U-Haul 2004 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

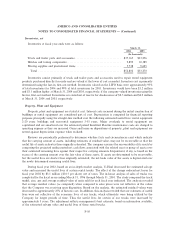

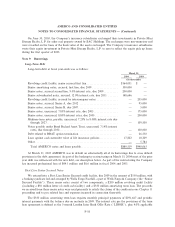

In December 2003, the FASB issued SFAS No. 132 (Revised 2003), Employers' Disclosures about

Pensions and Other Post-retirement BeneÑts and Amendment of FASB Statements No. 87, 88 and 106. This

Statement revises employers' disclosures about pension plans and other post-retirement beneÑt plans. The

disclosures required by this Statement are eÅective for Ñscal years ending after December 15, 2003. The

Company has incorporated these expanded disclosures into the notes to the Ñnancial statements.

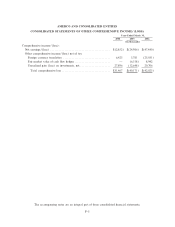

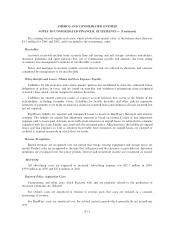

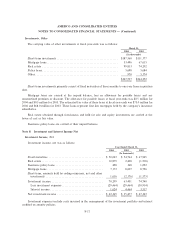

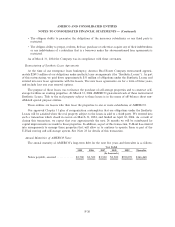

Note 4: Earnings Per Share

Net income for purposes of computing earnings per common share is net income minus preferred stock

dividends. Preferred stock dividends include accrued dividends of AMERCO.

The shares used in the computation of the company's basic and diluted earnings per common share were

as follows:

Years Ended March 31,

2004 2003 2002

Basic and diluted loss per common share ÏÏÏÏÏÏÏÏÏÏ $ (0.76) $ (1.82) $ (2.87)

Weighted average common share outstanding:

Basic and diluted ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 20,749,998 20,824,618 21,063,720

The weighted average common shares outstanding exclude post-1992 shares of the employee stock

ownership plan that have not been committed to be released as of March 31, 2004, 2003, and 2002.

6,100,000 shares of preferred stock have been excluded from the weighted average shares outstanding

calculation because they are not common stock equivalents.

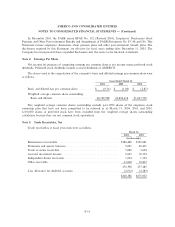

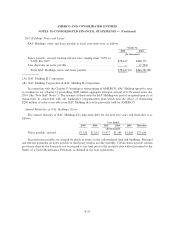

Note 5: Trade Receivables, Net

Trade receivables at Ñscal year-ends were as follows:

March 31,

2004 2003

(In thousands)

Reinsurance recoverable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $180,480 $150,681

Premiums and agents' balances ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,091 40,401

Trade accounts receivable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,080 3,694

Accrued investment income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,645 10,554

Independent dealer receivable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,054 1,152

Other receivable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 65,048 70,803

270,398 277,285

Less allowance for doubtful accounts ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (2,012) (2,283)

$268,386 $275,002

F-13