TomTom 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TomTom Annual Report and Accounts 2011

68

Notes to the Consolidated Financial Statements | continued

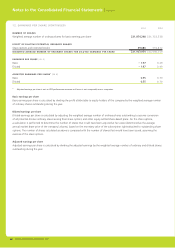

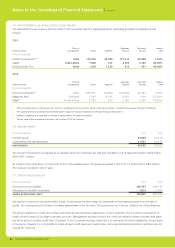

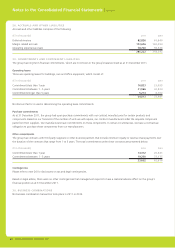

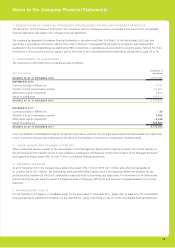

24. BORROWINGS (CONTINUED)

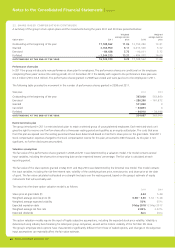

Finance leases

These are fi nance leases for plant and machinery, cars and equipment. The net book value of the assets related to these leases is nil

(2010: €1.2 million). Future minimum lease payments are as follows:

(€ in thousands) 2011 2010

Commitments less than 1 year 01,016

Commitments between 1 – 5 years 0201

Commitments longer than 5 years 0 1

TOTAL MINIMUM LEASE PAYMENTS 0 1,218

Less amounts representing fi nance charges 0 – 29

PRESENT VALUE OF MINIMUM LEASE PAYMENTS 01,189

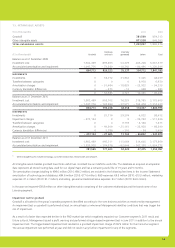

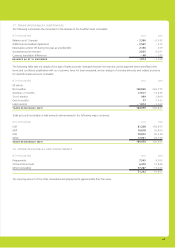

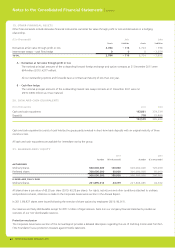

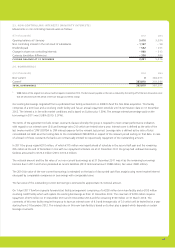

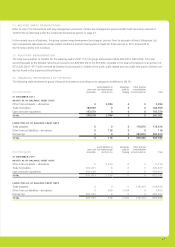

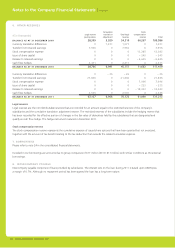

25. DEFERRED INCOME TAX

As at 31 December 2011, the group has a deferred tax liability of €182 million (2010: €211 million). A deferred tax asset has been recorded

amounting to €10 million (2010: €22 million). The deferred tax asset and deferred tax liability result from timing differences between the

tax and accounting treatment of the amortisation of intangible assets, tax-loss carry-forwards and certain provisions.

(€ in thousands) 2011 2010

DEFERRED TAX

To be realised after more than 12 months – 168,621 – 187,205

To be realised within 12 months – 3,159 – 1,544

– 171,780 – 188,749

The movement of the deferred tax is as follows:

(€ in thousands)

Stock

compensation

expense Other

Intangible

assets Provisions

Assessed

losses Total

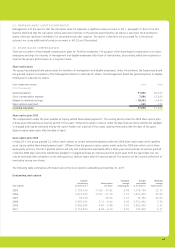

BALANCE AS AT 31 DECEMBER 2009 1,647 – 2,112 – 283,866 9,847 80,560 – 193,924

Charged / (released) to income 1,054 2,588 25,953 – 5,594 – 19,012 4,989

Currency translation differences 0 0 – 549 735 0 186

BALANCE AS AT 31 DECEMBER 2010 2,701 476 – 258,462 4,988 61,548 – 188,749

Charged / (released) to income – 2,619 – 277 26,122 – 968 – 10,463 11,795

Currency translation differences 0 138 7,251 130 – 2,345 5,174

BALANCE AS AT 31 DECEMBER 2011 82 337 – 225,089 4,150 48,740 – 171,780

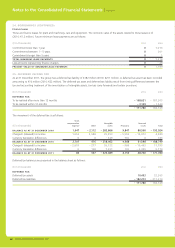

Deferred tax balances are presented in the balance sheet as follows:

(€ in thousands) 2011 2010

DEFERRED TAX

Deferred tax assets 10,493 22,265

Deferred tax liabilities – 182,273 – 211,014

– 171,780 – 188,749