U-Haul 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

‚ The obligors ability to guarantee the obligations of the insurance subsidiaries or any third party is

restricted.

‚ The obligors ability to prepay, redeem, defease, purchase or otherwise acquire any of their indebtedness

or any indebtedness of a subsidiary that is a borrower under the abovementioned loan agreements is

restricted.

As of March 31, 2004 the Company was in compliance with these covenants.

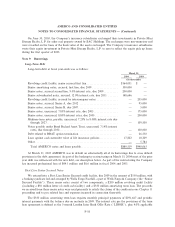

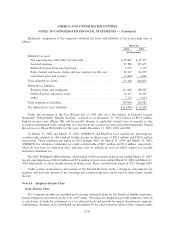

Restructuring of Synthetic Lease Agreements

At the time of our emergence from bankruptcy, Amerco Real Estate Company restructured approxi-

mately $249.5 million of our obligations under synthetic lease arrangements (the ""Synthetic Leases''). As part

of this restructuring, we paid down approximately $31 million of obligations under the Synthetic Leases and

entered into new lease agreements with the lessors. The new lease agreements are for a term of three years,

and include four one year renewal options.

The purpose of these leases was to Ñnance the purchase of self-storage properties and to construct self-

storage facilities on existing properties. At March 31, 2004 AMERCO guaranteed each of these restructured

Synthetic Leases. Title to the real property subject to these leases is in the name of oÅ-balance sheet non-

aÇliated special purpose entities.

These entities are lessors who then lease the properties to one or more subsidiaries of AMERCO.

Our approved Chapter 11 plan of reorganization contemplates that our obligations under the Synthetic

Leases will be satisÑed when the real property subject to the leases is sold to a third party. We entered into

such a transaction which closed in escrow on March 31, 2004, and funded on April 30, 2004. As a result of

closing this transaction, we expect that over approximately the next 24 months we will be reimbursed for

capital improvements we made to these properties. In addition, as part of this transaction, U-Haul has entered

into arrangements to manage these properties that will allow us to continue to operate them as part of the

U-Haul moving and self-storage system. See Note 23 for details of this transaction.

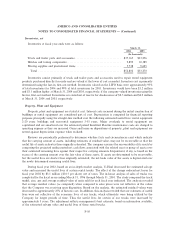

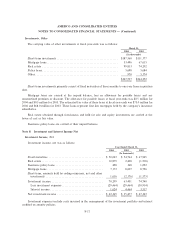

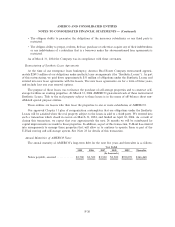

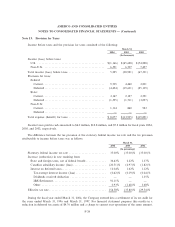

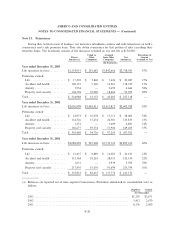

Annual Maturities of AMERCO Notes

The annual maturity of AMERCO's long-term debt for the next Ñve years and thereafter is as follows:

Year Ended

2005 2006 2007 2008 2009 Thereafter

(In thousands)

Notes payable, secured ÏÏÏÏÏÏÏÏÏÏÏÏ $3,500 $3,500 $3,500 $3,500 $700,051 $166,468

F-20