million from 2001 primarily due to decreases in new business. Fee income from surrendered annuity

policies is netted into this category. Surrender charge income increased $5.0 million from 2002 and

$5.2 million from 2001. General and administrative expenses net of fees collected decreased $4.3 million from

2002 to 2003 and $2.1 million from 2001 to 2003.

Earnings/(losses) from operations were $11.3 million, $(1.4) million, and $5.6 million for the years

ending December 31, 2003, 2002 and 2001, respectively. The increase from 2002 and 2001 is due primarily to

fewer other than temporary declines in the investment portfolio and improved loss ratios in the Medicare

supplement segment.

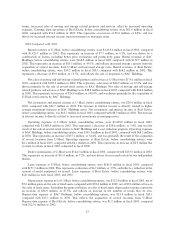

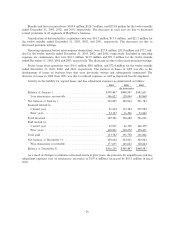

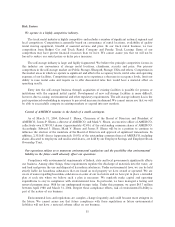

Republic Western Insurance Company

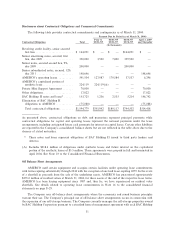

The following table sets forth certain revenue and statements of operations data for the periods indicated:

December 31,

2003 2002 2001

PremiumsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 93,242 $152,618 $261,975

Net investment income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 21,699 22,318 20,651

Total revenueÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 114,941 174,936 282,626

BeneÑts and losses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 109,362 128,680 255,756

Amortization of deferred policy acquisition costs ÏÏÏÏÏÏÏÏÏÏÏ 14,126 17,281 22,091

Operating expenses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 27,403 36,958 77,210

Total expenses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 150,891 182,919 355,057

Loss from operations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (35,950) (7,983) (72,431)

Income tax beneÑt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 12,508 2,612 23,736

Net income (loss) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(23,442) $ (5,371) $(48,695)

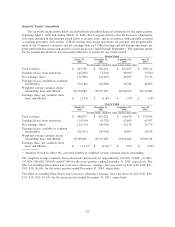

Premium revenues, before intercompany eliminations, were $93.2 million, $152.6 million, and

$262.0 million for the years ended December 31, 2003, 2002, and 2001, respectively. Cancelled agency

premiums were $65.6 million, $86.8 million, and $146.5 million for the years ended December 31, 2003, 2002,

and 2001, respectively. The decreases from 2002 and 2001 are the result of the Company's shift in its

operating focus away from non aÇliated and unproÑtable lines of business. Assumed treaty reinsurance

premiums were $1.7 million, $31.0 million, and $69.1 million for the year ended December 31, 2003, 2002 and

2001, respectively. The decreases in both years are due to the cancellation and non renewal of all assumed

treaty business. Rental industry revenues were $25.9 million, $34.8 million, and $46.3 million for the years

ended December 31, 2003, 2002, and 2001, respectively. These decreases are due to the change in structure of

the U-Haul business to deductible/self-insured arrangements.

Net investment income was $21.7 million, $22.3 million, and $20.7 million for the twelve months ended

December 31, 2003 2002 and 2001 respectively.

25