U-Haul 2004 Annual Report Download - page 53

Download and view the complete annual report

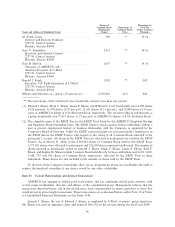

Please find page 53 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAC Holdings was established in order to acquire self-storage properties which are being managed by the

Company pursuant to management agreements. The sale of self-storage properties by the Company to SAC

Holdings has in the past provided signiÑcant cash Öows to the Company and the Company's outstanding loans

to SAC Holdings entitle the Company to participate in SAC Holdings' excess cash Öows (after senior debt

service). However, in connection with SAC Holdings' issuance of the New SAC Holdings Notes to

AMERCO's creditors in AMERCO's Chapter 11 proceeding, certain SAC Holdings notes payable to the

Company were satisÑed thereby extinguishing the ""cash Öow-based calculation.''

Management believes that its sales of self-storage properties to SAC Holdings over the past several years

provided a unique structure for the Company to earn rental revenues at the SAC Holdings self-storage

properties that the Company manages and participate in SAC Holdings' excess cash Öows as described above.

No real estate transactions with SAC Holdings that involve the Company or any of its subsidiaries are

expected in the foreseeable future.

During Ñscal 2004, AMERCO purchased $121,608 of reÑnishing supplies from Space Age Auto Paint

Store Inc. E.J. Shoen, a major stockholder, oÇcer and director of AMERCO, owns Space Age Auto Paint

Store Inc.

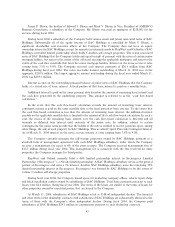

Item 14. Principal Accounting Fees and Services

The ultimate responsibility for good corporate governance rests with the Board, whose primary roles are

oversight, counseling and direction to the Company's management in the best long-term interests of the

Company and its stockholders. The Audit Committee has been established for the purpose of overseeing the

accounting and Ñnancial reporting processes of the company and audits of the Company's annual Ñnancial

statements.

The Company's Audit Committee is made up solely of independent directors, as deÑned in the applicable

Nasdaq and SEC rules, and it operates under a written charter adopted by the Board. The composition of the

Audit Committee, the attributes of its members and its responsibilities, as reÖected in its charter, are intended

to be in accordance with applicable requirements for corporate audit committees. The Audit Committee

reviews and assesses the adequacy of its charter on an annual basis.

The purpose of the Audit Committee is to assist the Board in its general oversight of the Company's

Ñnancial reporting, internal controls and audit functions. Management is responsible for the preparation,

presentation and integrity of the Company's Ñnancial statements; accounting and Ñnancial reporting principles;

internal controls; and procedures designed to reasonably assure compliance with accounting standards,

applicable laws and regulations. BDO Seidman, LLP, our independent auditing Ñrm, is responsible for

performing an independent audit of the consolidated Ñnancial statements in accordance with the standards of

the PCAOB Ì United States. The Audit Committee has ultimate authority and responsibility to select,

compensate, evaluate and, when appropriate, replace the Company's independent auditors. The Audit

Committee has the authority to engage its own outside advisors, including experts in particular areas of

accounting, as it determines appropriate, apart from counsel or advisors hired by management.

The Audit Committee members are not professional accountants or auditors, and their functions are not

intended to duplicate or to certify the activities of management and the independent auditors, nor can the

Audit Committee certify that the independent auditors are ""independent'' under applicable rules. The Audit

Committee serves a board-level oversight role, in which it provides advice, counsel and direction to

management and the auditors on the basis of the information it receives, discussions with management and the

auditors, and the experience of the Audit Committee's members in business, Ñnancial and accounting matters.

The Audit Committee includes at least one independent director who is determined by the Board to meet the

qualiÑcations of an ""audit committee Ñnancial expert'' in accordance with SEC rules. John P. Brogan is the

independent director who has been determined to be an audit committee Ñnancial expert. Stockholders should

understand that this designation is an SEC disclosure requirement related to Mr. Brogan's experience and

understanding with respect to certain accounting and auditing matters. The designation does not impose on

Mr. Brogan any duties, obligations or liability that are greater than are generally imposed on him as a member

48