U-Haul 2004 Annual Report Download - page 37

Download and view the complete annual report

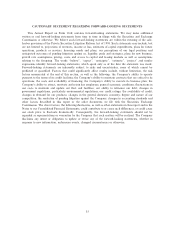

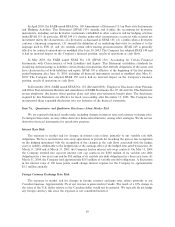

Please find page 37 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Corporation subsidiary, under which the Company receives a management fee equal to 6% of the gross

receipts.

Business Outlook

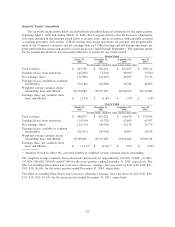

As we look ahead to Ñscal 2005, we believe the momentum in our Moving and Self-Storage segment will

continue, adjusted for the deconsolidation of SAC Holding Corporation. We reported approximately

$177.9 million of revenues, $55.2 million of earnings from operations, $67.9 million of interest expense, and a

net loss of $9.4 million in Ñscal 2004 that are related to variable interests in SAC Holdings that were

deconsolidated as of March 31, 2004.

U-Haul will continue to beneÑt from the initiatives mentioned earlier, including positive sales increases

and maintenance cost improvements associated with our Öeet replacement program.

Oxford is in the process of rebuilding its business that was impacted by the AMERCO restructuring.

Prior to the restructuring Oxford was rated B°° by A.M. Best. The rating was reduced to C° during the

restructuring, but has been recently upgraded to B- with a positive future outlook. Continued improvement in

the rating will be a key factor in the success of Oxford's marketing programs including annuities, life

insurance, Medicare supplement, and credit life and disability. Oxford's statutory capital measurements

continue to strengthen and its existing business is expected to continue to perform proÑtably.

RepWest expects to realize the beneÑts of our restructuring. During 2004 we successfully discontinued

the majority of the unproÑtable direct and assumed reinsurance lines and signiÑcantly strengthened our

reserves associated with those lines. U-Haul related lines have historically been proÑtable and we expect to see

the results of the new business plan during 2005. RepWest's statutory capital measurements will continue to

strengthen as the reserves of the discontinued lines run oÅ. We are working with the Arizona Department of

Insurance regarding the supervision order and expect it to be resolved in the future.

We expect no further costs associated with our Ñnancial restructuring during 2005.

32