TomTom 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TomTom Annual Report and Accounts 2011

34

Supervisory Board Report | continued

for participation in the Remuneration Committee and the Selection

and Appointment Committee is €4,000 for members and €7,000

for the Chairman. The remuneration of Supervisory Board

members and committee members is proportional to the number

of months served. The aggregate remuneration of the Supervisory

Board members in 2011 amounted to €304,000. The individual

remuneration of the Supervisory Board members is refl ected in

note 7 of our consolidated fi nancial statements.

Remuneration Committee

—

The Remuneration Committee met fi ve times during 2011. All

members were present at each meeting. Each of these meetings

was also attended by a member of the Management Board and

the VP Compensation and Benefi ts. Preparation meetings between

the Chairman of the committee, VP Compensation and Benefi ts

and the Company Secretary were held prior to each committee

meeting.

The Committee monitored the effectiveness and relevance of

TomTom’s Management Board Remuneration Policy throughout

the year, as well as the extent to which the individual

remuneration packages of the Management Board members

were in line with this policy. In addition, a scenario analysis within

the terms of the best practice provision II.2.1 of the Code was

performed on the variable remuneration components of these

remuneration packages.

In addition, the Committee reviewed whether the key

performance indicators (the ‘KPIs’) that had been set for the

variable remuneration components were in line with market

practice and appropriate with a view to the company’s strategy.

A benchmarking on the total cash component of these

Management Board packages was performed in October.

Other areas of attention which were addressed by the Committee

were:

– the 2011 conditional grant of stock options to Management

Board members under the TomTom Management Board Stock

Option Plan 2009;

– the outcome of the Remuneration Committee’s self-

assessment.

Remuneration report

—

Remuneration policy

The company’s Articles of Association state that the Supervisory

Board shall propose, and the General Meeting of Shareholders

shall adopt, the Remuneration Policy for the members of the

Management Board. The Supervisory Board determines the

remuneration of individual members of the Management Board

within the limits of the Remuneration Policy and reviews this policy

regularly in light of internal and/or external developments. At the

start of 2011 the Supervisory Board decided to continue to apply

the Remuneration Policy with the exception of the vesting timeline

applicable to the options granted to the Management Board

under the long-term incentive scheme (see for further details

under section 3 of this Remuneration Report). The full text of

the policy can be found on the TomTom website.

The objective of the company’s Remuneration Policy is to

ensure that the company rewards its Management Board in

such a way that highly qualifi ed and expert executives are

recruited and retained, and to ensure that the Management

Board members’ remuneration is consistent with the company’s

strategy, its operational and fi nancial results and delivery of value

to shareholders. Furthermore, the policy is aimed at applying a

responsible and sustainable remuneration framework in line with

the general result-driven remuneration principles and practices

throughout the company. Our Remuneration Policy establishes

that remuneration for the Management Board shall consist of four

components: base salary, short-term incentive, long-term incentive

and pension.

Application in 2011

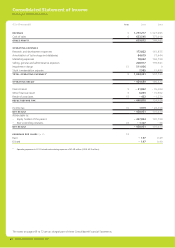

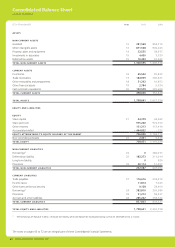

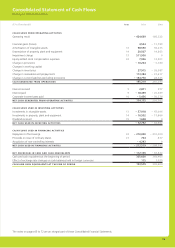

The details of the individual remuneration of all members of the

Management Board and the costs thereof to the company, as well

as the information described in best practice provision II.2.13 (d)

of the Code are presented in note 7 to the consolidated fi nancial

statements.

1. Base salary at median market level

Fixed remuneration consists of base salary plus 8% holiday

allowance, where applicable and is aimed at the median

of the pay practice for comparable positions in Dutch

listed companies. Base salary levels that are not in line with

median market practice shall be aligned with these levels

in a measured way. Annually, the base salary levels shall be

reviewed, taking into account developments in the pay market

and the job size as graded within the company.

In 2011 the base salary of the Management Board was

benchmarked against a peer group consisting of 70 Dutch

companies with a two-tier board structure, the majority of

which were AEX and AMX listed. Among these companies

were Aegon, Ahold, AkzoNobel, ASML, Heineken, KPN, NXP,

Philips, TNT, Unilever and Wolters Kluwer. On the basis of

this information, the Supervisory Board concluded that the

base salary of Harold Goddijn should be brought in line with

median market level, while those of Marina Wyatt and Alain

De Taeye were in line with the median market level and did

not need adjustment for 2011. The Supervisory Board further

decided to increase the CEO’s base salary to €375,000 in order

to bring it closer to the median market level.