U-Haul 2004 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2004 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

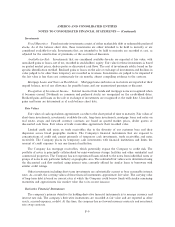

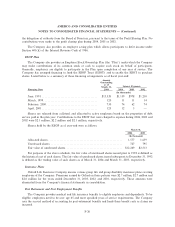

On June 30, 2003, the Company's insurance subsidiaries exchanged their investments in Private Mini

Storage Realty, L.P. for other real property owned by SAC Holdings. The exchanges were non-monetary and

were recorded on the basis of the book value of the assets exchanged. The Company's insurance subsidiaries

wrote their equity investment in Private Mini Storage Realty, L.P. to zero to reÖect the equity pick up losses

during the Ñrst quarter of 2003.

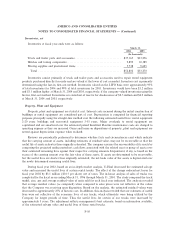

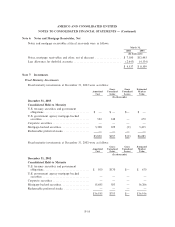

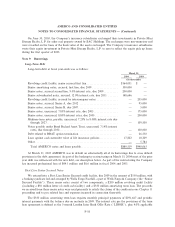

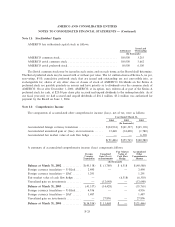

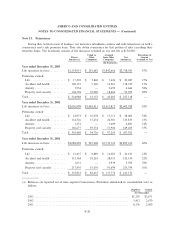

Note 9: Borrowings

Long-Term Debt

Long-term debt at Ñscal year-ends was as follows:

March 31,

2004 2003

(In thousands)

Revolving credit facility, senior secured Ñrst lien ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $164,051 $ Ì

Senior amortizing notes, secured, Ñrst lien, due 2009 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 350,000 Ì

Senior notes, secured second lien, 9.0% interest rate, due 2009 ÏÏÏÏÏÏÏÏÏÏ 200,000 Ì

Senior subordinated notes, secured, 12.0% interest rate, due 2011 ÏÏÏÏÏÏÏ 148,646 Ì

Revolving credit facility, secured by intercompany notes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 205,000

Senior notes, secured, Series A, due 2012 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 95,000

Senior notes, secured, Series B, due 2007ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 5,000

Senior notes, unsecured, 7.85% interest rate, due 2003 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 175,000

Senior notes, unsecured, 8.80% interest rates, due 2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 200,000

Medium-term notes, payable, unsecured, 7.23% to 8.08% interest rate due

through 2027ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 109,500

Notes payable under Bond Backed Asset Trust, unsecured, 7.14% interest

rates, due through 2032ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 100,000

Debt related to BBAT option termination ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 26,550

Loan against cash surrender value of life insurance policiesÏÏÏÏÏÏÏÏÏÏÏÏÏ 17,822 18,229

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 5,784

Total AMERCO notes and loans payableÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $880,519 $940,063

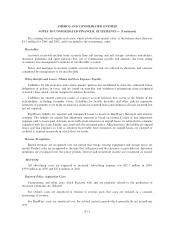

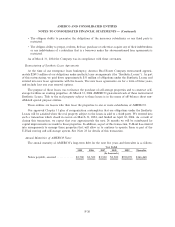

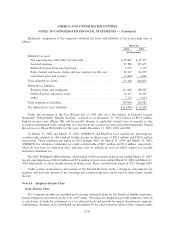

At March 31, 2003 AMERCO was in default on substantially all of its borrowings due to cross default

provisions in the debt agreement. As part of the bankruptcy restructuring on March 15, 2004 most of the prior

year debt was reÑnanced with the new debt, see description below. As part of the restructuring the Company

has incurred professional fees of $44.1 million and $6.6 million in Ñscal 2004 and 2003.

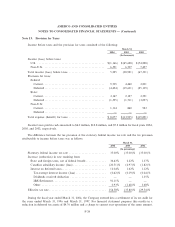

First Lien Senior Secured Notes

We entered into a First Lien Senior Secured credit facility, due 2009 in the amount of $550 million, with

a banking syndicate led and arranged by Wells Fargo Foothill, a part of Wells Fargo & Company (the ""Senior

Secured Facility''). These senior notes consist of two components, a $200 million revolving credit facility

(including a $50 million letter of credit sub-facility) and a $350 million amortizing term loan. The proceeds

we received from these senior notes were used primarily to satisfy the claims of the creditors in our Chapter 11

proceeding and to pay related fees and expenses incurred in connection therewith.

The $350 million amortizing term loan requires monthly principal payments of $291,667 and periodic

interest payments with the balance due on maturity in 2009. The interest rate per the provisions of the term

loan agreement is deÑned as the 3-month London Inter Bank OÅer Rate (""LIBOR''), plus 4.0% applicable

F-18