TomTom 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TomTom Annual Report and Accounts 2011

80

Shareholder Information

TomTom is committed to providing a high degree of transparency in its reporting and engages in open dialogues with investors. TomTom

has an extensive communication programme with investors and sell side analysts, which includes the Annual General Meeting of

Shareholders, roadshows, investor conferences and in-house meetings.

TomTom strictly adheres to applicable rules and legislation on fair disclosure. It is our goal to inform investors as well as possible about the

company and its management, our strategy, goals and expectations. Investors and analysts are invited to contact us with any information

requests they have. We do not hold roadshows, attend conference or meet with investors or analysts shortly before the publication of our

quarterly results.

Listing

TomTom NV (TOM2 / ISIN: NL0000387058) has been listed on NYSE Euronext Amsterdam in the Netherlands since 27 May 2005. TomTom

is included in Euronext’s Amsterdam Exchange Index (AEX) – composed of the 25 most traded companies in the Netherlands. Share options

of TomTom are traded on the Euronext Amsterdam Derivative Market.

Financial calendar

25 April 2012 Publication Q1 2012 results

26 April 2012 Annual General Meeting of Shareholders

24 July 2012 Publication Q2 2012 results

30 October 2012 Publication Q3 2012 results

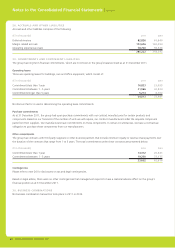

Shares outstanding

At the end of the year TomTom NV had 221,895,012 shares outstanding. The number of options outstanding was 16,724,749.

Major shareholders

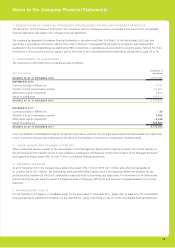

At the end of 2011 the following shareholders with a holding of 5% or more were known to us:

# shares

% of shares

outstanding

Harold Goddijn 26,137,832 11.8%

Corinne Vigreux 26,137,831 11.8%

Pieter Geelen 26,137,831 11.8%

Peter-Frans Pauwels 26,137,832 11.8%

Janivo/Cyrte 18,576,279 8.4%

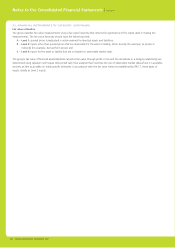

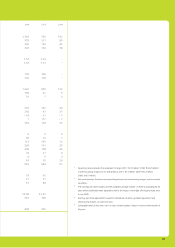

Protection mechanism

In 2005 the Stichting Continuïteit TomTom was established as an instrument of protection against hostile takeovers and to protect our

interests in other situations. We have granted Stichting Continuïteit TomTom a call option, entitling it to acquire from us preference shares,

up to a maximum of 50% of our total issued and outstanding share capital (excluding issued and outstanding preference shares). The issue

of preference shares or the grant of rights to subscribe for preference shares, may have the effect of preventing, discouraging or delaying

an unsolicited attempt to obtain control and may help us to determine our position in relation to a bidder and its plans, and to seek

alternatives.

In addition to the call option, the Management Board has the right to issue preference shares. The authority is limited to 50% of the

aggregate issued and outstanding share capital (excluding issued and outstanding preference shares) of the company at the time of issue.

As with the instrument in place for the Foundation, any possible issuances of preference shares will be temporary and subject to the

company’s Articles of Association and the legislation on takeovers.

There are currently no preference shares outstanding. More information on the protection mechanism can be found in the corporate

governance section pages 25 to 26.