U-Haul 2004 Annual Report Download - page 34

Download and view the complete annual report

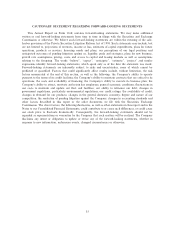

Please find page 34 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Öeet expansion requirements from leasing and from the proceeds from the sale of trucks. We intend to focus

our growth on expanding our independent dealer network, which does not require a substantial amount of

capital resources.

Real Estate has traditionally Ñnanced the acquisition of self-storage properties to support U-Haul's

growth through lease and debt Ñnancing. U-Hauls's growth plan in self-storage is focused on eMove, which

does not require acquisition or construction of self-storage properties by the company. Therefore, Real Estate

will not require substantial capital for its future plans and our loan covenants give us the necessary Öexibility to

implement this plan.

SAC Holdings operations are funded by various mortgage loans and unsecured notes. SAC Holdings does

not utilize revolving lines of credit to Ñnance its operations or acquisitions. Certain of SAC Holdings loan

agreements contain restrictive covenants and restrictions on incurring additional subsidiary indebtedness.

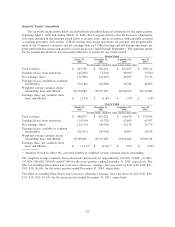

Life Insurance

As of December 31, 2003, Oxford had no notes and loans payable in less than one year and its accounts

payable and accrued expenses total approximately $5.5 million. Oxford's Ñnancial assets (cash, receivables,

inventories, short-term investments, other investments and Ñxed maturities) at December 31, 2003 were

approximately $846.6 million. State insurance regulations restrict the amount of dividends that can be paid to

stockholders of insurance companies. As a result, Oxford's funds are generally not available to satisfy the

claims of AMERCO or its legal subsidiaries.

The primary sources of cash for Oxford include premiums, receipts for interest sensitive products and

investment income. The primary uses of cash are operating costs and beneÑt payments to policy holders.

Matching the investment portfolio to the cash Öow demands of the types of insurance being written is an

important consideration. BeneÑt and claim statistics are continually monitored to provide projections of future

cash requirements.

In addition to cash Öows from operating and Ñnancing activities, a substantial amount of liquid funds are

available through Oxford's short-term portfolio. Short-term investments amounted to $122.9 million,

$81.4 million and $53.5 million at December 31, 2003, 2002 and 2001, respectively.

Property and Casualty Insurance

As of December 31, 2003, RepWest had no notes or loans due in less than one year and its accounts

payable, accrued expenses, and other payables were approximately $18.4 million. RepWest's Ñnancial assets

(cash, receivables, inventories, short-term investments and Ñxed maturities) at December 31, 2003 were

approximately $353.2 million.

State insurance regulations restrict the amount of dividends that can be paid to stockholders of insurance

companies. As a result, RepWest's funds are generally not available to satisfy the claims of AMERCO or its

legal subsidiaries. Conversely, AMERCO's loan agreements prohibit any further loans, capital contributions

or other advances to RepWest by AMERCO.

The primary sources of cash for RepWest include premiums and investment income. The primary uses of

cash are operating costs and beneÑt payments to policy holders. Matching the investment portfolio to the cash

Öow demands of the types of insurance written is an important consideration. BeneÑt and claim statistics are

continually monitored to provide projections of future cash requirements.

RepWest's cash and cash equivalents and short-term investment portfolio were $62.1 million, $35.1 mil-

lion, and $18.3 million at December 31, 2003, 2002, and 2001, respectively. This balance reÖects funds in

transition from maturity proceeds to long term investments. This level of liquid assets, combined with

budgeted cash Öow, is adequate to meet periodic needs. Capital and operating budgets allow Republic to

schedule cash needs in accordance with investment and underwriting proceeds.

29