U-Haul 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

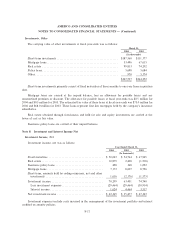

Environmental Costs

Liabilities are recorded when environmental assessments and remedial eÅorts, if applicable, are probable

and the costs can be reasonably estimated. The amount of the liability is based on management's best estimate

of undiscounted future costs. Certain recoverable environmental costs related to the removal of underground

storage tanks or related contamination are capitalized and amortized over the estimated useful lives of the

properties. These costs improve the safety or eÇciency of the property or are incurred in preparing the

property for sale.

Income Taxes

AMERCO Ñles a consolidated tax return with all of its legal subsidiaries, except for Christian Fidelity

Insurance Company, which Ñles on a stand alone basis. SAC Holdings and its legal subsidiaries Ñle a

consolidated return, and their return is not consolidated with AMERCO. In accordance with SFAS No. 109,

the provision for income taxes reÖects deferred income taxes resulting from changes in temporary diÅerences

between the tax basis of assets and liabilities and their reported amounts in the Ñnancial statements.

Comprehensive Income/(Loss)

Comprehensive income/(loss) consists of net income, foreign currency translation adjustment, unreal-

ized gains and losses on investments and fair market value of cash Öow hedges, net of the related tax eÅects.

Recent Accounting Pronouncements

In January 2003, the Financial Accounting Standards Board (FASB) issued Interpretation No. 46

(FIN 46), Consolidation of Variable Interest Entities, an interpretation of Accounting Research Bulletin

No. 51. FIN 46 requires that variable interest entities be consolidated by a company if that company absorbs a

majority of the entity's expected losses, receives a majority of its expected residual returns, or both, as a result

of holding a variable interest. In December 2003, the FASB issued FIN 46R, which reÖected certain

amendments to the standard. The provisions of FIN 46, as revised, are eÅective for the Ñrst interim or annual

period ending after March 15, 2004 when certain conditions are met by a variable interest entity. The

Company has adopted FIN 46R and the eÅects of the variable interest are further explained in the Notes to

the Ñnancial statements.

In April 2003, the FASB issued SFAS No. 149 Amendment of Statement 133 on Derivative Instruments

and Hedging Activities. This Statement (SFAS 149) amends and clariÑes the accounting for derivative

instruments, including certain derivative instruments embedded in other contracts and for hedging activities

under SFAS 133. In particular, SFAS 149 (1) clariÑes under what circumstances a contract with an initial net

investment meets the characteristic of a derivative as discussed in SFAS 133, (2) clariÑes when a derivative

contains a Ñnancing component, (3) amends the deÑnition of an underlying derivative to conform it to the

language used in FIN 45, and (4) amends certain other existing pronouncements. SFAS 149 is generally

eÅective for contracts entered into or modiÑed after June 30, 2003. The Company has adopted SFAS 149 and

it had no material impact on the Company's Ñnancial position, results of operations or cash Öows.

In May 2003, the FASB issued SFAS No. 150 (SFAS 150), Accounting for Certain Financial

Instruments with Characteristics of both Liabilities and Equity. This Statement establishes standards for

classifying and measuring as liabilities certain Ñnancial instruments that embody obligations of the issuer and

have characteristics of both liabilities and equity. SFAS 150 is eÅective at the beginning of the Ñrst interim

period beginning after June 15, 2003; including all Ñnancial instruments created or modiÑed after May 31,

2003. The Company has adopted SFAS 150 and it had no material impact on the Company's Ñnancial

position, results of operations or cash Öows.

F-12